AppLovin released its S-1 filing yesterday, bringing the Palo Alto-based mobile-app-focused software company a step closer to joining the public markets.

The business results detailed in the document are generally impressive. While some companies going public in recent months have detailed pandemic-fueled growth to lean against or membership in a sector hotter than individual results, AppLovin’s filing tells the story of a rapidly growing company that has managed to scale adjusted profit as it has grown.

And now, with annual revenue north of $1 billion, AppLovin is also a very large company, meaning that its IPO will be widely watched.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

So this morning we’re rifling through its IPO filing and yanking out what matters as we add one more name to our IPO lists.

The Exchange has a lengthy list of non-IPO topics that we’d like to get to. If everyone could stop going public for a few days, we’d love to write about something else! OK, let’s get into it!

The Exchange has a lengthy list of non-IPO topics that we’d like to get to. If everyone could stop going public for a few days, we’d love to write about something else! OK, let’s get into it!

Most of the news is good

As a short introduction, the company’s products are designed to help developers find users and monetize their apps. AppLovin has its own in-house suite of mobile apps, what its S-1 calls a “globally diversified portfolio of over 200 free-to-play mobile games run by 12 studios.” Those apps have 32 million global daily actives, the document added.

It’s a pretty neat company to dig into if you’re into mobile apps at all. Regardless, what we care about today are its numbers. So let’s talk growth, revenue quality, profits, cash consumption and capital structure. Most of the news is good, even if there are some downsides to AppLovin’s capital structure.

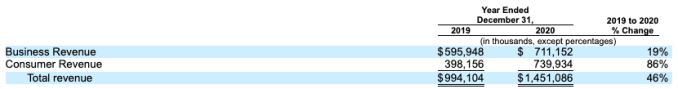

Recall that KKR bought a chunk of AppLovin back in mid-2018 at a valuation of around $2 billion. That number appears comically low, given that the company posted $483.4 million in revenue that year, a figure that it roughly doubled in 2019 to $994.1 million. Growth slowed in percentage terms in 2020, when AppLovin saw total revenues of $1.45 billion, though the company managed similar growth in gross-dollar terms.

In percentage terms, AppLovin grew 106% from 2018 to 2019, and 46% from 2019 to 2020. How KKR got to buy into the company at 4x revenues when it was growing at 100% is not clear.

The company is growing well, but is AppLovin accreting revenue of high quality? Yes, but we need to scrape some grime off the numbers to understand them. Turning to the company’s yearly results, AppLovin’s cost of revenue rose steadily as a percentage of revenue from 2018 to 2020. Indeed, the numbers went from 11% in 2018 to 24% in 2019 and 38% in 2020. That’s an awful progression, and if we lacked more information we’d posit that the company’s overall revenue quality was sharply declining.

It’s not that bad. There’s about $1 million in share-based compensation inside the 2020 cost of revenue figure and $228.3 million of “amortization expense related to acquired intangibles.” If we yank out those from the cost-of-revenue line item, AppLovin’s gross margin for 2020 grows from 62% to 77.5%. That’s much better.

Annoyingly, AppLovin’s amortization expenses from prior acquisitions persist throughout all of its results; the company does love to buy other companies, announcing a $1 billion deal to buy a German software firm in February, for example. So we’re wading through the detritus a bit in this document.

From a high level, AppLovin has maintained software-like margins as it scaled. That’s mostly what we wanted to find out. Now, did all the company’s growth help it start making money? Yes, and then no.

AppLovin swung from a $260 million net loss in 2018 to a $119 million net profit in 2019. However, the company returned to the red in 2020 with a $125.9 million net loss. Having a hugely profitable year under its belt is good, but what happened in 2020?

Two things, as it turns out. First, share-based compensation costs rose steeply at the firm, from $10.2 million in 2019 to $62.4 million in 2020. And our dear friend “amortization expense related to acquired intangibles” rose from $82.4 million in 2019 to a staggering $239.9 million in 2020.

You want to know more about the company’s profits, then, on a cash basis? To get rid of some of that noncash cruft? I got you. AppLovin’s adjusted EBITDA grew from $255.6 million in 2018 to $301.4 million in 2019 to $407.5 million in 2020. Those numbers, while moving in the right direction, do represent a failing adjusted EBITDA margin, calculated as a percentage of revenue. I suspect that fact will not bother investors excited by AppLovin’s growth.

Summarizing so far: AppLovin is growing quickly, has gross margins around where we’d expect them and has a somewhat muddy profit picture on a GAAP basis, along with solid non-GAAP black ink.

So what about cash? AppLovin’s operations generate oodles of cash, which it then uses to buy things. So while the company’s free cash flow results are wonky due to its acquisitiveness, the operating entity kicks off plenty of green. Indeed, in 2018 AppLovin’s operations generated $139 million in cash. That figure rose to $198.5 million in 2019 and $222.9 million in 2020.

That the company’s investing cash flow managed to come in at negative $411.6 million in 2019 and negative $679.9 million in 2020 is hilarious. Regardless, as expected from its adjusted EBITDA, AppLovin’s cash generation from its regular work is strong and implies a company safe from eating its own seed corn once it adds an IPO raise to its accounts.

Two more things to note:

First, the company’s capital structure sucks. If you buy shares in the IPO, you get basically no say. Read the following S-1 riff, keeping in mind that peons can only buy Class A shares in the AppLovin debut:

Following this offering, we will have three classes of common stock. Our Class A common stock, which is the stock we are offering by means of this prospectus, has one vote per share, our Class B common stock has 20 votes per share, and our Class C common stock has no voting rights, except as otherwise required by law. Upon the closing of this offering, Adam Foroughi, our co-founder, CEO, and Chairperson; Herald Chen, our President and Chief Financial Officer, and a member of our board of directors; and KKR Denali Holdings, L.P. (KKR Denali) (collectively, the Class B Stockholders) will together hold all of the issued and outstanding shares of our Class B common stock

You get no real say. You get no real vote.

AppLovin is yet another company that has decided that providing a bare-minimum nod to democracy provides enough of a patina of input to get away with monarchical control. Investors largely don’t mind such setups today because the markets are hot. But in time, I wonder if companies that enact such punitive, anti-shareholder structures will eventually trade at a discount to similar peers without the same setup.

Who knows. But looking ahead, there’s one last thing to chat about, namely that the company’s revenue split between its consumer and business revenues are decidedly not growing at the same pace. Here’s the table:

The two revenue lines are now roughly the same size, but their growth rates could not be farther apart. Could a bet on AppLovin then be viewed as a wager not on its business income growth, but on the strength of consumer app demand? We’ll see. More when we get first pricing.

DoorDash said to price at $102 per share, doubling its final private price

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, legal, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included in each for audience questions and discussion.

Comment