Startup health appears to be recovering in the United States, new data shows.

According to several metrics TechCrunch has tracked throughout the COVID-19 era, the fortunes of some startups appear to have bounced off lows set in March and April. Data concerning layoffs, and, more specifically, software revenue and customer losses indicate that many firms have stopped making aggressive staffing cuts and are shedding fewer customers than earlier in the pandemic.

These two signals don’t sum up the entire startup market. But while TechCrunch has spent time in recent days parsing surveyed sentiment and reported observations from founders and private-market investors alike, studying layoffs and churn should help sharpen some of the blurred edges in our view of the current landscape.

The Exchange is a daily look at startups and the private markets for Extra Crunch subscribers; use code EXCHANGE to get full access and take 25% off your subscription.

This morning let’s explore trends in software sales via ProfitWell, a startup focused on SaaS retention, and new data from Layoffs.fyi, a startup layoff tracker built by the co-founder of Human Interest. Both groups provided TechCrunch with freshly charted data to parse.

After we dig through the new information, we’ll check in with Bessemer growth-stage investor Elliott Robinson to compare our findings with what he’s seeing in the later stages of the venture market.

After we dig through the new information, we’ll check in with Bessemer growth-stage investor Elliott Robinson to compare our findings with what he’s seeing in the later stages of the venture market.

Startup health

Health amongst growth-oriented private firms varies greatly from company to company, often hinging on sector served; for example, upstart software companies that sell to the travel industry may still need to layoff staff despite improving performance amongst their general business model cohort.

And not all startups sell software, even though the Software as a Service model has become one of the most popular for high-growth private companies approaching the market. This means any single perspective on a startup group, or all startups, will necessarily miss nuance. But a general picture is better than no perspective at all, so we’ll proceed all the same; let’s begin with layoffs.

Staffing cuts in sharp decline

Layoffs.fyi has become an important hub for startup news in the COVID-19 era, counting up layoffs from startups around the world and noting unconfirmed reports as well, which helps workers keep tabs on their company and industry. (Notably, the same group recently put together a similar site that explores startup severance.)

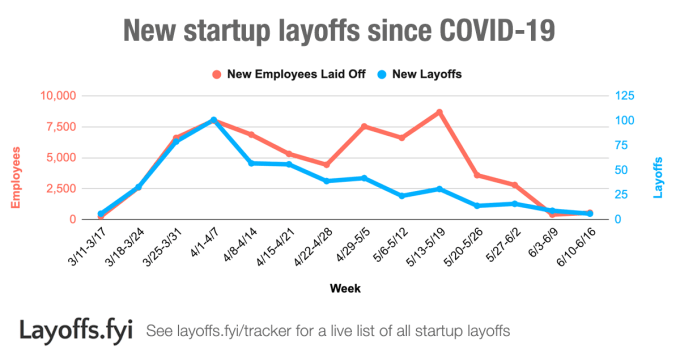

Via Layoffs.fyi, observe how far startup layoff activity has fallen in recent weeks, a trend TechCrunch noted earlier in June:

In the last two weeks, aside from the first week tracked back in mid-March, the number of startups executing layoffs (the blue line), and the number of employees actually cut (the orange line) are at record lows. Given that Layoffs.fyi isn’t sector-specific and has kept tabs on startup cuts around the world, we can view this chart as a loose proxy for global staff cuts at upstart firms generally.

Layoffs are not the only move startups are executing to cut costs. Some have instituted hiring freezes, for example. So, the decline to near-zero in terms of known staffing cuts doesn’t mean that the labor market is back to where it was.

Still: A bullish set of lows on a negative barometer is welcome, surely.

Software sales improve

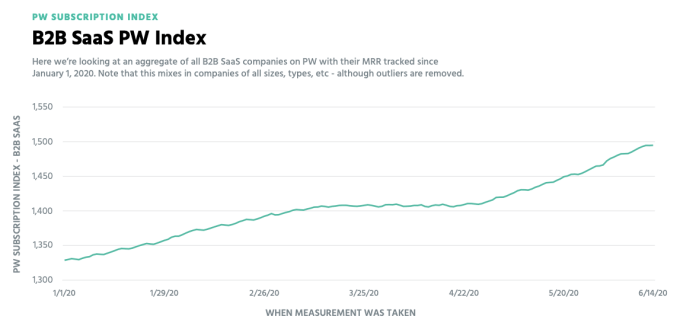

As with most metrics that help us understand the private markets, we’re looking at churn through a proxy: ProfitWell data aggregates subscription performance from over 15,000 companies, many of whom are the smaller, private firms that we care about. ProfitWell does have some larger customers as well, making the data imperfect for our startup focus.

