Russ Heddleston

All successful companies start off as a great idea, scribbled on the back of a cocktail napkin during a late-night meeting of the minds or gleaned from a fleeting inspiration that leaves you with a feeling of “I could do that better.”

For most, that’s as far as entrepreneurship ever goes, because, unfortunately, a great idea can’t raise money, develop a product or disrupt an industry.

It’s only an idea.

New data from the DocSend Startup Index show that for early-stage fundraising, particularly in the pre-seed round, founders need to approach VCs with much more than a great idea to secure funding. Our newest report on the state of pre-seed fundraising shows that investors became laser-focused on sections of the pitch deck that address monetization and business viability — signs that founders need to come to the table with better-defined businesses in order to succeed.

Do not pass go — VCs insist pitch decks meet 3 key criteria

According to the data, overall founder and VC activity took a nosedive in early 2020 once the serious nature of the pandemic became apparent. But as the year progressed and investors adjusted to the new market conditions and remote dealmaking, overall activity quickly surpassed pre-pandemic levels.

Despite this flurry of activity and an unprecedented appetite for new startup pitches, investors made it very clear that strong positioning in three sections of the pitch deck was nonnegotiable.

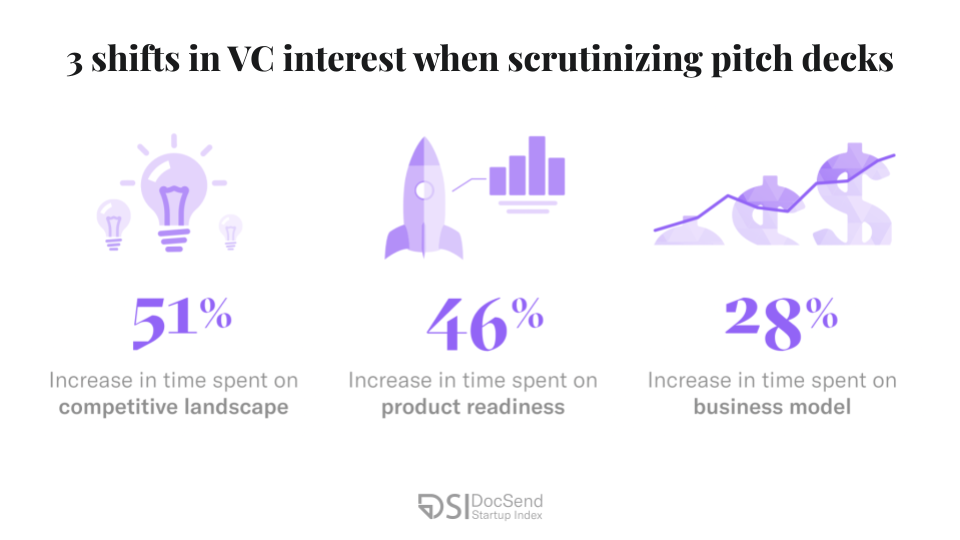

- Competitive landscape — When we published our 2019 pre-seed report, the competitive landscape section of pitch decks was firmly in the middle of the pack in terms of time spent reviewing by investors: They averaged around 35 seconds to clearly articulate their own uniqueness and product-market fit. In 2020, the VC time spent on the same section increased by 51% to an average of 53 seconds across both successful and unsuccessful decks (those that did or did not lead to a funding offer).

- Product readiness — The second significant increase in 2020 was in investor time spent on pre-seed product sections of pitch decks — VCs averaged about 46% more time on this section versus 2019. This shift shows that VCs prioritized investing in products that were already embedded in thoroughly conceived business models. Across both successful and unsuccessful decks, just 11% of companies lacked a product, and 89% of companies had a product at least in the alpha stage.

- Business model — Investors spent 28% more time on the business model section of pitch decks in 2020 compared to 2019. This increased scrutiny shows investors were interested in much more than just a compelling product. Going forward, pre-seed companies now need to show clear plans for monetization in their decks — more closely resembling fully fledged businesses rather than just promising ideas.

