Earnings season is racing past us, with the big ride-hailing companies’ numbers in, all of the Big Five having wrapped their reporting and lots of SaaS numbers in the market. But amidst all the noise, The Exchange has kept an eye on two companies in particular: PayPal and Square.

We’re not really concerned with their overall revenue and profit metrics. Instead, we’ve been hunting around in their numbers for hints and notes about what is going on inside of fintech itself. Why? There are a host of hugely valuable fintech unicorns that have to go public in the future that also share some market space with one or both of our public charges.

What can we learn from looking at what PayPal and Square reported to their own investors?

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

Lots, it turns out.

As TechCrunch reported when PayPal dropped its Q3 numbers, the public company had bullish results from its Venmo service, payment processing and consumer activity metrics. The numbers pointed to strong consumer adoption of fintech services during the pandemic, something that we presumed was not unique to PayPal itself, but was likely indicative of a generally warm environment for consumer fintech services.

Square continued the trend, posting a set of results that contains nearly all positive data for consumer fintech activity — with one critical caveat for Q4 that we’ll get to at the end.

Square continued the trend, posting a set of results that contains nearly all positive data for consumer fintech activity — with one critical caveat for Q4 that we’ll get to at the end.

Still, what the majors tell us about the fintech space indicates a warmth in activity that explains why Chime, Robinhood and others have had such fun in 2020, accreting tectonic capital to keep their growth hot.

Digging through Square’s earnings gives us a window into consumer payment activity, card usage, stock purchases and more. Let’s see what we can learn, and to which unicorns it might apply.

A very fintech 2020

Let’s start by talking about the broader fintech market before niching down.

The key paragraph from Square’s Q3 synthesis is as follows, weighing COVID-19 and its related negative impacts against what is effectively a strong tailwind from the same issue:

While the macroeconomic environment remains uncertain, we continue to believe that our Seller and Cash App ecosystems are well-positioned to benefit from the acceleration of secular shifts, such as omnichannel commerce, contactless payments, and digital wallets for consumers.

In case you don’t read Square’s earnings every quarter, “Seller” results refer to payments processed by companies that use the company’s tech to conduct transactions. Cash App is Square’s consumer-focused neobank-ish play, which includes peer-to-peer payments, banking and investing.

Driving results for the business and consumer sides of Square are a number of trends that are pushing customers and consumers in its direction. It’s a bullish remark. (And, for fun, we can infer that omnichannel commerce startups like Blueshift and Clevertap, perhaps, are doing well. That’s something to look more into, I reckon.)

Software companies are reporting a pretty good third quarter

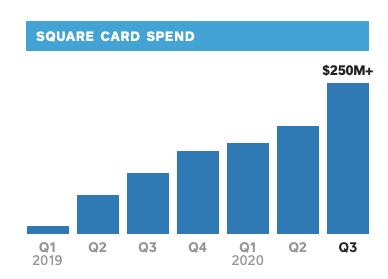

Moving along, cards. Card spend is a key way that many, many fintech startups earn revenue, usually in the form of interchange fees they collect when users employ a debit or credit tile from the company in question. Here’s what’s happened to Square’s card spend in 2020:

Hot damn, as they say.

We’re not trying to say all fintechs that provide cards are seeing similar gains. But the strength of Square’s results in this area at least point to a strong market for such products. That’s good news for lots of startups, from Chime to Acorns, and from Brex to Ramp.

The good news continues. A trend that has been noticeable in the fintech startup world for ages has been the expansion of services over time from single providers. This is why Square’s Cash App now offers stock purchases, Robinhood lets you buy crypto, Acorns moved into checking-like accounts, and so on; acquiring fintech customers (CAC) is expensive, so upselling them into more services is a way to juice their lifetime value (LTV), thus improving a startup’s CAC-to-LTV ratio over time (investors love a good CAC-to-LTV ratio).

Sticking to the point, here’s Square on how different cohorts of Cash App customers behaved in the period:

Customers who adopted two or more products were highly engaged: During the third quarter, these customers had 3-4x more transactions and generated 3-4x more gross profit compared to customers who only used peer-to-peer payments. Customers increasingly found daily utility: In the third quarter, daily transacting active Cash App customers nearly doubled from the prior year and represented nearly a quarter of monthly transacting active Cash App customers.

Our read of this is that consumers are content to wrap themselves tight inside fintech products, which suggests that efforts from fintech unicorns to offer more products over time probably had a good year.

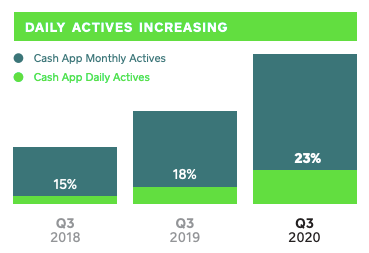

The pool of fintech users appears to be growing as well. For fun, here’s what Square saw on its consumer Cash App service in terms of usage growth in the last few third quarters:

Lots of folks have more than one peer-to-peer payment service on their phone, so it’s hard to correlate Cash App growth with aggregate results for the consumer fintech space. Regardless, the level of growth shown above is simply bullish and that matters.

Moving on, what about Robinhood, Public and Freetrade and all the other services that want to sell you stocks at little to no cost? Well, Square has seen strong results from its stock service. Here’s the company:

Stock brokerage saw the fastest adoption of any Cash App product: Since its launch less than a year ago, more than 2.5 million customers have bought stocks using Cash App, and billions of dollars had been traded by the end of the third quarter.

Impressive. But even better, combining our notes about the impact of having multiple types of service inside a single fintech shell and the stock market, Square noted the following set of metrics:

Stock brokerage customers had 28% more transactions across the platform and generated 15% more gross profit after they adopted stock brokerage.

More engaged customers are worth more over time. This is probably why Coinbase and Robinhood both launched debit cards, but in reverse.

The results from PayPal and Square seem to outline a hot consumer fintech market. 2020 has been a hard, long year for the world. But for startups hoping to help you manage and spend your money, it looks like a blockbuster trip around the sun.

There is some trouble on the horizon, however, as we head into 2021. Here’s Square on what it is seeing in October, the first month of Q4 2020:

Gross profit growth in October moderated compared to the third quarter, driven by a decrease in transaction volume per active customer. We believe this was partly a result of the end of government stimulus programs and unemployment benefits at the end of July, as stored funds in Cash App have decreased since July.

A lack of stimulus could impact fintech results. That’s something to keep in mind as Congress dithers, the pandemic rages and the outgoing president is too busy cosplaying as the victor to help his successor get started. We’ll see what happens, but it appears that 2021 could see tailwinds slacken if the government fails to act.

Comment