When founders start fundraising is as important as how they make their pitch to investors.

Timing matters and it’s more complicated than founders might realize, but it’s not just about picking the right month or time of day. Finding the right time to fundraise requires a micro- and macro-level strategy, according to Jake Saper of Emergence Capital, who joined TechCrunch’s virtual Early Stage event last week.

“There are really two angles to think about,” Saper said. The first is the macro perspective that takes into account the general flow of deals in the industry. Then there’s the micro timing that is specific — and different — for every startup, he added.

While Saper was particularly focused on giving advice to startup founders who have already raised a seed round and are preparing to raise a Series A, he said that most of his guidance can be applied to companies at a variety of funding stages. Let’s get started with the basics.

Peak pitch deck

The reality is that founders fundraise in all times of the year. However, there are certain times of the year when investors are more actively reviewing pitch decks.

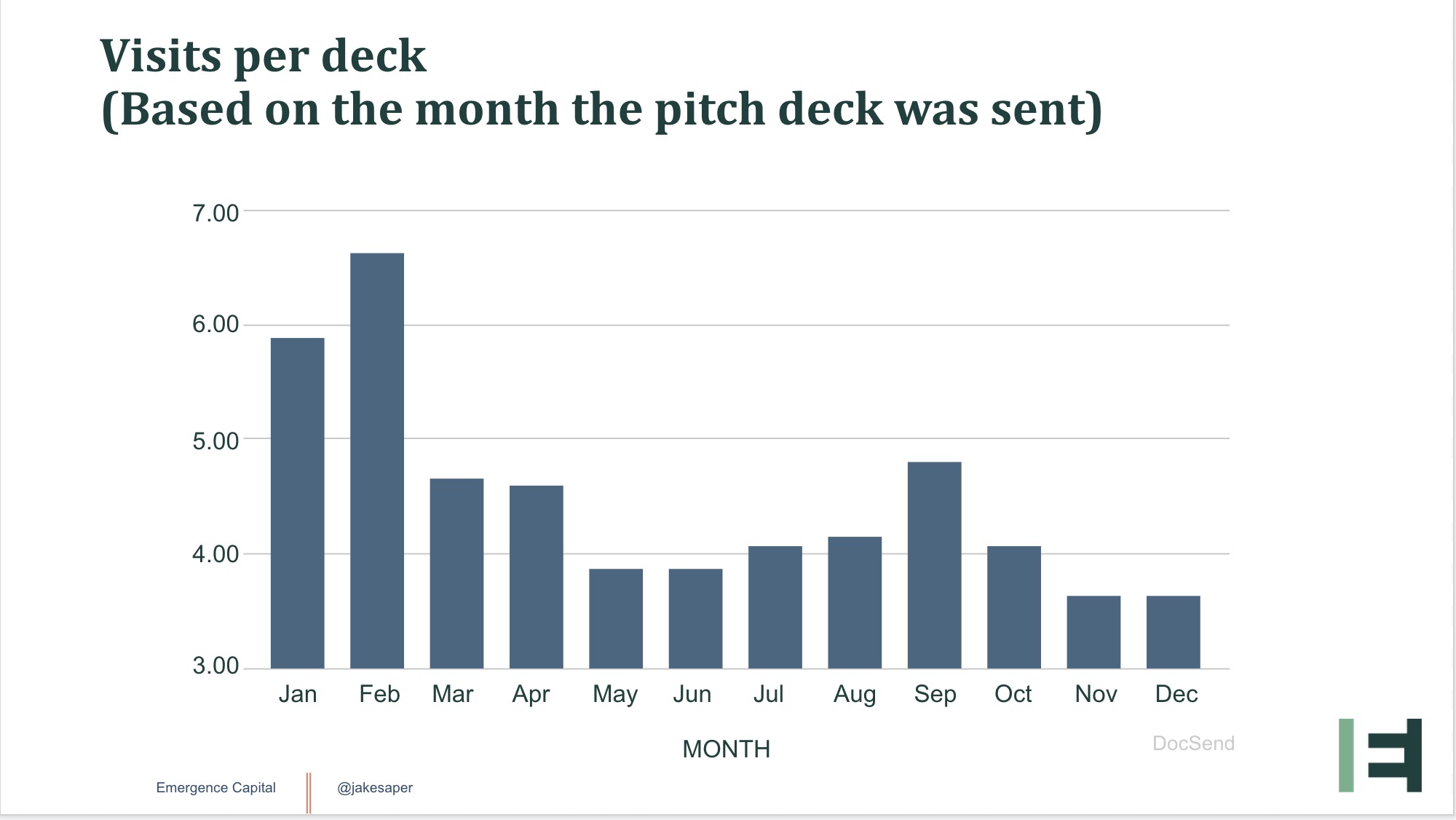

January and February, followed by September, are the most active months for investors, based on data from DocSend that measured visits per pitch deck sent out by entrepreneurs each month.

