Another day brings another public debut of a multibillion-dollar company that performed well out of the gate.

This time it’s Coupang, whose shares are currently up just over 46% to more than $51 after pricing at $35, $1 above the South Korean e-commerce giant’s IPO price range. Raising one’s range and then pricing above it only to see the public markets take the new equity higher is somewhat par for the course when it comes to the most successful recent debuts, to which we can add Coupang.

The company’s mix of rapid growth and slimming deficits appear to have found an audience among public money types, so let’s quickly explore the price they paid. What was the company worth at its IPO price, and what is worth now? And, of course, we’ll want to calculate revenue run rates for each figure.

Oh — we’ll also need to calculate how much money SoftBank made. Inverted J-Curve indeed!

Coupang’s IPO and current value

As Renaissance Capital notes, Coupang boosted its share allocation to 130 million shares from 120 million. This made the value of both primary and secondary shares in its public offering worth a total of $4.55 billion. That’s a lot of damn money.

At its IPO price of $35, the same source pegged the company’s fully diluted IPO valuation at $62.9 billion. By our accounting, the company’s simple valuation at its IPO price came to $60.4 billion. Those numbers are close enough that we’ll just stick with the diluted number out of kindness to the company’s fans.

Doing some quick math, Coupang is worth around $92 billion at the moment. That’s a huge number that nearly zero companies will ever reach. Some do, of course, but as a percentage of startups that start, it’s an outlier figure.

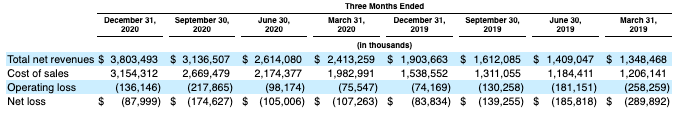

Driving the company’s IPO valuation and early post-IPO gains are its Q4 numbers, I reckon. Here’s the data:

The upper-left area is where to find the most recent revenue figure: $3.8 billion in Q4 2020, which yields an annualized run rate of $15.2 billion. That may sound high compared to the company’s valuation, but, after all, if Coupang were a software company, it would be worth hundreds of billions.

Instead of gross margins around 71% that we might find at a software company, Coupang has gross margins of 17% in its most recent quarter. That’s down from around 19% in the year-ago quarter, which is pretty not good. But investors did not seem to mind, awarding the company a multiple of around 6x. If we use its 2020 revenue instead of the run-rate figure, the company’s multiple jumps to 7.5x.

For reference, Alibaba is trading at around 7x its trailing revenues, while Amazon is worth around 4.2x the same numbers. (Data via YCharts.)

Surprised that Coupang is worth more in multiples terms than Amazon? Recall that while AWS, a key Amazon division, is worth a lot of money, it also has slowing growth. And the rest of Amazon isn’t growing too quickly, so its multiple is lower. Whether Coupang’s numbers mean it should trade at nearly 2x the multiple of a larger rival that makes money is up to you.

Coupang’s IPO was a success, no matter how you slice it, even if you have valuation quibbles. And it was a huge win for SoftBank. Here are the numbers:

- Coupang shares owned by SoftBank: 568,156,413.

- Value at IPO price: $19,885,474,455.

- Value at current price: ~$28,975,977,063.

Yes, but what did SoftBank pay for them? Was it a lot? Yes, but nothing compared to what it has made in returns. SoftBank put a known $3 billion into the company, for nearly a 10x return at present prices. That’s a huge sum of gains. Recall that the SoftBank vision fund was around $100 billion all told. Here’s around 30% of the whole fund in a single go.

Not bad. For the company and its most famous backer.

The IPO market looks hot as Airbnb and C3.ai raise price targets

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20 percent off tickets right here.

Comment