This morning as the markets rally, shares of Lyft are up 3% while Uber shares are up 6%.

Why is Uber so far ahead of Lyft, its domestic ride-hailing rival that is suffering from the same economic impacts? It appears that investors are heartened that Uber has closed its Postmates acquisition after both firms danced around each other for some time, leading to all sorts of leaks that wound up being not coming true.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

This explains why Uber investors are excited about Uber’s Postmates buy; what about the smaller company is making Uber shares so buoyant? Let’s take a walk through the numbers this morning.

If we reexamine Uber Eats’ recent growth, contrast it to Ubers Rides’ own growth, mix in Eats’ profitability improvements along with Postmates’ own financial results, we can start to see why public investors might be heartened by the deal.

If we reexamine Uber Eats’ recent growth, contrast it to Ubers Rides’ own growth, mix in Eats’ profitability improvements along with Postmates’ own financial results, we can start to see why public investors might be heartened by the deal.

Afterward, we’ll toss in a note about how Postmates may provide Uber some narrative ammunition heading into earnings. This exercise should be fun, and a good break from our recent IPO coverage. Let’s get into the numbers.

Growth, losses

In case you are behind, Uber is buying Postmates for $2.65 billion in an all-cash deal. Uber estimated that it would issue around 84 million shares to pay for the transaction. At its share price as of the time of writing, the deal is worth $2.72 billion at Uber’s newer share price. For reference, that price tag is about 4.8% of Uber’s current-moment market cap.

To understand why Uber would spend nearly 5% of its worth to buy a smaller rival, let’s remind ourselves of the performance of the group that it will plug into, namely Uber Eats.

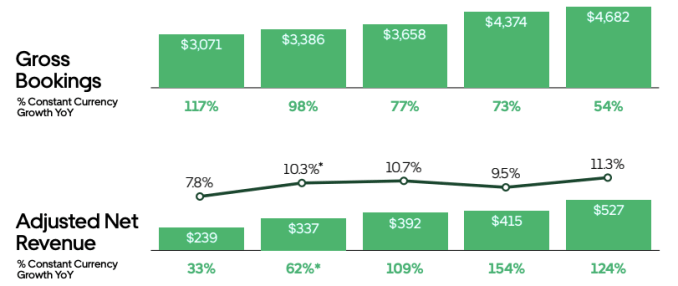

From Uber’s Q1 2020 financial reporting, the following chart will ground our exploration, showing how Eats has performed in recent quarters:

You can see why Uber investors are keeping an eye on the Eats business. It posted adjusted net revenue (a very Uber metric, we admit) growth accelerating from 33% on a year-over-year basis in Q1 2019 to 124% in Q1 2020; sure, growth was even better in Q4 2019, but the general pace of quickening top line expansion is encouraging believers in the unprofitable company.

Even better, Uber’s take rate — the portion of gross bookings it gets to keep for itself — reached an all-time high in Q1 2020 at 11.3%.

Good growth in total spend (gross bookings), and accelerating adjusted Eats net revenue expansion made Uber’s aggregate Q1 results better than they otherwise might have been, as ride-hailing had its smallest gross booking result during the same quarter since at least Q1 2019.

But Uber Eats has a downside. Namely large, regular losses. From the same dataset:

As you can see, Uber Eats loses around $300 million each quarter on an adjusted basis, with the fast-growing Q4 2019 costing a chunk more.

Uber fans will point to the Eats group’s falling losses as a percentage of revenue, with Eats’ adjusted EBTIDA falling to 59.4% of Eats Adjusted Net Revenue (to use Uber’s own phrasings) in Q1 2020 from 111.1% in Q4 2019. But that means, still, that Uber Eats is oceans away from break-even on an adjusted basis, let alone contributing to helping finance the rest of Uber’s costs.

We can now turn to Postmates.

Growth, losses, redux

We know lots about Uber Eats’ performance because its parent company is public. Postmates’ own results are a bit harder to nail down.

Still, there’s been some good reporting on the company over time. So, let’s see what we can scare up this morning:

- 2017: “Postmates’ revenue grew more than 85 percent to around $250 million in 2017 on nearly $900 million in total gross sales, according to a document viewed by Recode,” according to the same publication. The same piece noted that Postmates had an operating loss of around $75 million that year.

- 2018: “Postmates, which completes 5 million deliveries per month, reportedly expected to record $400 million in revenue in 2018 on food sales of $1.2 billion,” TechCrunch reported. Postmates confirmed these estimates in April of that year.

- 2019: Who knows?

Information gets harder to come by for 2019, the same year that competitors DoorDash raised well over $1 billion and Uber Eats saw its own revenues rise sharply. Perhaps Postmates didn’t leak numbers that year as they didn’t show lots of growth; perhaps its competitors ate its market’s expansion. The company’s filed, but aborted IPO lends some credibility to the idea.

But let’s presume that Postmates grew by $100 million in 2019, or around 25%. That would put it on a $125 million quarterly run rate, against which it would lose about $31 million on an operating basis, provided that it kept the same revenue:operating loss ratio from 2017, a very bold estimate on our part.

We can now have fun. With our numbers, Postmates had around 24% of Uber Eats’ adjusted net revenue in revenue in the first quarter, and about 10% of Uber Eats’ losses during the same period, comparing its own operating losses (a somewhat strict metric) to its new org’s adjusted EBITDA.

So, from this super loose and directional comparison of estimated numbers, Uber Eats looks like it bought a real revenue jump at a limited loss-pace. Of course, it cost a few billion to lock down, but Postmates could bring an efficient chunk of top line to Uber Eats, allowing the group to grow more quickly while bringing down its losses as a percent of revenue.

That is what Uber investors want to see. After all, Uber’s Rides business is going to have a terrible Q2 and what could prove to be a tough Q3 and even Q4. Growth tailwinds at limited cost — to cash reserves, that is — are welcome. And Postmates could bring just that.

None of this solves the fact that the only unit-profitable portion of Uber’s business is sharply lower than year-ago results, but at least the growth side of the Uber Eats story is set to get a shot in the arm, provided that the deal gets approved.

Given all the above, then, it’s hard to hate on the deal from any particular angle. Uber gets the growth it needs and Postmates gets the exit it needed to keep its investors happy enough; now we need to learn what impact on the transaction’s price has on common shareholders. I want to know if they are going to be smacked by downside protection that could have been written into the company’s later funding rounds.

From a purely corporate perspective, however, this tie-up seems more than just fine.

Comment