If ever there was a typically quiet tech industry that seemed to drive massive headlines this year, it was semiconductors. From record-setting M&A purchases to prodigious venture capital financing, the decline of major players and huge international trade fights, semiconductor companies found themselves in the crosshairs of inventors, VCs, regulators, politicians and, well, Apple.

2020 was a banner year, mostly since it was the culmination of patterns we’ve been watching in the industry for years now. It’s dangerous to predict that there will be “less news” in any tech industry, but these patterns have in many ways worked themselves out, and it seems highly probably that 2021 will be a quieter year for semiconductors than the past year has been.

Here’s a snapshot of four of the largest storylines of 2020 and what may happen next as we enter 2021.

Chip consolidation is in process. The question is whether it will all be approved

The biggest story this year in chips was the rapid consolidation of the industry in just the span of a few months. That consolidation was headlined by Nvidia’s $40 billion purchase offer of Arm, the chip design firm that supplies the blueprint for almost all smartphones and is also starting to encroach on the desktop world with Apple’s launch of its M1 processor.

Nvidia wasn’t unique in throwing around big money to consolidate. AMD spent $35 billion to buy Xilinx, which makes reprogrammable chips known as FPGAs that are increasingly vital in tech stacks like 5G, where technologies change faster than silicon can be replaced. Intel sloughed off its memory unit to SK Hynix for $9 billion as it fights for survival, and Analog Devices bought Maxim for $21 billion in a bid to consolidate the embedded chips market in areas like sensors and power management. Beyond the major headlines of course, there were many smaller acquisitions made across the industry.

The chips industry isn’t unique in its heavy consolidation — plenty of other industries have also taken the M&A route given the relatively lenient antitrust policy in place and the abundant capital from the public markets at their disposal. Yet, there are also unique forces pushing semis to head this direction.

First, the cost of staying competitive in the chip industry have been rising rapidly. For the most high-performance chips, fabs cost tens of billions of dollars to construct and require years of lead time. R&D costs remain high, which is one reason why VC financing of the industry has been limited in the past (although that has changed — read below). It’s just tough to make it in chips if you are small and don’t have the capital to burn to stay competitive.

Perhaps even more importantly though, there has been consolidation on the customer side, and that monopsony is also forcing general consolidation for suppliers. Among the largest buyers of high-performance compute and storage today are the big cloud platforms like AWS, Google Cloud and Microsoft Azure. Apple and a few other manufacturers control most of the market in smartphones, and even in embedded systems, the number of buyers is apparently consolidating. Customer consolidation forces supplier consolidation, fighting market demand power with market supply power.

Those two trends have been around for years, but they culminated this year with the M&A frenzy we saw. That’s not to say that there is nothing left to buy in the market, but big players like Nvidia and AMD have made their biggest bets and are unlikely to make any more major acquisitions in the meantime.

What to watch for in 2021: The big story next year is which of these massive acquisitions actually receives approval. Antitrust regulators have been remarkably sanguine about consolidation in the sector, but now that consolidation is reaching its logical end, with only a few players — or even just one — existing in their respective markets.

These antitrust concerns are most notable with Nvidia/Arm, which has to receive simultaneous approval from four authorities (United States, Britain, Europe and China). Experts in the industry that I have talked to have been divided on their predictions, with some feeling that the parties can “work out a deal” and others feeling that China in particular is unlikely to approve a deal. We can expect some signs of how this is going in 2021, although approval of the deal might well head into 2022.

AMD/Xilinx has also raised some eyebrows among experts, but hasn’t gotten nearly the press that Nvidia/Arm has. As for Analog Devices and Maxim — which is pretty much classic horizontal consolidation — shareholders approved the merger in October, and the company said in its press release then that the period for the U.S. to intervene on antitrust grounds had expired. It still faces regulatory approvals in other regions and could close by summer 2021.

Given the huge spike in antirust concerns in the United States among both Democrats and Republicans around platform companies like Google and Facebook, the big question is whether those concerns spill over into other technology industries like chips. So far, that hasn’t been the case, but the new Biden administration might have other ideas when it sets up shop in January.

Venture capital activity in chips flourished in 2020. How much more investment can the industry take though?

