This morning, investor and SPAC raconteur Chamath Palihapitiya announced two new blank-check deals involving Latch and Sunlight Financial.

Latch, an enterprise SaaS company that makes keyless-entry systems, has raised $152 million in private capital, according to Crunchbase. Sunlight Financial, which offers point-of-sale financing for residential solar systems, has raised north of $700 million in venture capital, private equity and debt.

We’re going to chat about the two transactions.

There’s no escaping SPACs for a bit, so if you are tired of watching blind pools rip private companies into the public markets, you are not going to have a very good next few months. Why? There are nearly 300 SPACs in the market today looking for deals, and many will find one.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Think of SPACs are increasingly hungry sharks. As a shark get hungrier while the clock winds down on its deal-making window, it may get less choosy about what it eats (take public). There are enough SPACs on the hunt today that they would be noisy even if they were not time-constrained investment vehicles. But as their timers tick, expect their deal-making to get all the more creative.

This brings us back to Chamath’s two deals. Are they more like the Bakkt SPAC, which led us to raise a few questions? Or more akin to the Talkspace SPAC, which we found pretty reasonable? Let’s find out.

Keyless locks = Peloton for real estate

Let’s start with the Latch deal.

New York-based Latch sells “LatchOS,” a hardware and software system that works in buildings where access and amenities matter. Latch’s hardware works with doors, sensors and internet connectivity.

The company has raised a number of private rounds, including a $126 million deal in August of 2019 that valued the company at $454.3 million on a post-money basis, according to PitchBook data. The company raised another $30 million in October of 2020, though its final private valuation is not known.

As Chamath tweeted this morning, Latch is merging with TS Innovation Acquisitions Corp, or $TSIA. The SPAC is associated with Tishman Speyer, a commercial real estate investor. You can see the synergies, as Latch’s products fit into the commercial real estate space.

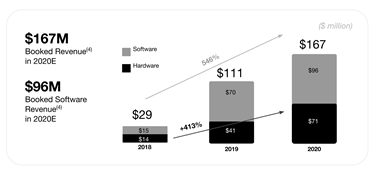

Up front, Latch is not a company that is only reporting future revenues. It has a history as an operating entity. Indeed, here’s its financial data per its investor presentation:

Doing some quick match, Latch grew booked revenues 50.5% from 2019 to 2020. Its booked software revenues grew 37.1%, while its booked hardware top line expanded over 70% during the same period.

That could be due to strong hardware installation fees, which could later result in software revenues; the company claims an average of a six-year software deal, so hardware revenues that are attached to new software incomes could low key declaim long-term SaaS revenues.

Update: Adding some clarity here, the above are “booked” revenues, which I’ve made more clear, not actual revenues. Its net revenues, better known as actual revenues, were $18 million, with $14 million of that coming from hardware. So, today, the company is certainly more hardware-heavy than I first thought. Damn non-S-1 filings!

While some were quick to note that the company is far from pure-SaaS — correct — I suspect that the model that could get some traction amongst investors is that this feels a bit like Peloton for real estate. How so? Peloton has large hardware incomes up front from new users, which convert to long-term subscription revenues. Latch may prove similar, albeit for a different customer base and market.

Per the deal’s reported terms, Latch will be worth $1.56 billion after the transaction. The combined entity will have $510 million in cash, including $190 million from a PIPE — a method of putting private money into a public entity — from “BlackRock, D1 Capital Partners, Durable Capital Partners LP, Fidelity Management & Research Company LLC, Chamath Palihapitiya, The Spruce House Partnership, Wellington Management, ArrowMark Partners, Avenir and Lux Capital.”

Lux Capital led Latch’s Series A, so to see them crop up is not a surprise. And see Chamath in there? This is a deal that he’s involved in, but not leading if that makes sense.

Shares of the SPAC Latch will merge with were up around 66% as of the time of writing.

Now, let’s discuss Sunlight Financial.

House of the rising EBITDA

Sunlight Financial is teaming up with Spartan Acquisition II Corp in a deal that will value the combined entity at an “estimated implied pro forma equity value at closing of $1.3 billion.” Hell yeah, finance speak.

As before, Chamath is taking part in putting capital into the deal via a PIPE, along with Coatue, BlackRock, Franklin Templeton and others.

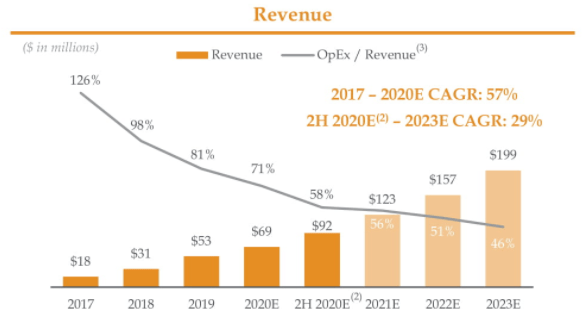

So what does the company look like? Parsing its investor presentation, Sunlight Financial has growing revenues and improving operating expense performance:

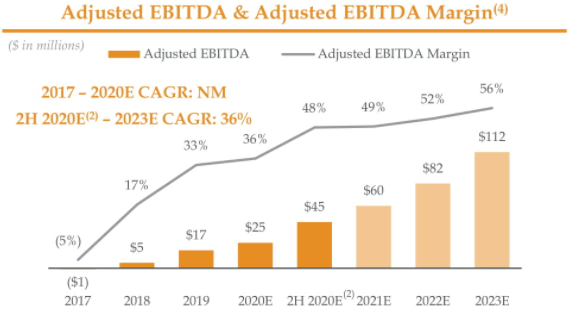

And the result of its improving operating expense:revenue ratio is that its adjusted EBITDA margin — a very non-GAAP metric — is going up nicely over time:

Looking at the numbers, it’s somewhat clear that the company could have gone public in a year or two; another year’s growth, and it would have had enough revenue to pursue a traditional debut. Via this SPAC-led deal it will get out sooner and have more cash while it scales. Perhaps that is the value of the SPAC here for Sunlight.

Provided that its future metrics meet its listed expectations — including 27% revenue growth from 2021 to 2022 — the company could work out as a public concern. It certainly has the profits you might have once expected of a public entity.

To wit, of its estimated 2020 full-year revenues of $68.8 million, Sunlight Financial turned in $16.9 million in net income and $24.7 million in adjusted EBITDA during COVID-19.

That explains the hype, I reckon.

After the deal was announced, shares of the public company Sunlight will merge with were up a somewhat-steady 34%.

Taboola is also going out via a SPAC. Buckle up.

Comment