Steve Sloane

In both the private and public markets, valuations for B2B software companies continue to climb. The average publicly traded cloud company trades at nearly 12x forward revenue, while in the private markets, investors are considerably more aggressive. With record levels of private capital, continued outperformance in the public markets and a zero interest rate environment, it can be hard to imagine an impetus for slowing down this runaway software train (even the COVID-19 pandemic has not yet been successful!).

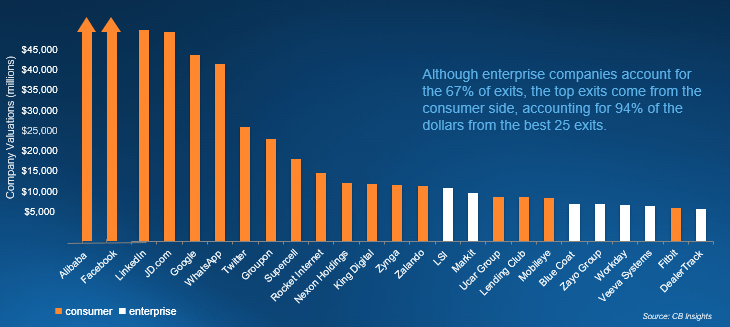

Yet, only four or five years ago, outsized exits in the enterprise sector were outliers. In 2016, we built the slide below (showing value at the time of IPO/acquisition) to demonstrate the dominance of large B2C exits. Back then, the 14 most significant venture-capital outcomes came from consumer companies, and the first enterprise outcome listed was LSI, a semiconductor company acquired for $6.5B in 2014.

Times have changed. In 2019 alone, seven enterprise exits would make this chart (Slack, Qualtrics, Datadog, CrowdStrike, Cloudflare, 10x Genomics and Zoom). As I write this, 14 enterprise software businesses boast a market cap exceeding $20B.

To further illustrate this point, the two most valuable private venture-backed businesses (Stripe and SpaceX) are both enterprise businesses, and the top 25 most valuable companies are now nearly evenly split between consumer and enterprise. If this truly reflects the pipeline for the next generation of significant VC exits, we should expect the pendulum to continue to swing in favor of enterprise investing.

Investors used to face a choice: Invest in enterprise businesses and capture steady yet unspectacular returns or swing for the fences with consumer investments. That’s no longer the case, as today’s enterprise investors benefit from predictable business models and the potential for significant value creation. However, the market has woken up to this fact. Enterprise valuations have soared, making it challenging to generate outsized returns for all but the most significant companies.

In my relatively brief time in the industry, I’ve seen venture capital pour into everything from social apps to marketplaces but eventually run into diminishing returns. SaaS is a much broader and more durable category, but at some point, it seems inevitable that venture capital firms will also over-rotate into software.

In fact, according to the Q1 2020 edition of PitchBook-NVCA Venture Monitor, this may be happening now. From 2017 to the first quarter of 2020, the average late-stage VC deal had a nearly 2x increase in valuation.

However, over the same period, the average software deal had nearly a 4x step up!

This rapid acceleration in software valuations reflects the specific incentives of mega-funds. While we all know that record-size VC funds drove valuations up significantly across the board, larger funds face an even greater incentive to invest in software. VC mega-funds tend to have lower returns expectations from LPs who want to ensure that their $100M+ checks are well protected, even at the expense of potentially lower gains. Many of these funds behave more like private equity.

For these late-stage investors, software is the perfect asset class, with a generally capital-efficient and predictable model that allows for more straightforward cost cutting to weather a downturn. These investors are incentivized to aggressively push valuations upward so that they can keep up with capital commitment timelines. Despite these high prices, late-stage software investors still have reasonable certainty that they won’t lose money due to their preferred shares (which allow funds to get their equity capital out first). Even with a basket of overpriced software investments, a large fund can still generate acceptable IRRs from blending a stable base of nonmoney losing software businesses with a few outliers.

Additionally, the very public struggles of SoftBank further accelerated the move away from capital intensive, nonsoftware businesses. OpenDoor and Wag are frequently cited as examples of businesses that have struggled. In many ways, the Vision Fund provided a lesson in how NOT to commit extraordinary sums of capital, and many funds are now running in the opposite direction.

As a result, software businesses experienced even faster valuation inflation than the rest of the market, a trend that I don’t expect to relent anytime soon. B2B software outcomes will still be attractive, but elevated entry prices may mean that other sectors will offer better risk/reward. Structurally, those seeking excess returns may need to gravitate toward less popular bets.

Secular trends drive outperformance over time, but don’t continue indefinitely. The social and mobile waves that spawned businesses like Twitter, Facebook and Uber eventually fizzled out. Over the past decade, SaaS businesses uniquely benefited from falling infrastructure costs, superior business models, low interest rates and a shift from on-premise IT systems. These tailwinds won’t last forever.

Ultimately, the next wave of technological change will come along, which may mean that the lessons of this era may not hold in five years’ time.

Comment