Julio Vasconcellos

More posts from Julio Vasconcellos

“Gradually, then suddenly.” Hemingway’s words succinctly capture the recent history of tech in Latin America. After more than a decade of gradual progress made through fits and starts, tech in Latin America finally hit its stride and has been growing at an accelerating pace in recent years.

The region now boasts 17 unicorns up from zero just three years ago. For the first time, the most valuable company in the region isn’t a state-controlled oil or mining behemoth, but rather e-commerce platform MercadoLibre.

We are only in the first chapter of this long story, however. When we compare the penetration of tech companies in Latin America to both developed and developing markets, we estimate that the market could grow nearly tenfold over the next decade. The value to be unlocked will be measured in trillions of dollars and the lives improved in the hundreds of millions.

Our venture capital fund, Atlantico, conducts a thorough annual analysis of market data from Latin America in what we call the Latin America Digital Transformation Report. The report consists of hundreds of data-rich slides based off of original studies, surveys and models constructed from a combination of public and proprietary data shared by many of the region’s leading tech companies. This year, for the first time, we have decided to make the report public and here we highlight some of the findings from this year.

Global venture capitalists, the likes of Sequoia, Benchmark and a16z have planted their flags through key investments in companies like Nubank, Wildlife and Loft. Those are not isolated incidents – venture capital investments in the region have nearly doubled annually for the last three years according to the Latin American Venture Capital Association (LAVCA). In order to understand what investors are seeing in the region, we analyzed the market through a simple framework we apply throughout our report.

The starting point for this framework is the socioeconomic foundation in place. The context in which transformation occurs is important in shaping its possible outcome. The same ingredients applied in different contexts and time periods will produce very different results. Thus, we believe that Latin America is unique globally, and the types of companies that will flourish (and to what extent) will be different than in other parts of the world. Trying to shoehorn foreign business models and products is unlikely to yield good results.

In the case of Latin America, it’s key to remember the region boasts a population twice that of the United States and a GDP half that of China’s (but similar on a per capita basis). In short: Latin America is big, a central factor that has the power to attract capital and talent. However, also critical to note is that economic inequality is severe. While a quarter of the region’s population lives in poverty, the wealthy in Mexico City and São Paulo enjoy living standards in line with their peers in New York and London.

This unique mix of large opportunity and critical problems waiting to be solved has provided fertile ground for the gig economy to flourish. Case-in-point: Brazil is Uber’s largest market globally in volume of rides, with São Paulo its largest city. Rappi, a major food delivery player in the region, valued at over $3 billion, grew its sales by 113% over the first five months of the pandemic. When taken together, the largest ride-hailing and food-delivery services in Brazil are already the largest private employer in Brazil, a formidable contribution to reducing high unemployment.

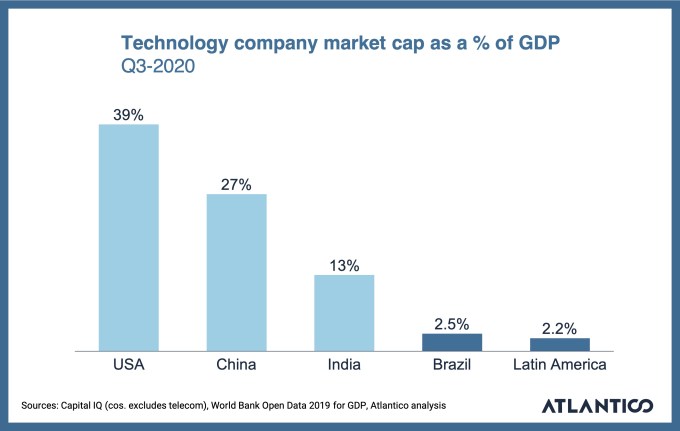

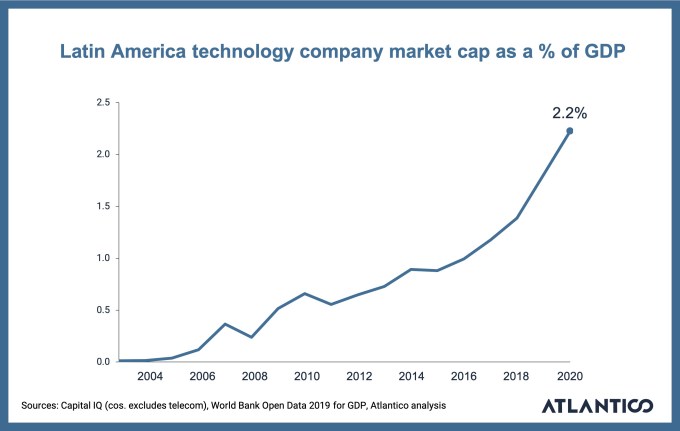

When we track technology company value as a percent of the economy (tech company market cap as a % of GDP) we clearly see that Latin America, at 2.2% penetration, has a ways to go. Our estimate is that it is 10 years behind China (at 27% penetration), which itself is five years behind current U.S. levels (39% penetration).

