Some well-known VC firms have spent the last few months crunching data while working to chart, graph and map the world of venture investing. Happily for you and I, they’ve been pretty free with their time and data, helping us better understand today’s market for high-growth, software startups.

Last week The Exchange dug into data from Battery Ventures, which worked to explain some of the gains software companies have made in recent years in terms of their valuation multiples. The short gist is that multiples expansion — the repricing of software companies higher for each dollar of revenue they command — could be explained in part by segmenting the companies into various growth cohorts. Once accomplished, it’s easy to see that the fastest-growing software startups are enjoying the most price appreciation.

As one Battery investor explained, growth rates de-risk valuation multiples.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The logic is sound enough. I can doodle on it in a future column if you’d like. But today, instead of retreading familiar ground, we’re diving into new data from Bessemer, a VC group that should be familiar to Exchange readers thanks to its cloud index that we refer to quite often. Regardless, Bessemer’s 2021 cloud report is out, and it assists some of the work we did with Battery’s charts.

What we can do with Bessemer’s dataset is extend the argument from Battery’s report: Sure, strong growth rates de-risk multiples, but what the new report indicates is that growth rates themselves amongst cloud companies (modern software, SaaS, call it what you will) should prove more durable than nearly anyone historically expected.

You can quickly see the synthesis. If growth rates de-risk rising multiples, we can infer some logic to higher-growth companies being valued more richly than their slower-growing peers. But that doesn’t get us to understanding why multiples themselves might be rising, provided we wanted to find some argument for why they are sane. More durable growth rates, however, provide a possible answer.

You can quickly see the synthesis. If growth rates de-risk rising multiples, we can infer some logic to higher-growth companies being valued more richly than their slower-growing peers. But that doesn’t get us to understanding why multiples themselves might be rising, provided we wanted to find some argument for why they are sane. More durable growth rates, however, provide a possible answer.

Why? The longer a company can keep up its growth rate from year to year, the larger it will be in the future. Modern software companies do have a history of growth-rate retardation over time, but nearly never negative growth rates.

More durable growth today implies more cash generation in the future. Up go valuations, and, for the fastest-growing today, the bump in worth comes with the valuation downside protection inherent in quick growth.

Got all that? If not, don’t worry — I have charts. Let’s keep going.

A theory for why software valuations aren’t irrational (maybe)

The key reason that startup and public-company software valuations are so high is because investors are willing to pay those prices. Hungry for yield on their capital, buying growth via software has been a trade for some time. It was even accelerated last summer as the pandemic gripped the global economy.

Suddenly software was not just a possible place to bet on growth, it was also a durable place to stash cash, because without software the world would stop. And that couldn’t happen, so most folks kept paying their software bills.

You might think that the valuation gains companies saw as other stocks fell out of favor would fade. After all, if they got a bump and the bump faded, surely they would lose some air from their balloon. Kinda? But mostly it appears that software valuations have stayed pretty damn aloft. And this brings us to the future.

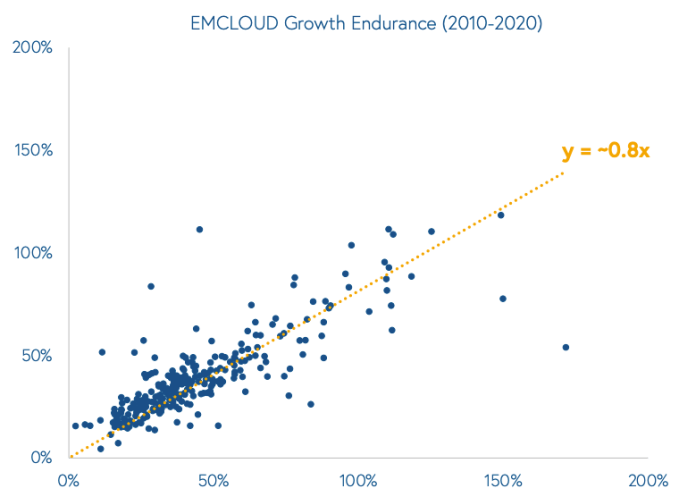

Check out the following chart, via the Bessemer report (and shared with permission), that I will explain immediately afterward:

Bessemer partner Mary D’Onofrio, one of the report’s lead authors and part of the growth team, told us that the x-axis is the growth rate of public software companies last year, while the y-axis is what it is managing in the current year. And that 0.8x? That’s the correlation.