2020 was another major year for VC dollars in next-generation silicon, after huge investment in 2019 and 2018. I’ve covered a lot of the exciting startups in the space, including Nuvia (which announced $240 million in September for its Series B), SiFive, EdgeQ, and Cerebras, and there are even more companies in the sector, including Graphcore and Mythic that are working on exciting products. Aggregate dollars in the sector are hard to calculate, since most chip companies stay very quiet about their funding for years due to concerns about competition. Nonetheless, even just the rounds that have been announced are staggering in scale.

Many VCs entered the space on the back of a couple of major trends. First, the idea that all compute should be handled by a one-chip-to-rule-them-all general architecture has been (mostly) thrown out in lieu of a diversity of chips that are customized for specific workloads (typically AI workloads, but there are exceptions). As companies move more of their compute needs on to the cloud, providers are able to match this new generation of specialized chips to customer workloads for better efficiency.

Second, many VCs felt that after a decade of underinvestment, the sector was ripe for disruption by new entrants and the next generation of chip designers and engineers ready to approach long-time processing challenges in new ways. Finally — and I think this point doesn’t get enough attention — VC fund sizes have finally ballooned to a scale where the occasional massive chip investment is actually realizable (did I mention Nuvia raised $240 million for a Series B? That’s like an entire VC fund a decade ago).

What to watch for in 2021: For all the excitement of the space, one of the most common patterns I have heard from VCs in recent months is that they have “made their bets” if they wanted to invest in semiconductors, and they are much less willing to countenance further investment in the space. There are a couple of prime startup niches available in chips, and therefore, VCs are loathe to invest in new startups that might become competitors with other portfolio companies either intentionally or accidentally. With so many investments already made, VCs are now slowing down the pace, watching who rises and falls, and potentially looking at investing at the growth stage when technical risk is out of the way for these companies.

Expect to see fewer new companies getting launched, and more doubling down of investments into existing companies as they hit their own roadmap milestones.

Intel: Phoenix or tomb?

My god. When you think about American industrial might, I think of three companies: Intel in semiconductors, Boeing in planes, and GE in, well, everything else. It’s not been a great year for any of these companies, with GE falling apart due to one financial crisis after another of its own making, and Boeing being battered by the travel industry’s collapse in the wake of the COVID-19 pandemic as well as its own self-induced mess surrounding the 737 MAX crashes and concerns around the company’s 787 Dreamliner, with the company announcing this month that it is widening inspections after finding defects post-assembly.

‘Made in America’ is on (government) life support, and the prognosis isn’t good

Now, Intel seems to be the next industrial and manufacturing giant ready to plunge into the ground.

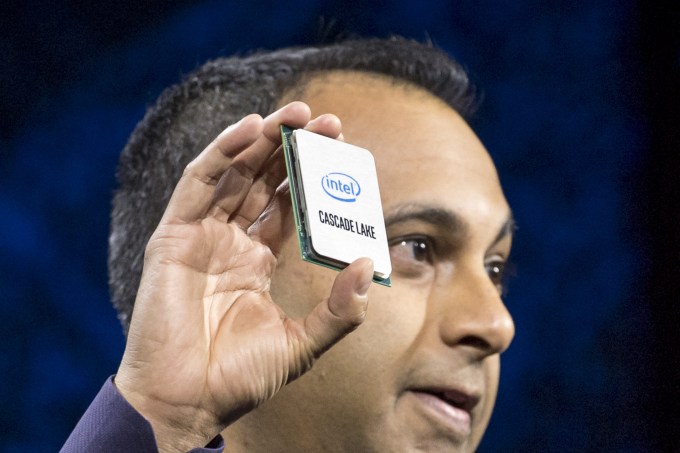

“Ready” is the keyword there of course. Intel has made numerous strategic blunders in the past two decades, most notably completely missing out on the smartphone revolution and also the custom silicon market that has come to prominence in recent years. It’s also just generally fallen behind in chip fabrication, an area it once dominated and is now behind Taiwan-based TSMC.

Yet, it’s still a massive company, with a market cap today of nearly $200 billion and revenues of $72 billion in 2019. How can a company making so much money lose so much investor love so quickly?

The answer is that unlike in software, chips require huge lead times to be successful. Trajectories are often set years in advance and take years to realize. Intel is widely perceived as being on a bad course now, which likely means that it will remain on a bad course for years to come. When Intel decided not to make mobile processor chips in the 2000s, it didn’t get to course correct and make them later — it was permanently locked out of the market.