However, it is important to note that Latin America is making up for lost time. This metric for tech company penetration or share has been growing on average at 65% per year since 2003. In comparison, the growth in U.S. tech company penetration has grown at 11% annually in the same period, while China’s has expanded at 40%.

Drivers of digital transformation

Within the socioeconomic context of the region, we advance to looking at the three drivers of change in our framework: people, capital and regulation.

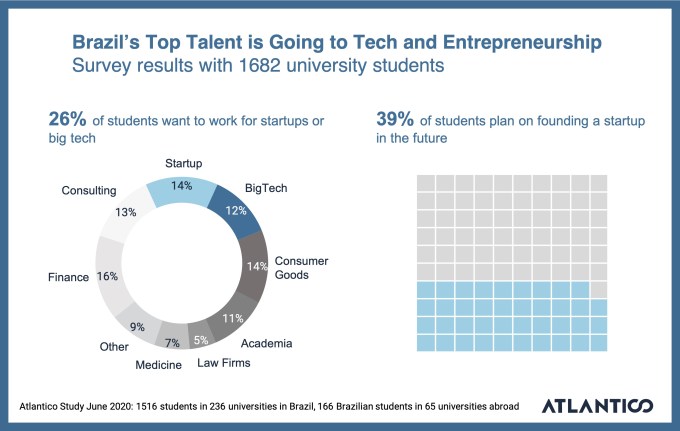

On the people front, the greater visibility of successful role models has catalyzed a desire to follow entrepreneurial footsteps. People like Mike Krieger (co-founder of Instagram), Marcos Galperin (founder/CEO of Mercado Libre) and Henrique Dubugras (founder/co-CEO of Brex) have shown that local talent can go on to build global companies.

In a survey we conducted with nearly 1,700 college students from the top universities in Brazil, 26% of students voiced a desire to work at startups or big tech companies. A whopping 39% expressed plans to start a company in the future, that number rising to 60% when we consider only computer science students. As more and more of the region’s top graduates flock to tech, it gives us confidence in the accelerating growth of the sector over many years to come.

On the capital front, the growth of venture funding in the region has been frequently written about. Last year, it hit a peak of $4.6 billion after doubling from the year before. However, what perhaps is more surprising is that despite this rapid growth, we are still far from the ceiling. When we view venture capital investments as a proportion of GDP, we see Latin America as only one-seventh of the U.S. level and a quarter of the level in India.

Interest in venture capital and tech has not been limited to international institutions but has also reached more conservative sources of capital like the wealthiest of local families. In a recent survey with 31 of the largest family offices in Brazil, we gathered that these investors have 3.5% of their assets in venture capital today and expect to more than double that to 7.4% by 2025. In contrast, a recent Silicon Valley Bank and Campden Wealth report estimated that large international family offices (mostly in North America and Europe) hold 10% of their assets in venture capital.

The draw to invest in innovation and technology has been compounded as public market tech companies far outperform their traditional peers. The Bovespa stock exchange in Brazil is down approximately 20% for the year, while most regional publicly traded tech companies like Mercado Libre, Globant, Stone, Locaweb and Totvs are up 20% (or far more) in the same period.

The attractive returns haven’t been limited to the public markets, as local venture capital funds have also outperformed their global peers. In interviews with General Partners and Limited Partners of the largest local funds of the last decade, we estimated that 66% of funds had performed in the top quartile of global venture capital returns as published by Cambridge Associates.

The third and final driver we examine is regulation. My partner Guilherme Telles, who was head of Uber in Brazil for the first four years, can testify that despite all the regulatory ups-and-downs that a company like Uber endured, regulators in LatAm are generally pro-innovation and willing to embrace new technologies and business models that can have a positive impact. That is not to say that well-funded special interests don’t often try to put the nation’s interests behind their own, but by and large, regulation has been welcoming.

Perhaps the most noteworthy advance we’ve seen has been the Brazilian Central Bank’s innovation agenda, which encompasses a new instant payment system (named “PIX”) to be launched later this year and an Open Banking rollout set to be completed by the end of next year. Brazil’s Open Banking initiative is the most aggressive we’ve seen (in terms of scope and speed) and in a series of 43 interviews with key leaders in the banking sector we heard from startups and incumbents alike a very favorable review of the Central Bank’s policy agenda. Perhaps not surprisingly, startups saw both Instant Payments and Open Banking as having a “strong” or “very strong” impact in the sector, while incumbents saved their praises for Open Banking alone.

