Charles Yu

As a founding member of TI Platform Management, I have quarterbacked more than $200 million in investments into first-time fund managers around the world. That portfolio includes being one of the first institutional checks into Atomic Labs ($170+ million), SaaStr ($160+ million) and Entrepreneur First ($140+ million), among many others.

Having seen successful returns as a fund manager and an early-stage VC (as well as recently raising my own angel fund), I’ve formulated several best practices and strategies for investing in fund managers. If you want to raise your first fund, here’s how.

Understand the mentality of an LP

Just as VCs bucket startup founders into categories, limited partners (the investors in your venture fund, also known as “LPs”) have an unwritten way of categorizing venture managers. The vast majority fit one of three archetypes:

- Former founder/operator turned VC

- Spin-off manager from a mega fund

- Angel investor with a strong track record

Here’s how each is perceived by institutional LPs and the unique blockers they have to overcome:

Former founder/operator turned VC

Having been through the journey of starting a company, former founders/operators often have strong intuition in identifying founders and an empathy/rapport that raises their win-rate on deals. Additionally, having built an innovative company, they can bring special insights in where the market is headed. Building a company, however, requires different skills from founding a fund.

If you’re a former founder/operator turned VC, expect LPs to ask questions that suss out:

- How well do you understand the intricacies of fund management (including portfolio construction, back-office functions and hiring)?

- How will you leverage your experience to the fund’s advantage (building a company is very different from picking companies)?

- Will you stick with the fund for 10+ years (or are you at risk of returning to entrepreneurship)?

If you’re a former founder or successful operator aiming to create a VC fund, LPs are much more likely to fund you if you can de-risk the differences mentioned above.

Spin-off managers from mega funds

After a string of successes at a brand-name fund, experienced venture investors sometimes set off on their own. In my experience, these spin-off managers are the least risky to back because they’ve been through all the intricacies of institutional fund management (fundraising, investing and communicating with LPs).

If you’re a spin-off investor from a mega fund, demonstrating individual performance and differentiation from other managers is key. Expect LPs to be curious about:

- What deals have you sourced that are truly attributable to you? (LPs will typically do background checks on portfolio founders here.)

- What differentiates you from your prior fund? (If you follow the same strategy and playbook, but now have fewer resources, LPs will believe you’re unlikely to replicate the same level of success.)

- How much of your previous success came from the structural support of your former fund (and how effective will you therefore be on your own)?

Spin-off managers are more likely to succeed when they show individual promise and differentiation, not just a strong history as part of a team. We’re looking for a rock star who has outgrown their prior fund — not just a junior partner.

Angel investors with strong track records

If you achieved strong returns on personal capital and want to parlay that into a formal fund, LPs will typically ask:

- Can you continue to achieve success at a much greater scale? (You might have turned $1 million into $10 million, but how will that scale in a $30+ million fund? After all, accessing top deals with a $50,000 check is much easier than joining with $1+ million.)

- Do you understand proper fund management practices? (The mechanics of operating a fund can be complex. No LP will invest when they fear you’ll make structural mistakes.)

Due to the intricacies of running a VC fund, angels are rarely able to raise VC funds without another advantage (either as a founder/operator or a partner at a fund). The practical challenges are typically too large to overcome.

Check as many boxes as possible

These individual archetypes do not exclude each other. In fact, most institutional LPs prefer to back someone with experience across archetypes. The best fund investments are a combination of all three. This trifecta — a former fund manager with entrepreneurial experience and a successful track record in angel investments — is the perfect combination of ingredients to make the equivalent of a “unicorn” in the fund-investing world. Typically first-time managers have at least a combination of two out of the three experiences.

Building trust with investors is a top priority

The majority of LPs manage institutional capital (endowments, foundations pensions) or family offices. While you may expect them to prioritize performance, that’s not entirely true. Instead, a large part of the LP’s job is avoiding big (often public) mistakes.

As the old saying goes, “nobody ever got fired for buying IBM.” On the other hand, investors are fired for selecting investments like Theranos or Rothenberg Ventures. Consider how long a money manager keeps their job after investing in a first-time fund that’s shut down for fraud.

This concern LPs have around job security raises the bar that much higher for first-time managers with limited credibility. To bypass these blockers, begin by building trust with LPs.

Even before you mention your track record or strategy, leverage social signals that show credibility. In building trust with LPs, the three most effective strategies are:

Build relationships early

Raising a VC fund can take 12-18 months, but typically starts years before. I know one fund manager who built a relationship with his anchor LP for 10 years before raising.

While building an LP relationship, keep in mind that these needn’t be formal business relationships or “networking” in the derogatory sense of the word. Being friendly, sharing helpful information and developing cordial relationships goes a long way in sewing the seeds for future investment from an LP. After all, if they have to choose between you and another VC with similar returns, they’ll select whoever they know better.

Gather referrals from respected people

Hundreds of first-time fund managers show a solid strategy and track record. One endorsement from a reputable industry leader is worth much more than pitching your track record deck.

The most compelling referrals typically come from GPs at established funds, famous founders, or known names in the startup world. (That said, institutional LPs are typically more removed from the market, so someone being well-known in the venture community does not guarantee your LPs have heard of them.)

Anchor with institutions that have already invested

Most LPs are risk averse. They aren’t innovators or even fast followers. If you can close one investor, that social signal goes a long way toward demonstrating your trustworthiness to others. This initial LP may not be the best fit, but any investment gets the ball rolling.

