According to Palantir’s latest S-1 amended filing published this morning, the company intends to start trading in two weeks on September 23 under the ticker PLTR.

That gives us a bit of time to speculate about how the company will perform on the public markets, particularly given Palantir’s unusually shareholder-hostile governance structure, which was a topic at today’s Investor Day event.

The good news: Palantir gave us the latest secondary sale trading data for shares traded by insiders before the company starts trading publicly. We also now know how insiders are going to register their shares, giving us some hints about who is excited to double down and who is looking to move on from the company.

Palantir has a large number of insiders today compared to other tech companies that recently filed to go public. According to its S-1, the company has 2,794 owners of its Class A stock, and 738 of its Class B stock. While there is almost certainly overlap between those two groups, it indicates that there are thousands of owners of Palantir shares today. Compare those figures to Snowflake, which had 1,026 owners, or Sumo Logic, which had 473 owners.

Palantir has more shareholders since it has been around longer (it’s approaching two decades), many early and even some recent employees would have had to exercise their stock options by now lest they expire, and there has been a robust secondary market for shares that has allowed new investors to buy into the company.

Given the number of people involved and the number of shares bought and sold over the past 18 months, we can get some insight regarding how insiders perceive Palantir’s value.

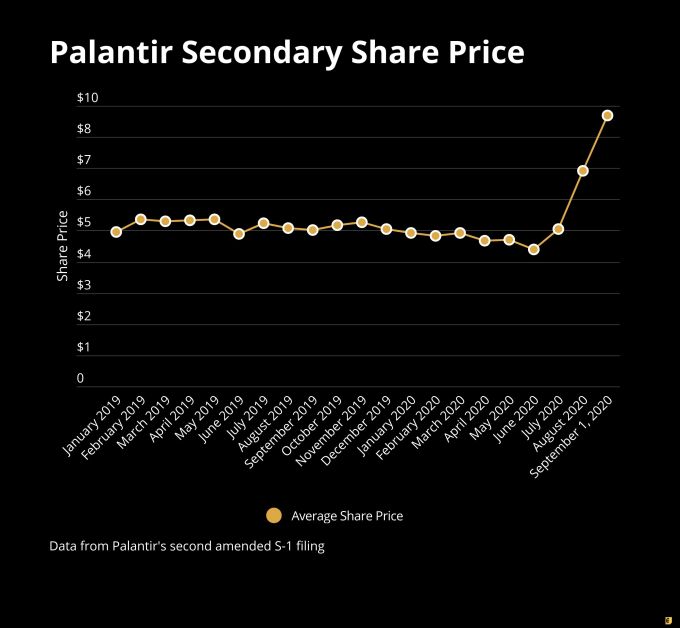

First, the company’s internal share price stayed flat for most of the past 18 months, but started to increase dramatically last month as the company prepared to go public. From January 2019 to July 2019, Palantir’s average price hovered around $5.30 a share, with little deviation. However, in August, that price suddenly scaled up to $7.31 a share, and on September 1, reached $9.17 a share.

Palantir cut off secondary sales after September 1 to facilitate going public, so trades for “September” are really trades made on the first day of the month.

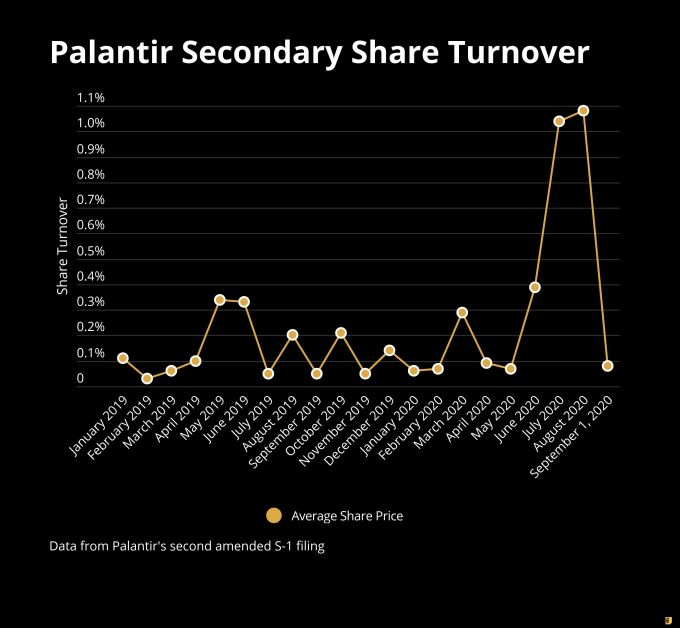

The bigger signal though is that the amount of turnover in shares has also heavily increased. When we look at the number of shares sold compared to the number of shares outstanding (turnover percentage), from January 2019 to May 2020, the average share turnover hovered around 0.13% with only small bumps in months like May 2019 and March 2020.