Digitalization after the pandemic

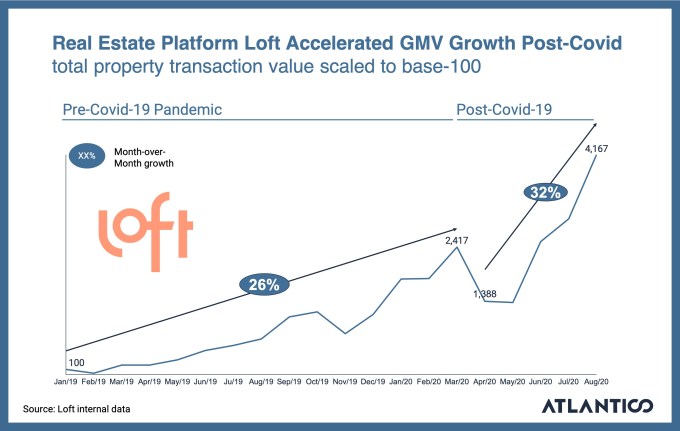

A curious by-product of the COVID-19 pandemic was the massive pressure it placed on regulators to adapt existing laws and restrictions to become more digitally friendly. The obvious first sector to be impacted was healthcare, where telemedicine was rapidly sanctioned after years of stalemate between regulators and physician groups. Conexa, one of the leading technology platforms for telemedicine, grew to over 10,000 telemedicine appointments per day from a baseline 100 times smaller. Loft, a real estate platform backed by a16z conducted the first fully digital deed signing and closing process in Brazil. The company subsequently saw the growth rate of property sales grow by 23% from pre-pandemic levels, flying in the face of a global real estate sector in turmoil.

We also explored COVID-19’s impact on other parts of the market. One positive by-product of the pandemic was how it increased access to the financial system. According to the World Bank, nearly 30% of the adult population lacked access to a formal account at a financial institution. That number is now expected to have dropped by half in Brazil as the government used primarily a mobile app to distribute COVID-19 relief funds. Analyzing app download metrics provided by Appfigures, we measured a fourfold increase in the number of monthly downloads of finance apps post-pandemic, showing the digitalization of finance happening right before our eyes.

We were also able to put numbers behind the tales of e-commerce expansion. We literally witnessed one of Lenin’s “weeks where decades happen:” In the first 10 weeks of the pandemic, e-commerce’s share of total retail commerce grew the same it had grown in the prior 10 years. Data from VTEX, Latin America’s largest e-commerce platform and newest unicorn, showed us that during the pandemic, growth in new online stores grew 26% while same-store-sales of existing large stores grew 95% versus the prior year.

The food delivery market is also booming. iFood, another Brazilian unicorn that leads the local delivery market, shared data with us showing a jump of 32% in the number of orders they are fulfilling, up from an already massive scale.

As the pandemic brought uncertainty, many people intensified their search for new stores of value beyond the traditional dollar and gold. Cryptocurrencies and innovation in the crypto space have long been present in the region, which has historically suffered from hyperinflation, currency fluctuations and constraint on capital flow. Twelve percent of Brazilians and 11% of Mexicans own a cryptocurrency, a number that is only 7% in the United States. In September of this year, in partnership with Nasdaq, Hashdex launched the world’s first cryptocurrency ETF. The company has seen its assets under management grow by nearly 250% since April as more people buy its regulated crypto index funds.

Education: Turning a barrier into a driver

An oft-cited barrier to Latin America’s coming-of-age in the technology world is a deficit of technical talent. It is true that both on an absolute and relative scale, Latin America falls short of other emerging economies in the availability of technical talent. Perhaps in part due to this shortage, many of the large technology startups in the region are tech-enabled businesses that efficiently move both bytes and atoms, rather than pure software (as some of the largest American tech companies). Thus far, this approach has allowed for world-leading companies to emerge and scale in the region without being bottlenecked by the availability of technical talent.

However, fast-forwarding three years into the exponential growth curve we’re on will rapidly change this reality, and the availability of engineers and technical talent has the potential to become a barrier to growth. The numbers show that the largest countries have been accelerating the graduation of STEM students, with Mexico growing science graduates at 9% per year (compared to 5% growth in the US) and Brazil has been growing engineering graduates by 11% per year (compared to 2% in the U.S.).

It is ironic that in Brazil, a country with 14 million unemployed, 70,000 technology jobs remain unfilled, despite being jobs that pay triple the national average. These statistics explain why the demand for courses like Trybe’s fully financed (via an income sharing agreement) year-long software developer course is in such high demand. Today, the company has among the lowest acceptance rates in the category (2.3%) and is more selective than the likes of Harvard and Stanford.

Descomplica, a 100%-digital university is close to reaching 10,000 postgraduate students with an offering, which, thanks to its digitally native roots, is nearly 70% cheaper than traditional courses. Technology can indeed be the great equalizer when it comes to physical and financial access to opportunity.

It is easy to get lost in pages of data and lose sight that behind every number there is a person, there is a story. This week, Trybe’s first software developer class is graduating, with 100% of its students gainfully employed. Many are students that joined after graduating from some of the most selective universities and come from well-to-do backgrounds. There are also many others that thanks to the affordable model the company pioneered in Brazil, found a path to a better life. One student I met used to make ends meet driving for Uber while his wife cleaned houses. They lived together in low-income urban housing; the “slums” often cited in news articles. Next week the new grad will start his first-ever formal job, working as a software developer in a renowned publicly traded company.

The impact of the tech transformation goes beyond the glamour of unicorns or the next hot app. If we look beyond the data at the bigger picture instead of searching for mythical creatures, the promise of digitalization in Latin America is clear: a brighter, more equal and accessible future for all.

Comment