After years of rumors and high-flying headlines, we finally have the S-1 for DoorDash. Alex has covered the primary details, but I figured it would be good to dive in so we can see who is raking in the returns on the country’s delivery startup champion.

DoorDash’s filing indicates that the company raised a combined $2.485 billion in capital across a seed round and eight rounds Series A-H. The three VC firms with the largest holdings noted in the filing were the SoftBank Vision Fund, Sequoia and Singapore’s GIC investment fund, listed here as Greenview (no relation to the cannabis fund of the same name that was charged with fraud a few years ago).

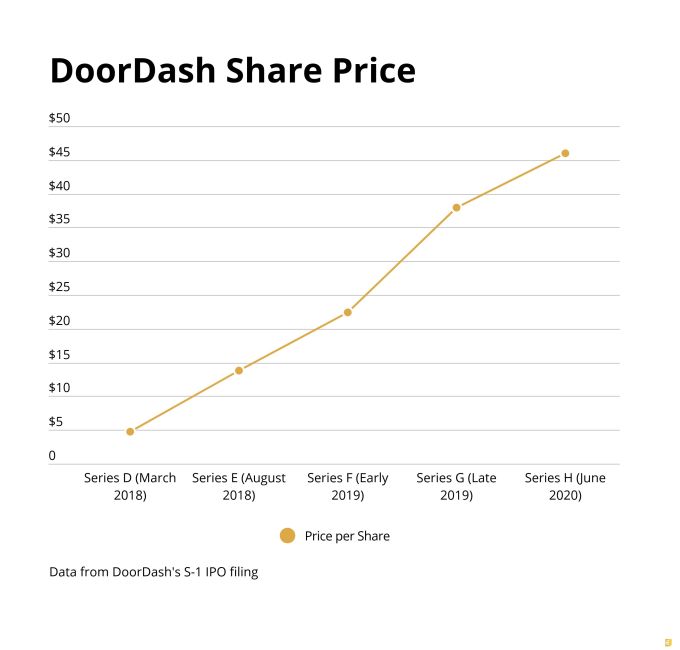

DoorDash’s most recent per share valuation was $45.91 for the Series H back in June. Shares purchased by investors over the entire life of the company had an average value of $8.73.

We’ll dive into the VCs and who won here in a second, but first, I want to discuss the founders and their ownership stakes. Co-founder and CEO Tony Xu currently owns 5.2% of DoorDash, according to the filing, which doesn’t include any future performance incentives. Co-founders Andy Fang, who is CTO, and chief product officer Stanley Tang both own 4.7% of the company. A fourth co-founder, Evan Moore, formerly head of operations at DoorDash and now a partner at DoorDash’s seed investor Khosla, doesn’t have his ownership listed, as he is no longer an active executive with the company.

Using DoorDash’s Series H price as its current share price, that comes out to about $680 million for Xu in holdings and $620 million for his two co-founders. A nice haul for sure, but also a sign of just how much dilution the co-founders took given the sheer amount of capital the company fundraised over its life (it also probably doesn’t help to have four co-founders).

Now, let’s head over to the venture capitalists, starting with Sequoia, which was among the earliest backers of DoorDash. According to Crunchbase, Sequoia led the Series A and Series C rounds, but it also apparently invested in later rounds as well. According to the S-1 filing, Sequoia invested about $115 million in the company’s Series D (which SoftBank’s Vision Fund led) and invested another $50 million in the company across Series E through H.

Today, Sequoia owns approximately 18.2% of DoorDash, giving it a holding value of $2.38 billion using the Series H share price. About 40% of Sequoia’s stake is held by the firm’s fourteenth early-stage fund in a so-called “holdco,” with the balance held across several of the firm’s growth funds. That Sequoia early-stage fund was $553 million according to Reuters back in 2013, which means that the DoorDash IPO will singularly make that fund’s performance look stellar.

Next, we have the SoftBank Vision Fund, which owns 22.1% of DoorDash. The firm invested $280 million in the company’s Series D, $100 million in its Series F, $250 million in Series G and $50 million in Series H, for a grand total of $680 million invested. Its current holding valuation for the company is $2.89 billion, so a nice, tidy return of approximately 4.25x prior to the IPO.

Finally, we have Singapore’s GIC, which owns 9.3% of DoorDash and has a current holding value of $1.22 billion. The firm invested about $155 million across DoorDash’s later growth rounds, so it’s looking at a pretty damn good MOIC, mostly because it invested in the cheaper growth rounds and tapered back more recently.

On that point, one spectacular graph to look at is DoorDash’s price per share over the last two-plus years. The company has seen its price soar from $4.79 in early March 2018 to $45.91 in June 2020 — a jump of almost 10x in just about two years. And that acceleration started well before the coronavirus pandemic, perhaps providing an indication that the company was already proving out its operational model before COVID-19.

One final note: Kleiner Perkins invested $7.6 million into the last growth round of the company this past June. Kleiner led DoorDash’s Series B, but seems otherwise to have been uninvolved in the company’s growth investments of the past few years.

No idea why they suddenly jumped in right before the IPO, but I thought that was interesting. The firm doesn’t own more than a 5% stake in the company, and so no further details were disclosed.

Comment