This fits with Emergence’s anecdotal evidence. The firm sees founders who spend a lot of December preparing for a big launch or fundraise in January and February, Saper said. By the time founders begin sending decks out in January, VCs are back from holiday vacations or other tech-related events, like CES. The same rhythm begins in summer with founders using these months to prep for fundraising in the fall.

While this is a common time to pitch VCs, keep in mind that you’re also fighting for their attention, Saper said.

It’s never too early

Once you’ve raised a seed round, the focus should be on products and customers. However, it’s also a good time for founders to begin thinking about a Series A round.

The fundraising process has become packed into a super tight period. The result is many short conversations with investors that make it difficult for either party to really get to know each other. Saper strongly encourages founders to give themselves time to find the right investors — people who might be on their board for decades — by beginning the process early.

Saper said founders should start to get to know a handful of potential Series A leads, shortly after they close a seed round.

You know you’re ready to start the Series A when …

” … you know how to spend the money,” Saper said. The answer is quippy, yet it gets to the heart of that nagging question of when a founder should actually start the Series A fundraising process.

The first steps are to build out the product enough and to have some initial go-to-market motion so that when the topic of a Series A comes up you know exactly what to spend that money on, Saper said. Founders should have an immediate sense as to what those funds would be used for.

The proxy for that, Saper said, is a concept known as product market fit. He admits that this is a subjective term. Investors at Emergence have come up with a simple definition for product market fit that might help. “It means your target customers love your products, and they’re happily paying for it,” Saper said.

“One thing that can be tricky is if people love your product, but they have a very low willingness to pay,” he added. “You may not actually have product market fit, and so it’s important to understand both.”

Sequencing the fundraise

Once a founder has a rough product-market fit and knows how they would spend that Series A capital, it’s time to start the actual fundraise process.

There’s a science to sequencing the fundraise that begins with understanding how long it takes to work through each step. There are three basic steps: prep, execution and close. Founders should budget at least three months for this process.

Prep takes about one month and is the time when founders and their team gather core materials, meet with seed investors and work on demo pitches. Saper recommends making the pitch with those friendly to the company — such as seed investors — to get feedback. This is also the time to line up customer and manager references.

Phase two is execution. This two- to six-week period is when founders are making their pitches to investors. The length of this period will vary depending on how hot the deal or industry is.

Keep in mind that founders should allow for two weeks advance notice to schedule VC meetings. This means that you might be starting to schedule meetings while you’re still in the prep phase.

Saper said founders need to think through the sequencing of these meetings. Go to the venture capitalists you’re most excited about first; don’t put them at the end of the process, he advised.

Phase three is the close, a period that follows signing the term sheet. This is when all the legal due diligence occurs. While founders should budget about a month for this process, Saper said it can last up to six weeks.

The three-step fundraise process might take three months, but founders should begin far earlier. Founders will want to start a fundraise at least six months prior to their zero-cash date. They should also factor venture debt runway at 50% to be conservative, Saper said.

Common mistakes to avoid

Even after following the three-step process, it’s possible to muck up a Series A fundraise by making one of several common mistakes that Saper has seen as an investor. Here’s a checklist of mistakes to avoid:

- Unless the deal is incredibly hot and the founders already have established relationships, avoid fundraising around holidays like Thanksgiving.

- Avoid being in the thick of conversations with investors at the quarter end. If you are close to the quarter end, most investors will want to wait to see the results. If you miss your quarter badly, then your process will die, Saper said. “I highly recommend being very careful about that quarter, and if you’re going to raise around it be very confident that you’re going to hit your quarter.”

- Seasonality: If your business has a strong seasonality, then time the fundraise for the tail end of strong periods and avoid raising during the weak periods.

- Milestones and metrics: Raise right before or after a big milestone. “The before or after basically depends on your confidence in hitting that milestone,” Saper said, adding that if you’re about to sign a big order with a customer or a channel partner who is going to help sell the product, wait to fundraise until after you’ve locked in the deal.

COVID-19 disruption

There’s no question that COVID-19 disrupted the typical fundraising cycle. However, it might have also inadvertently opened up new opportunities for founders looking for funding.

When COVID-19 first hit North America in March and April there was a drop in activity as investors became focused on the startups in their portfolios and founders turned to shoring up their own businesses. However, data shows that pitch deck interest didn’t decline drastically.

In recent months, Saper has even seen a resurgence in fundraising.

“It’s actually higher than it has been in previous years during the summer,” Saper said. “Is this going to be a season where summer is actually more active than it typically has been for fundraising?”

Vacation schedules have also been thrown off due to COVID-19. That means people are generally more available to take meetings and even close a deal on video conferencing apps like Zoom. Emergence recently made its first investment in a startup based on meetings exclusively conducted over Zoom, Saper added.

“So it’s a weird year, but it seems like there’s a lot of appetite to invest,” Saper said. “Keep that in mind as you’re thinking about fundraising.”

Saper is also quick to note it’s still too early to tell if COVID-19 has caused the number of deals or total funding amounts to fall. There’s often a lag between when the fundraise closes and when it’s announced and Saper expects to have a clearer understanding of COVID’s impact later this year.

Comment