Or more simply amongst public cloud companies over the past decade, around 80% of revenue growth is maintained from one year to the next.

That strong base of growth reservation from year to year led to a number of funny misses by the analyst camp, which Bessemer chided:

The charts, showing growth rate changes post-IPO, give a whimsical look at how analysts have underestimated growth from a host of cloud and SaaS companies. Software companies, in other words.

Summarizing: Valuations are up because software company growth will persist longer than most analysts and investors expected, making the present value of software companies’ future cash flows larger, even if they had yet to grow into those later projections. Make sense?

The point hinges on the idea of very, very deep software markets. Something The Exchange has actually touched on in recent weeks, albeit for different reasons. As the market for software expands, these companies have more space and time to grow as they move from seed stage to post-IPO.

That means more future high-margin revenues kicking off cash like a donkey lost in a vault. At least that’s the idea.

There are other nuances when it comes to software valuations. The accelerating digital transformation could provide a steady tailwind to software revenue growth for a few years, past what had been expected pre-pandemic. Of course, we could still see some air-letting from some software valuations as investors get more savvy about culling B-team players from A-team valuations.

But what I want to close on is not that. Instead, observe the following chart, which shows the same thing as our first, but this time looking at the a collection of 100 private software companies that Bessemer corrals every year:

As you can tell, 0.7, or an expectation that private software companies will only retain around 70% of their growth from year to year, is lower than what we can expect from the public cloud players. How is that possible? Why don’t smaller, private companies have better growth reservation? After all, they are growing from smaller revenue bases!

D’Onofrio told The Exchange that the lesser growth conservation amongst private companies makes sense as not every firm in its Cloud 100 is IPO-worthy. But every public cloud company is. So, while the same Bessemer report does show that different Cloud 100 cohorts are enjoying rising average growth rates, they aren’t hanging onto the stuff at the same rate.

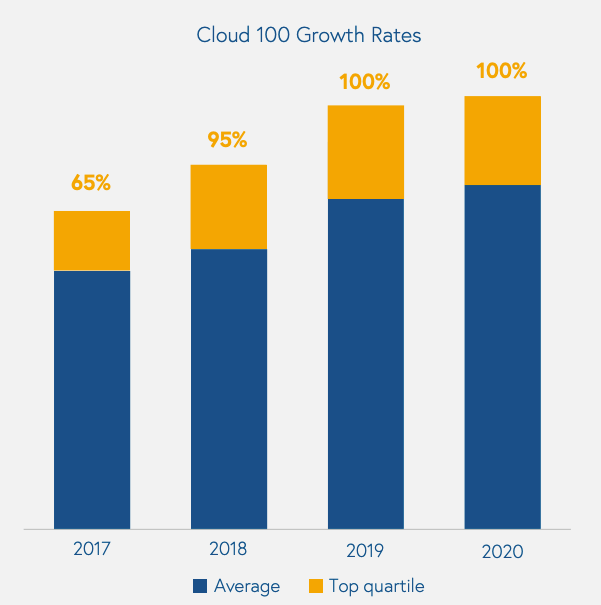

Which is why the contrast between this chart, showing rising average growth rates amongst the Cloud 100 over time:

Seems to pale in contrast to this set of data points:

Think about how far private software valuations stretched after 2018. And then how much faster average growth rose. There’s a big gap there!

So here’s the other side of the general theory that current software valuations could make sense, that we could be seeing slightly more rational pricing amongst public software companies, given their ability to retain long-term growth. Private software companies, which are not as good at the same effort, could be hitching a ride that they could never cover the fare for on their own.

We’re just chewing the fat at this point, but I am curious all the same if that’s the case.

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20 percent off tickets right here.

Comment