If we are not careful, every entry of this column could consist of SPAC news.

Special purpose acquisition companies, or blank-check companies, whatever you prefer to call them, are enormous business today. But they aren’t the only thing going on, and we’ll get to other things shortly. Consider this an apology for having written about SPACs twice in two days.

Yesterday, we considered the rise of the VC-led SPAC and whether venture capital groups that offer seed-through-SPAC money will wind up with advantage in the market over firms that specialize on any particular startup stage. Sticking to the blank-check theme, this morning we’re looking into two SPAC-led deals, namely those involving Rover and MoneyLion.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We’re doubling up to prevent more SPAC-related posts. And we’ve selected Rover because Chewy, another pet-themed entity, is an already-public company. As both were venture-backed, we may be able to contrast their trading performance post-debut. Sadly, Chewy is focused on pet e-commerce while Rover is more centered around pet services, but they may prove close enough for some loose comparisons.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

And why chat about MoneyLion? Because it’s a heavily venture-backed fintech startup, one that TechCrunch has covered extensively. If its SPAC-assisted vault into the public markets goes well, it could smooth the same path forward for myriad other yet-private fintechs sitting atop a mountain of raised capital.

So this is a SPAC post, but as we’ll largely be looking at the financial health of two companies that we’ve heard about for ages and never got to see inside of, I hope you join me all the same.

We’re starting with the Rover investor presentation, before zipping over to MoneyLion’s own.

Rover

Rover is merging with Nebula Caravel Acquisition Corp., which is affiliated with True Wind Capital. The deal gives Rover an anticipated market cap of around $1.6 billion, with around $300 million in cash on its books.

So, how attractive is this new unicorn? You can find its investor deck here, if you want to read along as we peek.

First up, the company stresses rising use of digital services in the last year thanks to the pandemic and the fact that pet ownership is growing. Both of which are true. We’ve seen the accelerating digital transformation for both companies and consumers. And if you’ve tried to adopt a pet lately, you’ve seen how few are left waiting for forever homes.

With those things behind it, you might be wondering why Rover is pursuing a SPAC-led debut as well. If its market is hot and it has previously raised venture capital, why not just go public via an IPO? Because 2020 was tough on the company.

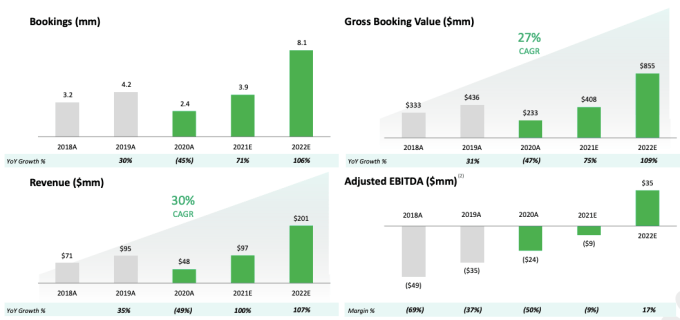

Revenue dipped from $95 million in 2019 to just $48 million last year. Bookings fell from 4.2 million to 2.4 million over the same time frame, leading to gross booking value falling from $436 million in 2019 to $233 million in 2020. Why? Because everyone was stuck at home. With their pets. A situation that limited demand for Rover-delivered pet services.

With travel set to pick back up, Rover expects to get back on track this year. It anticipates 3.9 million bookings in 2021 and revenues recovering to $97 million off of $408 million in gross bookings. After that the numbers, per Rover’s projections, keep going up. Rover also expects to improve from a modest, $9 million adjusted EBITDA loss in 2021 to profit in 2022.

You can see why Rover is going out via a SPAC; it sees a winsome future for itself in the coming quarters as the world gets back to normal, travel picks up and more pets need Rover-linked services like walks and care. And it probably wanted to raise money. So with this SPAC, it gets a slug of cash at a price it likes — no need for a tricky IPO pricing dance — which should afford it the time needed to recover from COVID-19’s economic impacts.

Why not? I don’t hate this deal. Sure, Rover is pretty unprofitable at the moment, but vaccines are rolling out. Perhaps Rover’s decision to recover in the public eye instead of while private will bear out. Let’s see.

MoneyLion

MoneyLion is merging with Fusion Acquisition Corp. in a deal that will value the combined entity at around $2.9 billion with around $500 million in cash once completed. That’s a huge step up from the valuation that MoneyLion last raised at, which Crunchbase pegs at $900 million, post-money. You can read TechCrunch’s coverage of the round here.

But we care more about the company’s performance. So, how is the company that provides consumer banking, loans and investing products performing? Pulling from its investor pitch here, pretty well?

As with all SPAC-led public debuts, the deck features a blizzard of information. For example, enjoy this:

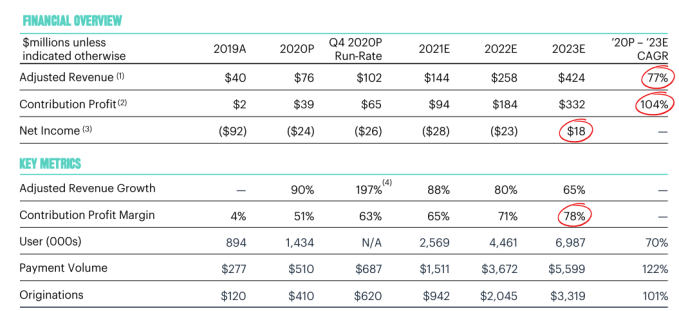

What this table shows is that on an adjusted revenue basis (gross revenue minus charge-offs, basically), MoneyLion grew 90% from 2019 (actual results) to 2020 (anticipated totals). And that the company grew its Q4 adjusted revenue run rate by 197% from 2019 to 2020. Those are great results, frankly.

MoneyLion also lost a lot less money in 2020 than it did in 2019. Its net income improved from -$92 million to around -$24 million last year. That’s insanely better. And while the company anticipates a few more years of net losses worth $28 million to $23 million apiece, MoneyLion also dangled $18 million in 2023 net income in front of public-market investors.

To get there the company’s growth needs to keep up with payment volume — MoneyLion expects to generate 17% of revenue in 2023 from payments, it notes on page 31 of its deck — rising sharply along with loan originations. Total expenses at MoneyLion fell from $127 million in 2019 to $99 million in 2020; that gain helped reduce its net losses, but the company may have to spend more on travel and marketing in the future. If so, that could make it a bit harder to reach break-even status.

All the same, MoneyLion expects to reach traditional IPO revenue scale this year with an effectively flat net loss. If it can do that, and public market valuations hold up, the company’s market cap isn’t too hard to grok. Especially with Affirm sporting a prices/sales multiple of more than 46x, right?

Summarizing, it appears that our two SPACs today are taking companies public that make some sense. Rover seems like a good fit as it gets lots of cash, and thus time to recover from COVID-19-driven changes to the pet care market. And MoneyLion gets a nice womp of greenbacks, along with a sparkly new valuation.

It’s hard to get irked by either outcome. Let’s see how they trade.

Investors’ SPAC push could revamp the private market money game

Comment