But, the trends their data shows us concerning some critical subscription software companies is super clear, and thus directionally useful even if it is not perfectly precise. That in mind, observe ProfitWell’s business-to-business software index:

You can see the impact of COVID-19 as it cut growth in March to zero. That plateau persisted into the end of April, after which growth got back to normal.

This data comports with what we’ve heard more generally from startups. Yesterday we noted that founders were increasingly optimistic about things like how long the slowdown might last and how much cash they might need to get through the pandemic. A return-to-form in business software growth is just the sort of thing that could help entrepreneurs regain confidence.

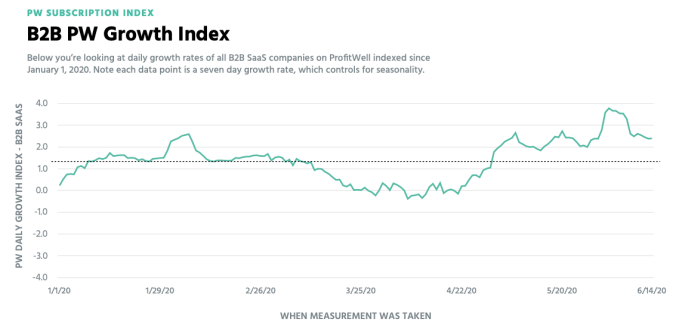

We can look at the same timeframe through the lens of daily growth rates instead of MRR, which helps us better see the decline and recovery from COVID-19 driven changes to B2B SaaS:

What stands out is that the growth starting in May appears to be stronger than growth seen prepandemic. If that is a result of pent-up demand, or merely the market’s new normal, is not clear.

Good news, mostly

Today we’ve mostly covered good news. But lost in the mix is the fact that many companies are still struggling for one reason or another. To make sure that we weren’t over-indexing to our disparate proxy data sources, TechCrunch turned to Elliott Robinson, an investor who focuses on the late-stage market.

TechCrunch asked Robinson about the health of his part of the startup market, companies that are taking on larger checks to keep scaling and eventually go public, or sell for a high price. According to the investor, “there’s more late [and] growth-stage capital in the market than ever before thanks to all of the funds that have raised in the past nine months.” In his estimation this has helped keep prices (through the lens of revenue multiples) at “all-time highs for the best performing private and public companies.”

We’ve previously noted the public market performance of many tech companies since their torrid rebound off their March bottoms.

Robinson sorts today’s late-stage startups into three buckets. In the first, startups that are struggling in Q2 and are thus looking to raise as soon as they can on the strength of their results through the end of Q1 2020 (this window of opportunity is closing as there are less than two weeks left in Q2). In the second, Robinson discussed late-stage startups that previously expected to raise in the second half of 2020, but are pushing those timings up due to uncertainties driven both by COVID-19 and the election.

And in the third bucket are the late-stage upstarts that everyone wants to talk about, the “companies that are experiencing a complete tailwind from COVID [and] work from home, and are raising now knowing that prospects may change whenever we get back to normal.”

Tying these notes to our data, two out of the three late-stage buckets he describes would likely not need to cut staff and would likely be seeing reasonable-to-good business results. So, what Bessemer is seeing matches our data.

We highlight all three of Robinson’s categories as they indicate that perhaps most late-stage startups are looking to raise right now, either to avoid talking about their Q2 performance, to dodge later-year market uncertainty, or raise while they are hot. This makes for an uncertain picture; if fewer rounds get done than startups hope, some companies could face a cash crunch, others will take a valuation cut if markets decline heading into the election and the remainder may have to raise after their tailwind subsides.

The fewer late-stage rounds that we see, then, the more we’ll know that investor caution won out over startup impatience. And that would be one more signal to add to our mix regarding startup health, just not a very positive one.

Comment