When COVID-19 began to shutter the United States economy, startups jumped into cost-cutting mode as expectations rose that venture capital was about to get a heck of a lot harder to raise. After all, prior downturns in the broader economy, and tech sector in particular, had taken a bite out of the ability for startups to attract new funds.

PitchBook research shows that, in the wake of the 2008 financial crisis, the amount of money venture capitalists invested fell, with early-stage deal and dollar volume enduring the largest cuts. Late-stage valuations during the same period came under steep pressure. The connection between a slipping economy and a rapidly deteriorating venture capital market, therefore, seems strong.

The Exchange explores startups, markets and money. You can read it every morning on Extra Crunch, and now you can receive it in your inbox. Sign up for The Exchange newsletter, which drops every Friday starting July 24.

The historically grounded feeling from startups in Q2, as the stock market sold off and unemployment rose, was one of concern: VCs were about to cut their deal pace, and the number of dollars that they were willing to put into each deal would likely fall as well. That investors would need to shake up their process and do deals remotely was not confidence inspiring.

We don’t have full Q2 VC numbers yet, so it’s too soon to say that Q2 was worse or better than expectations. But what we can say, thanks to a new survey from OMERS Ventures, is that VCs moved with reasonable speed to get over the technology and cultural hurdle of remote deal-making to keep the checks flowing. Indeed, according to OMERS Ventures’ research, 69% of the VCs it surveyed in June were willing to do fully remote deals; for startups worried that the venture class was simply going to pack up its checkbook and take an extended vacation, it’s good news.

We don’t have full Q2 VC numbers yet, so it’s too soon to say that Q2 was worse or better than expectations. But what we can say, thanks to a new survey from OMERS Ventures, is that VCs moved with reasonable speed to get over the technology and cultural hurdle of remote deal-making to keep the checks flowing. Indeed, according to OMERS Ventures’ research, 69% of the VCs it surveyed in June were willing to do fully remote deals; for startups worried that the venture class was simply going to pack up its checkbook and take an extended vacation, it’s good news.

But the news isn’t all rosy — most VC firms from the 150 in North America and Europe that the venture group surveyed have yet to actually execute a remote deal. And, there’s some indication that overall deal volume could be slowing, perhaps due to “dwindling supply of companies formally going to market,” according to OMERS Ventures’ Damien Steel, a managing partner.

This morning let’s examine which VCs have been the most active, and the least, to find out which types of firms are still investing, and where investors are seeing more deal flow, and less.

Remote deals, fewer deals

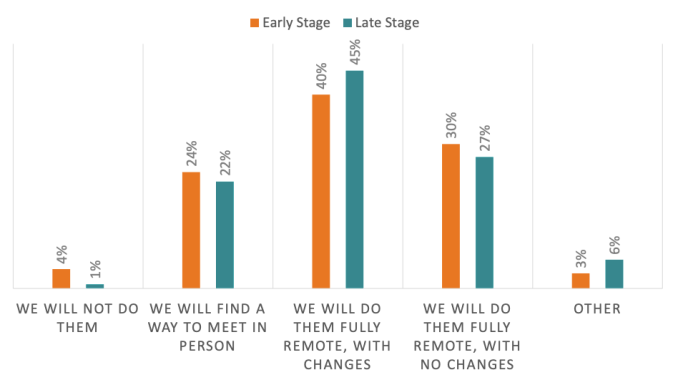

Most VCs have decided that remote deal-making is, at minimum, something that they need to become accustomed to. Only 4% of surveyed VCs said that they would not do remote deals, full-stop. Another 23% said that they were fine with remote deals, albeit with some ability to meet entrepreneurs in person.

A slightly larger slice of surveyed investors — 27% — said that they are willing to do remote deals with no process changes. The largest cohort of 42% of respondents said that remote deal-making was a go, along with changes to their process. So, 69% of VCs are willing to go ahead with remote deal-making, with another fourth mostly game for the same challenge.

If you are a startup looking to raise, these should be heartening numbers.

Notably there isn’t too much difference between what percentage of early-stage investors and late-stage investors are up to. I would have anticipated a more old-school approach from later-stage deal-makers. But, the data shows that late-stage VCs are less likely to decline all remote deals, and less likely to require some in-person contact during the COVID-19 era:

While stage-demarcated differences appear modest, there are some geographic differences worth keeping in mind. For example, Bay Area and European VCs were the most likely to say that they would find a way to meet in-person in the course of deal-making, at 24% and 27%. New York City-area VCs, in contrast, were the least likely to demand some in-person contact at 9%, of the geographies that were broken out. (New York City was hit hard by COVID-19, perhaps making local VCs less interested in trying to find a way to meet founders in parks or other outdoor spaces.)