Then something peculiar happened. Starting in June 2020, insiders started selling a much larger portion of shares as the company zeroed in on an IPO date. June, July and August set records for the number of shares turned over, and the single trading day of the first of September saw 0.08% of shares sold, a rate that if linearized, would have been over 2% for the month.

One reason for the increased trading volume might simply be price. With prices rising in August by more than 36% compared to July, there may have been shareholders who saw the surge and decided to sell rather than risk all the volatility that typically accompanies a new stock entering the public markets. However, that doesn’t explain the increase in June and July. In fact, prices were lower in June than they had been for the previous 18 months, so that explanation seems implausible.

One challenge with secondary transactions is that it is harder to aggregate and match supply and demand in private markets, and so bigger stock sales tend to get much lower relative prices. If you want to unload a lot of shares, you need to offer a bigger discount to find buyers willing to pick up such a large block (what is sometimes referred to as a liquidity discount). However, a basic linear regression shows that the share price and the number of shares sold have almost no correlation to each other throughout this period.

Taking a large liquidity discount when your shares are going to be liquid in just a matter of weeks seems like poor investing — unless, of course, you are trying to rush to sell before the public gets a fuller understanding of the stock.

Some insiders are registering a lot of their shares

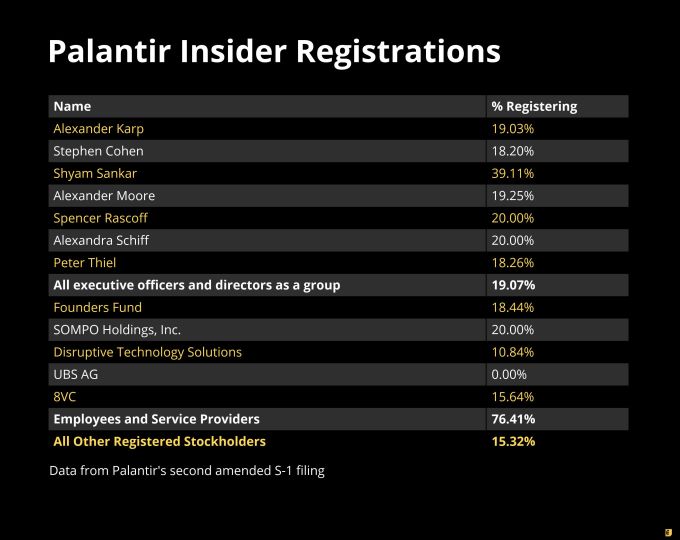

A few more notes on which insiders are registering their shares in the direct listing. Palantir, according to its amended filing this morning, said that it intends to register 244,233,967 shares, out of roughly 1.6 billion, or about 15%. That’s a pretty standard float for a new registration.

Where this gets interesting is seeing who is registering a lot of their securities, and who is not.

Most insiders are selling between 18% and 20% of their shares, including founders Alex Karp, Stephen Cohen and Peter Thiel, as well as investors like Founders Fund and Japanese insurance company SOMPO Holdings. Selling that percentage is typical for many insiders in order to cover the cost of the long-term capital gains tax, which is currently upward of 20%, depending on income in the United States.

Who are the exceptions though? Shyam Sankar, the company’s current COO, is registering nearly 40% of his outstanding shares, or roughly double that of other directors and executives. Given his prominence in the running of the company and the fact that he won’t own the special Class F “founder shares” that give Karp, Cohen and Thiel comprehensive control, it’s important to observe his actions. Like other executives however, he is entitled to a stock performance plan, which for him includes a stock award of about $25 million.

The bigger surprise than Sankar though is around past and current employees and service providers, who are registering a whopping 76% of their shares and will represent roughly 40% of the shares registered when the company goes public (despite only being about 8% of Palantir’s cap table).

Maybe Palantir’s slow path to the public markets has exhausted this group, but the size of the sale here is telling, particularly given that Palantir has had a robust secondary market for years that would allow at least some of these shares to be sold off the past few years.

On the more positive side, UBS isn’t registering any of its shares, and investor Disruptive Technology Solutions is only registering about 11% of its shares. So at least some of the investors sitting around the table seem willing to dive head first into the public markets and stick with the company long term. Ultimately, anyone interested in buying Palantir should understand its unique dynamics, governance and financials.

But observing how insiders and those close to the company are responding is another lens to glean insight on the company’s future fortunes. From the looks of it, the coming direct listing has at least some insiders heading toward the exit doors at a furious pace.

Comment