WFH meets the land of opportunity

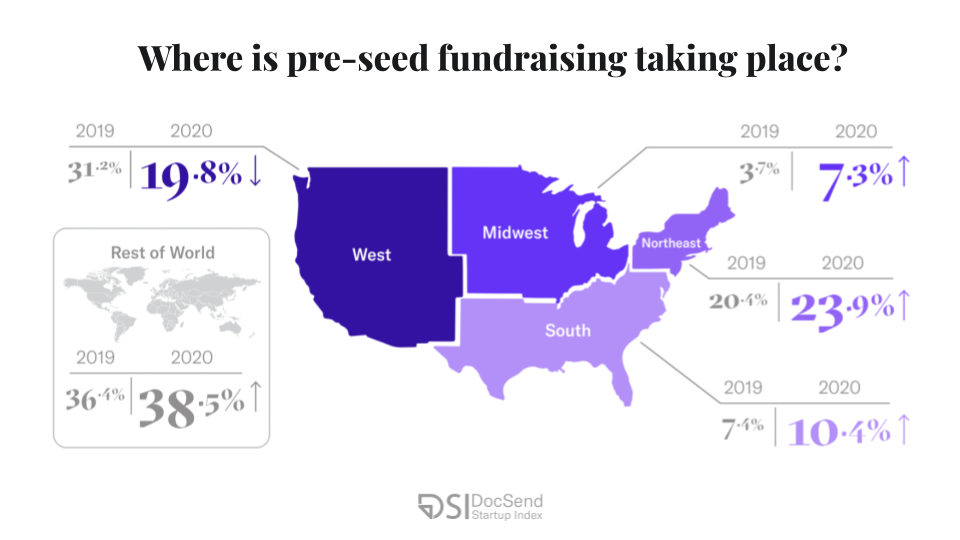

One of the more popular Silicon Valley narratives to come out of 2020 is that VCs, founders and tech professionals across the board are packing up and leaving the Bay Area for other cities. While it’s not an exodus to hotspots like Miami and Austin, as some predicted, the data show that many pre-seed founders are starting companies in cities outside the Western United States.

In our 2019 report, pre-seed companies were mostly located in the West. In 2020, all regions except the West saw an increase in representation compared to 2019, including the rest of the world. When it comes to fundraising success among U.S.-based startups, the picture is more mixed: Companies in the Northeast and West were more successful in 2020 than 2019, while the South and Midwest were less successful. This suggests that although many more pre-seed companies were founded outside the West Coast, the shift hasn’t necessarily been accompanied by an uptick in successful fundraising.

As companies and VCs continue to operate virtually, expect to see startup founders continue to enter the fray from more diverse geographies. That said, the West will continue to be a dominant player in the years to come.

Investors adopted an approach that allows zero room for error

Investors, like everyone else in 2020, were under a lot of pressure to keep the wheels turning while dealing with market instability brought on by the unpredictable effects of the pandemic.

The data show that while they were still writing checks to promising startups, they were evaluating pitch decks with nearly zero room for error. Compared to 2019, VCs in 2020 were much quicker to dismiss pitches that raised red flags such as a poorly defined business model or a lack of a compelling competitive advantage. On average, VCs stopped viewing unsuccessful decks after only 1 minute and 36 seconds — less than half the time spent in 2019 (3:30).

When it comes to successful pre-seed pitches, VCs in 2020 were much more judicious than in years past, spending an average of 4 minutes and 10 seconds reviewing (compared to 3:21 in 2019). While there are a number of factors that may have contributed to the higher average times VCs spent reviewing decks, one explanation is that they simply had more hours in their workdays.

During quarantine and in the absence of long commutes to the office, in-person meetings and other “before time” activities, VCs were under heightened pressure to make the right deals and had more opportunities to scrutinize decks from promising companies.

Are 2020’s shifts here to stay?

In short, yes.

Investors’ heightened expectations for monetization potential and a company’s positioning within its competitive landscape are unlikely to lessen in the years to come, even in a post-COVID economy. Pre-seed companies should proactively adjust to these changes by articulating clearly and concisely their business model in their pitch decks, as well as understanding what makes their product and company unique compared to other key players.

While the fundraising marketplace is and always will be unpredictable, it’s simply not likely that investors will slide back into old routines after applying this level of scrutiny to get through 2020. Doing so would leave them at a competitive disadvantage.

Luckily, startup founders don’t usually abide by the status quo and are by nature adaptable, they would be well served to apply that same spirit to their fundraising efforts as the marketplace continues to recover and change following the pandemic. Dive deeper into the data that will define the pre-seed round for years to come in the full report.

Comment