Finally on this topic, 47% of VC firms that preferred to lead deals expected to shake up their process, compared to just 26% of VCs who prefer to follow. In contrast, 63% of VCs who prefer to follow in deals were willing to do remote deals sans changes to process, while just 20% of VCs who prefer to lead were in the same boat. The more conviction required, then, the more process tweaks that VCs may need to undertake.

Doing the deal

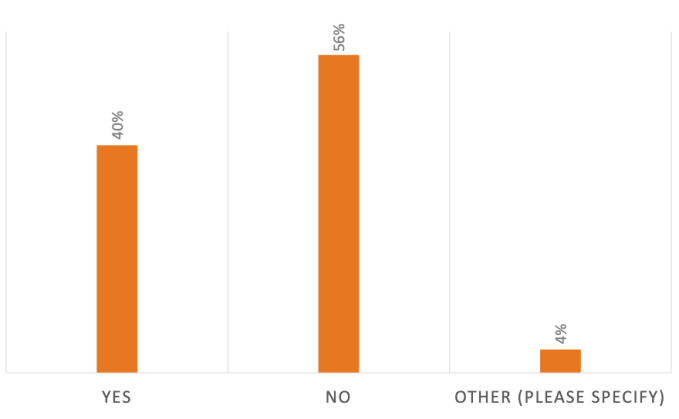

Next, let’s look at the data for whether a firm has actually done a fully remote deal. After all, intent to do a deal in the new world is far less important than actually sending a wire.

Here’s the breakdown:

That is slightly less encouraging than we might have anticipated, given the above data. Put another way, just two in five VC firms have done a fully remote deal as of the time of the survey. Three in five have not.

This asks an obvious question about deal volume. Given that so many VCs have yet to do a fully remote deal, does that mean that we’re staring at a VC slowdown a la 2008 and 2009? Maybe, but perhaps not for an incredibly terrible reason.

Recall that earlier we mentioned that startups cut costs early in the COVID-19 economic cycle? Well, those cuts can extend runway, giving startups more time before they need to raise. Looking at deal volume reports from surveyed VCs, OMERS Ventures’s Damien Steel connected cost-cutting to possible falling deal volume in an email to TechCrunch:

We were surprised that more than 20% of firms have reported an increase in deal activity. But it makes sense when you dig deeper to see most of these VCs are follow firms — indicating that rounds may be having difficulty closing/filling the subscription amount. Given the majority of VCs reported some level of decline in dealflow (between 25%-50%), this would suggest there is a dwindling supply of companies formally going to market — as many companies opted to extend runway, bridge to their next financing or approach VCs where they have an existing relationship.

Extended runways aren’t eternal, and the companies that delayed fundraising will eventually need to go to the market. This is perhaps why there’s been anecdotal evidence that more startups are raising extensions to their preceding rounds; this allows them to take on more cash at investor-favorable terms, often quickly. But such deals are less bullish than new rounds, and indicate that for some startups the fundraising market isn’t what it was.

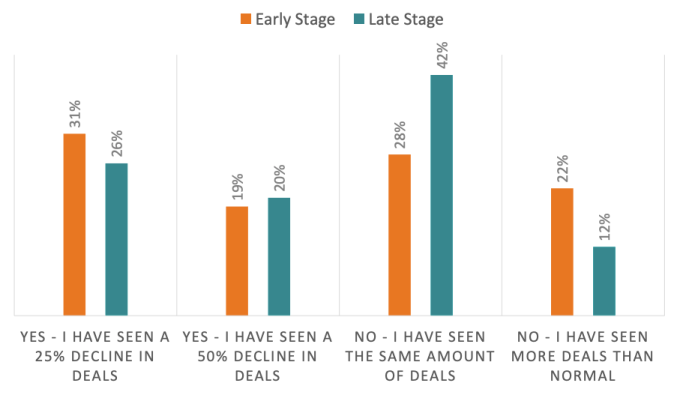

For a final look at the data, let’s peek into reported deal volume that VCs have seen in the early and late stages. Here’s the chart:

Most notable in the above chart is that early-stage VCs are both the most likely to report that they have seen a decline in deals (50%) and that they have seen more deals (22%). Perhaps early-stage investing is super uneven, while the 42% of late-stage investors reporting flat deal volume implies the opposite with investing in later-stage startups?

Wrapping as we’ve gone on for a while now, the gap between the share of VCs who say that they are open to remote deals, and the smaller portion that have actually done them, could bode well for Q3 as it implies pent-up investing activity. Or, you could read it as a lot of VCs talking a big game and not following through. Either way, full Q2 VC data is going to be fascinating, but perhaps not as curious as Q3’s eventual numbers.

With more time, will VCs get better at remote deal-making, or not?

Comment