Intel’s core product — and where it derives most of its margin — is having the best general-purpose compute chip out there. The problem is, the world is moving away from general-purpose chips to specialized chips that are capable of processing specific workloads at much greater efficiency.

We can see this pattern in Apple’s M1 chip announcement, the first chip in more than a decade in its computers that wasn’t from Intel but rather based on Arm’s technology. The M1 chip isn’t “a” chip, but rather a collection of subchips with unique computing capabilities tied together in one integrated architecture — what’s called a system on a chip or SoC.

That theory of compute is also spreading throughout the data center and cloud. Cloud providers are increasingly offering specialized chips to handle specific workflow tasks. So, for instance, AWS offers EC2 P4d instances that use Nvidia’s A100 Tensor Core GPUs as their main processor, designed to expeditiously train ML models. Today, most of these specialized chips handle AI-related workflows given their computational intensity, but there is absolutely a new world of chips coming that will optimize other workloads as well (particularly if that VC investment is successful).

That model of compute is heavily at odds with how Intel has built up its business over its lifetime and left it open to attack from ambitious competitors like Nvidia and AMD to take the lead in many of its most lucrative markets. No wonder then that investors have given Intel a PE ratio of 9.29, compared to 124.14 for AMD and 84.13 for Nvidia. Investors are much more excited for the growth of the latter two than for Intel.

Is Intel dead? No. But like I said, trajectories are hard to change in semiconductors, which is why Intel has to move aggressively to shore up its future now before the future becomes the present.

What to watch for in 2021: The key question then is how Intel handles all the criticism it received throughout the past year. The company has tens of billions of dollars on its balance sheet and tens of thousands of some of the smartest chip designers, engineers and salespeople on the planet. What’s its next play? M&A is looking increasingly dicey given the number of big juicy targets that were taken off the market this year (and almost anything Intel buys triggers at least some antitrust concerns), so much of the innovation it needs is going to have to come internally. Expect some heavy announcements and marketing in 2021, or if not, a much better glimpse at the declining future of Intel this decade.

U.S.-China trade friction — a complete unknown at this point

One of the driving stories of the semiconductor industry over the past four years has been the divide between the United States and China on the future of the industry. The Trump administration aggressively attempted to curtail Chinese expansion into the market, placing trade sanctions on companies like ZTE and Huawei and placing other companies on “entity lists” to prevent them from using American technology in their products.

In response, China has been working to build up an indigenous supply chain for designing and manufacturing chips, offering tens of billion of dollars of investments and incentives to bootstrap the sector. So far, its results have been mixed. One major player in Beijing’s hopes for chip independence was Tsinghua Unigroup, which is owned by China’s eponymous top engineering university. It reportedly defaulted on nearly $200 million in corporate bonds a few weeks ago, raising questions of its financial stability. Meanwhile, the country’s top chip fab SMIC was placed on the U.S. entity list two weeks ago, endangering one of its key hopes to topple Taiwanese fab giant TSMC.

It’s been nothing but international trade drama, and there’s not even a TikTok video involved (which is a whole other story that seemed to … just disappear. It’s Snap, but for trade disputes).

What to watch for in 2021: The big question for 2021, of course, is whether the Biden administration is going to continue the Trump administration’s approach to China, intensify it or relax it. It’s a question that so far has been mostly inscrutable to the DC political press, although most analysts believe Biden will lock in a somewhat looser trade policy. Biden has nominated Katherine Tai to be U.S. trade representative, who as a Capitol Hill staffer is a rare DC figure with broad support from all the constituencies that struggle over trade deals.

Meanwhile, there’s not much change expected on the Chinese side, with its policy positions having been clear for years now. The country’s indigenization of the industry is expected to continue, although the current setbacks might have it adjust its course in 2021. One major flashpoint to watch is the Nvidia/Arm deal, and whether China leverages its approval power over the deal to get a better setup on trade from America. That would in many ways mirror a similar trade dynamic between Broadcom, Qualcomm and NXP back in 2018.

In short, expect a little trade loosening, which might lower the frictions for semiconductors and smolder some of the news fires that have been burning on this beat for several years now.

Comment