The venture capital market appears to be getting later, larger and more expensive. As a result, fintech — one of its hottest and most-funded sectors — is evolving in a similar manner.

For late-stage fintech companies, it’s great news. But for smaller players, is the shift toward bigger, more mature rounds undercutting their ability to attract capital and reach scale?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Venture capital getting later and larger was something we saw repeatedly in our examinations of what happened in Q3 2020 more broadly. For example, during our look into United States’ results during the period, we noted that “54% of all venture capital money invested in the United States in the third quarter was part of rounds that were $100 million or more,” with those 88 rounds — a record — totaling $19.8 billion.

The other 1,373 rounds in the quarter had to split the rest of the money. And the percentage of rounds that are late-stage is rising, along with their average deal size, to add to the trend.

Late-stage deals made Q3 2020 a standout VC quarter for US-based startups

Fintech appears to be in a very similar boat.

The Exchange previously dug into the fintech VC market, focusing our examination on the payments, insurtech, wealth management and banking verticals.

This morning, leaning on a report from PitchBook covering fintech’s third quarter, I want to highlight how the vertical is also tilting later-stage — a trend to keep in mind as we care not only about which startups are gearing up to go public, but also which ones have a shot at raising the capital they need to make it to the growth stage.

This morning, leaning on a report from PitchBook covering fintech’s third quarter, I want to highlight how the vertical is also tilting later-stage — a trend to keep in mind as we care not only about which startups are gearing up to go public, but also which ones have a shot at raising the capital they need to make it to the growth stage.

More big, and more late

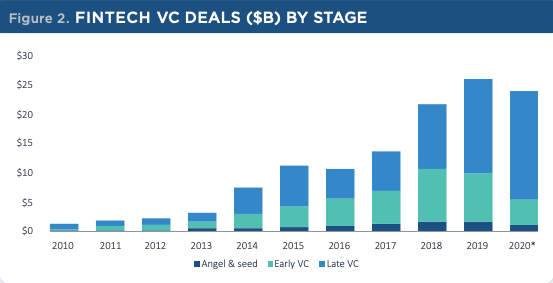

Top-line numbers from PitchBook concerning North American and European venture capital results for fintech in Q3 are as follows: $8.9 billion in total capital raised, +$1.3 billion or +17% from Q2 2020’s $7.6 billion haul.

But, as PitchBook notes, “only 414 deals closed during the quarter—the lowest count since Q3 2017.” More capital then, into fewer rounds. That sounds familiar.

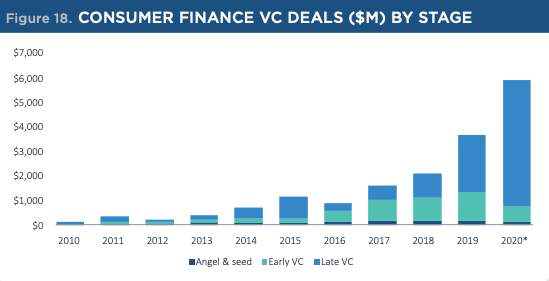

Initially, when looking at the data set, we were going to note that consumer fintech startups are having a great year, while it appears that certain B2B fintech categories were pulling back. Indeed, after raising $3.7 billion in 2019, consumer-facing fintechs in North America and Europe have already raised $5.9 billion in 2020.

But that growth story was dwarfed by the figures on this chart:

This data set is, again, only covering North America and Europe, but observe the changes visible in the angel/seed and early-stage venture capital results in 2020. Despite being on pace for a record total year on the two continents for fintech venture capital investment, the pace at which pre-late-stage startups have attracted capital actually declined.

The trend is not new: 2019’s combined angel/seed and early-stage VC totals fell from 2018’s own, a decline masked by a surge in late-stage investment into the niche. 2020 is the same story, but on steroids.

Deal data concerning North American/European fintech investment in the quarter helps detail how things are changing:

- Median pre-money valuation for late-stage VC-backed fintech startups in Q3 was $95.0 million, according to PitchBook. That’s up from $73.8 million in 2020.

- Median pre-money valuation for early-stage VC-backed fintech startups in Q3 was $20.0 million, again above 2019’s result, which in this case was $15.6 million.

PitchBook reports that valuation multiples also ticked higher, though not to new all-time records in Q3.

Returning to fintech sectors, recall that our initial observation of this particular data set initially made us lean toward a B2C versus B2B comparison? That would have worked, but it would have masked the key story, we reckon. Here’s North American and European consumer fintech VC activity going back a few years, with the 2020 data current through September 30:

Sure, consumer fintech has had a big 2020, but hot damn, look at how angel/seed and early-stage fell while late-stage dollars exploded.

What does all this mean for fintech founders of younger startups? Perhaps the horizontal product expansion we’ve seen amongst larger fintechs is reducing market space for smaller companies to get into the game. If so, the huge late-stage dollars that we can see could act as a dampener for new fintech startups trying to get off the ground.

A bit like how it would be hard to found a new food-delivery service given the capital bases of GoPuff, Uber and DoorDash, perhaps lots of fintech has been solved and funded. And, thus, once a number of the bigger players exit, VC investments in the space could fall. What do all these numbers look like without, say, Robinhood and Chime? Would the aggregates be as impressive?

We’ll ping some fintech-focused VCs and get their notes on what’s up with the early-stage world. We’re curious. (If that’s you, email me.)

Comment