LPs are constantly on the lookout for red flags that a fund manager is unethical or incompetent. Myriad funds have failed due to illegal activity (both intentional and unintentional) or inexperience building out back-office functions. There’s a reason LPs spend an exorbitant amount of time making reference calls and conducting legal/operational diligence.

When raising your first fund, keep in mind: LPs look for trustworthiness before anything else.

Differentiate yourself

Even after establishing trust and reliability, you’re competing with hundreds of established funds. Every successful first-time manager I’ve ever seen differentiated themselves through either structure or performance.

Structural/strategic differentiation

In an investment industry where the top decile of performers take home the vast majority of wins, LPs want to invest in someone who can access and close top deals.

Most structural differentiation comes in the form of accelerated scale. Structural differentiation means you have a unique advantage in either deal flow or performance. Despite having only a single GP, SaaStr accesses over 30,000 SaaS founders because Jason Lemkin has built a brand and conference that drives top deals to him. Y Combinator pairs similar network effects that appeal to founders with impressive deal economics (how can other investors replicate YC’s $150,000 for 7%?!).

If you can also build a proprietary network of valuable resources such as engineering, product or design talent, you’ll differentiate yourself to both founders and LPs. This is why firms like a16z, First Round Capital and others have built a deep network of operators as a resource for portfolio companies. While it may be challenging to build a stacked roster off of your first fund, you can focus on one niche and expand from there. For example, one notable fund I diligenced started out by building a team of in-house counsel to offer free legal guidance to portfolio founders. Another one specialized in providing government contacts for international expansion.

The other method of acquiring impressive deal flow comes from focusing on an individual region or sector.

While most funds are sector-agnostic, if you have specific knowledge or experience in an area, you may succeed with a sector-specific fund. It’s a high-risk strategy, because some LPs will reject you out of hand if they’re already over-exposed in your sector or if they believe that the sector is unlikely to grow. The reward, however, comes in spades: If you’re a senior operator, founder or technologist with experience in a specific sector, you’ve already proven yourself promising. Imagine the hardware engineer who invented the iPhone now making predictions about the future of hardware: His expertise is already assured.

Examples that come to mind are James Lindenbaum, the founder of Heroku, who went on to start Heavybit, an accelerator focused on developer tools. Brad Greiwe, who was founder of Invitation Homes, went on to co-found Fifth Wall, a venture fund focused on real estate tech.

Sometimes you can even find a market gap like what Catharine Dockery did with Vice Ventures, a fund investing in vice industries like Cannabis, sex-tech and gambling.

Over the last few years, emerging markets funds (e.g. region-specific) and cross-border funds (e.g. between China and the U.S.) have also increased in popularity. The fundraising success of these specified strategies depends entirely on the manager’s local expertise. Most U.S.-based LPs lack sufficient knowledge of international markets to confidently back an international-focused fund. The risk that comes with a Wild West ecosystem also brings the promise of a land grab. Since the VC ecosystem is more nascent in emerging markets, successful funds can close the majority of strong deals and reap much more of the benefits. If you can show impressive local connections and a strong track record of helping top companies, you can structurally differentiate your fund by focusing on a specific region. Strong regional specialists that come to mind here are BECO Capital based out of the MENA, Kaszek Ventures in Brazil, Coral Capital in Japan and Blackbird Ventures in Australia, to name a few.

Performance differentiation

Performance differentiation is harder to pull off than structural differentiation. I’ve seen plenty of angels fail to raise a fund from LPs despite a track record of 3x-ing their initial, self-funded “fund zero.” With so many venture managers entering the market and other asset classes performing strongly, the “wow” bar for a first-time fund manager is around 7x TVPI. This figure is higher than what most managers expect. Given that angel investing has become increasingly accessible, there is a larger number of aspiring managers who have achieved 3x+ returns on their angel portfolio. Unless you have achieved outsized returns (7x+ TVPI), I would avoid making this the meat of the pitch.

With so many tech companies creating massive amounts of value, large opportunities still exist in VC. To raise a first-time fund, start by considering how LPs will perceive you, then build trust and differentiate yourself.

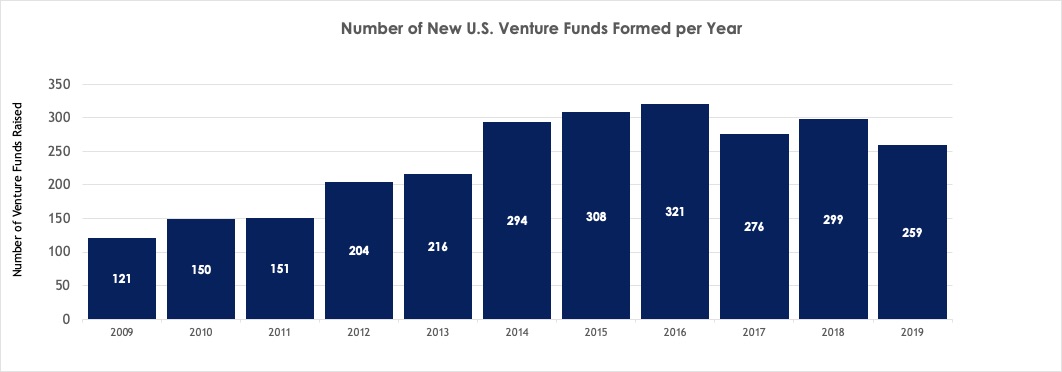

Starting a venture fund is more accessible than it has ever been. While that accessibility is exciting and appealing, it also raises the level of the competition. In an industry that only rewards top performers, be prepared to show why you are exceptional. Start early, find your niche and happy hunting.

Comment