Israel’s ironSource, an app-monetization startup, is going public via a SPAC.

But before you tune out to avoid reading about yet another blank-check company taking a private company public, you’ll want to pay attention to this one.

For starters, this is the second SPAC-led debut from an Israeli company in recent weeks worth more than $10 billion. And secondly, ironSource is actually a pretty darn interesting company from a financial perspective.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The company follows eToro in announcing its combination with a public entity designed to help startups get over the private-public divide. Valued at just over $11 billion by the deal, it will best eToro’s valuation by several hundred million. Combined, both companies will bring more than $20 billion in liquidity to their founders, backers, ecosystems, employees and SPAC teams associated with their impending debuts.

This morning, let’s rewind through TechCrunch’s ironSource coverage during its life as a private company and then examine its financial results. At the end, we’ll ask ourselves whether its new valuation makes any damn sense.

This morning, let’s rewind through TechCrunch’s ironSource coverage during its life as a private company and then examine its financial results. At the end, we’ll ask ourselves whether its new valuation makes any damn sense.

It’s Monday, and that means it’s time to strap in and get to work. Let’s get to it!

ironSource’s past, performance and future

TechCrunch has covered ironSource for years, including a piece on its 2014-era $85 million investment. At the time, we noted that the company “support[s] about 5 million installs per day and [has] more than 50,000 applications using [its] SDK.”

In 2019, ironSource raised more than $400 million at a valuation of more than $1 billion, though details were fuzzy at the time. TechCrunch wrote about the company last month when it announced its second acquisition of the year; ironSource bought Soomla — app monetization tracking — and Luna Labs — video ad tooling — toward the end of its path to a public debut.

PitchBook data indicates that the company was worth an estimated $1.56 billion when it closed its 2019-era round. That ironSource intends to go public with a valuation of $11.1 billion means that it is shooting for a commanding increase in value in just a few short years.

Is the company worth the new number? Let’s find out, starting with a look at its revenue growth over time:

First, observe ironSource’s historical performance in 2020 compared to 2019; posting 83% revenue growth from a nine-figure base is impressive. The company only expects to grow a hair over 37% in 2021, however, though it doesn’t anticipate further revenue growth deceleration in percentage terms the following year.

The chart on the right is useful as well. Note how the company’s 2019 saw strong growth from its Q1 to its Q4. But also note its flat summer, in which sequential growth came to a near halt. Comparing that lackluster middle period with the rapid growth ironSource posted in every quarter of 2020 is stark. Sure, the pandemic boosted screen time for all of us, but my gosh, did ironSource have a great year on the back of the pandemic.

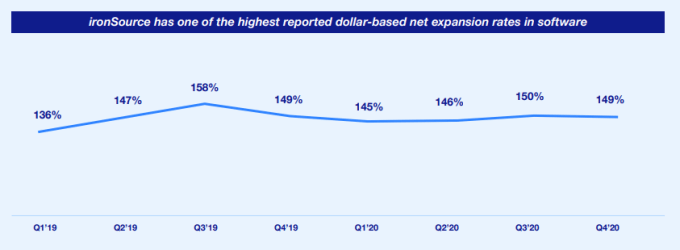

How does the company intend to grow at nearly 40% in the next two years? Rapid expansion among its existing accounts. In software-accounting terms, ironSource has strong net expansion, hovering around the 140% to 150% mark:

And the metric appears to be nonbullshit, with the company noting in the fine print that its “calculation of our dollar-based net expansion rate includes the effect of any customer renewals, expansion, contraction and churn, but excludes revenue from new customers,” with the emphasis by TechCrunch added for clarity.

So far we’ve drawn the picture of a quickly expanding software company in a hot market with strong software metrics. How does the company look when we change our lens from “revenue and growth” to “margins and profits”? Pretty well, as it turns out. Or as well as any other startup, at least.

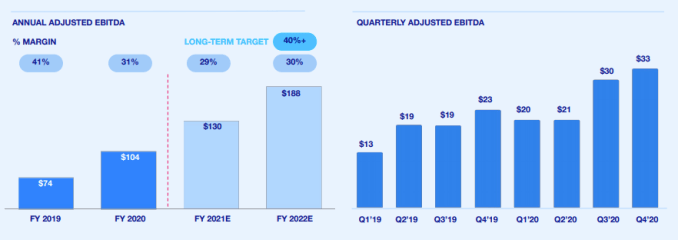

Here’s some data:

It’s worth noting that we’re once again dealing with adjusted EBITDA, a very kind metric that discounts all sorts of costs. So the above numbers are a bit like a digitally touched-up selfie that you had a friend take of you; they are real-ish. And the adjusted profit numbers are quite good, as you can see, though there are some caveats to ponder.

First of which: Why did the company’s adjusted EBITDA profit margin shrink so much from 2019 to 2020, falling from 41% to 31%? And ironSource anticipates further declines to 29% in 2021 before a modest improvement to 30% in 2022. As it scales, it anticipates more gross adjusted EBITDA, but it will take a long time for the company to get close again to its long-term target of 40% adjusted profit margins.

When we drill into ironSource’s numbers, we find GAAP operating profits materially lighter than its adjusted EBITDA incomes. In 2019 and 2020, for example, the company’s operating income came to $43.3 million and $74.1 million, far under its adjusted EBITDA results of $74.5 million and $103.6 million.

But we’re splitting hairs. Investors are more than happy to pay for growth-oriented shares sans any income at all, so our quibbles about non-GAAP accounting are likely moot. What matters most to the public investor world, I presume, is growth. The question regarding the value of ironSource thus becomes whether investors are more content to value the company on its 2020 growth or its anticipated 2021 growth.

The former is hot; the latter is middle-tier. But we can get closer to the truth with a little math. At $11.1 billion in value and a Q4 2020-based, annualized run rate of $432 million, ironSource is being valued at around 25.5x revenues. Or 33.1x its 2020 revenues. Or 24.2x its expected 2021 revenues.

Notice anything weird about those numbers? You should: The company’s Q4 annualized run rate of $432 million is generating nearly the same multiple as the company’s expected 2021 revenues. Or, more simply, the company’s Q4 2020 was likely around the same result that ironSource expects to manage every three months in 2021; growth on a sequential basis is going to slow down sharply, the company expects.

Again, this is not to be rude, but to wonder how investors will determine the worth of the company once it begins to trade. Its backers have laid their bet at the $11.1 billion mark. Soon, others will get to vet their work and come to their own decision.

In expecting 37% growth this year, ironSource has a similar growth profile to Slack, Hubspot and Wix, leaning on the Bessemer Cloud Index for comps. They trade at 23x, 20.1x and 13.7x their annualized incomes. So, compared to some similar-growth companies, ironSource feels a little expensive. But it’s profitable, which tilts the balance in its favor.

Regardless, for ironSource the SPAC deal appears to be a good one; it raises lots of cash, goes public at a price that it likes and can now get on with the rest of its corporate life. More when it trades.

Comment