Lemonade, a heavily-backed startup that sells renters and homeowners insurance to consumers, filed to go public today. The company (backed by SoftBank, part of the Sequoia empire, General Catalyst and Tusk Venture Partners, among others) releasing its financial results helps shed light on the burgeoning insurtech market, which has attracted an ocean of capital in recent quarters.

TechCrunch covered a part of the insurtech world earlier this year, asking why insurance marketplaces were picking up so much investment, so quickly. Lemonade is different from insurance marketplaces in that it’s a full-service insurance provider.

Indeed, as its S-1 notes:

By leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, we believe we are making insurance more delightful, more affordable, more precise, and more socially impactful. To that end, we have built a vertically-integrated company with wholly-owned insurance carriers in the United States and Europe, and the full technology stack to power them.

Lemonade is pitching that it has technology to make insurance a better business and a better consumer product. It is tempting. Insurance is hardly anyone’s favorite product. If it could suck marginally less, that would be great. Doubly so if Lemonade could generate material net income in the process.

Looking at the numbers, the pitch is a bit forward-looking.

Parsing Lemonade’s IPO filing, the business shows that while it can generate some margin from insurance, it is still miles from being able to pay for its own operation. The filing reminds us more of Vroom’s similarly unprofitable offering than Zoom’s surprisingly profitable debut.

The numbers

Lemonade is targeting a $100 million IPO according to its filings. That number is imprecise, but directionally useful. What the placeholder target tells us is that the company is more likely to try to raise $100 million to $300 million in its debut than it is to take aim at $500 million or more.

So, the company, backed by $480 million in private capital to date, is looking to extend its fundraising record, not double it in a single go. What has all that money bought Lemonade? Improving results, if stiff losses. Let’s parse some charts that the company has proffered and then chew on its raw results.

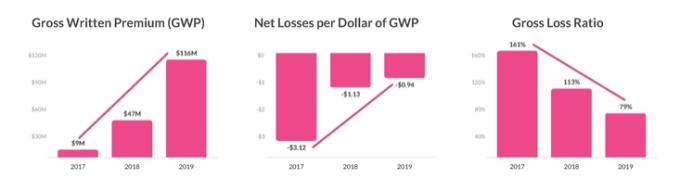

First, this trio of bar charts that are up top in the filing:

Gross written premiums (GWP) is the total amount of revenue expected by Lemonade for its sold insurance products, notably discounting commissions and some other costs. As you’d expect, the numbers are going up over time, implying that Lemonade was effective in selling more insurance products as it aged.

The second chart details how much money the company is losing on a net basis compared to the firm’s gross written premium result. This is a faff metric, and one that isn’t too encouraging; Lemonade’s GWP more than doubled from 2018 to 2019, but the firm’s net losses per dollar of GWP fell far less. This implies less-than-stellar operating leverage.

The final chart is more encouraging. In 2017 the company was paying out far more in claims than it took in from premiums. By 2019 it was generating margin from its insurance products. The trend line here is also nice, in that the 2018 to 2019 improvement was steep.

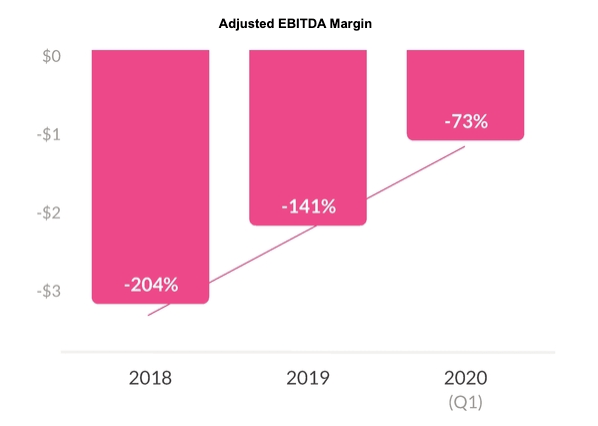

And then there’s this one:

This looks good. That said, improving adjusted EBITDA margins that remain starkly negative as something to be proud of is very Unicorn Era. But 2020 is alive with animal spirits, so perhaps this will engender some public investor adulation.

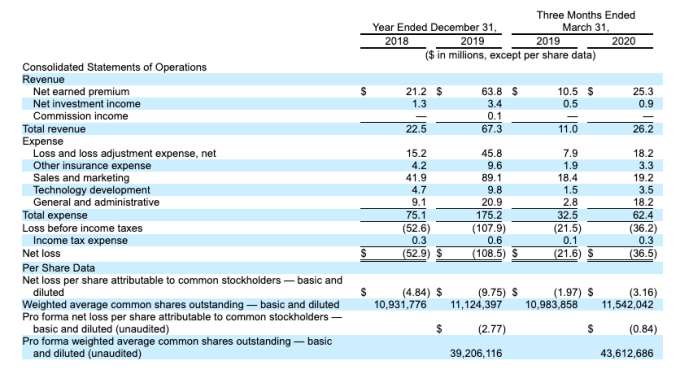

Regardless, let’s dig into the numbers. Here’s the main income statement:

Some definitions. What is net earned premium? According to the company it is “the earned portion of our gross written premium, less the earned portion that is ceded to third-party reinsurers under our reinsurance agreements.” Like pre-sold software revenue, premium revenue is “earned pro rata over the term of the policy, which is generally.” Cool.

Net investment income is “interest earned from fixed maturity securities, short term securities and other investments.” Cool.

The two numbers are the company’s only material revenue sources. And they sum to lots of growth. From $22.5 million in 2018 to $67.3 million in 2019, a gain of 199.1%. More recently, the company’s Q1 results saw its revenue grow from $11.0 million in 2019 to $26.2 million in 2020, a gain of 138.2%. A slower pace, yes, but from a higher base and more than large enough for the company to flaunt growth to a yield-starved public market.

Now, let’s talk losses.

Deficits

We’ll talk margins a little later, as that bit is annoying. What matters is that Lemonade’s cost structure is suffocating when compared to its ability to pay for it. Net losses rose from $52.9 million in 2018 to $108.5 million in 2019. More recently, a Q1 2019 net loss of $21.6 million was smashed in the first quarter of 2020 when the firm lost $36.5 million.

Indeed, Lemonade only appears to lose more money as time goes along. So how is the company turning so much growth into such huge losses? Here’s a hint:

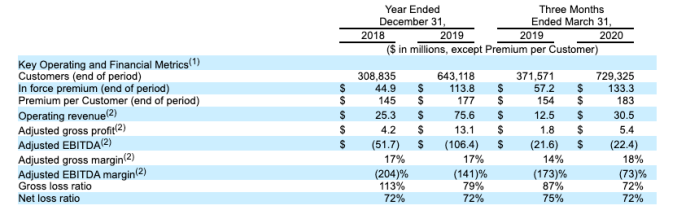

This is messy, but we can get through it. First, see how operating revenue is different than the GAAP revenue metrics we saw before? That’s because it’s a non-GAAP (adjusted) number that means the “total revenue before adding net investment income and before subtracting earned premium ceded to reinsurers.” Cool.

That curiosity aside, what we really care about is the company’s adjusted gross profit. This metric, defined as “total revenue excluding net investment income and less other costs of sales, including net loss and loss adjustment expense, the amortization of deferred acquisition costs and credit card processing fees,” which means gross profit but super not really, is irksome. Given that Lemonade is already adjusting it, it’s notable that the company only managed to generate $5.4 million of the stuff in Q1.

Recall that the company had GAAP revenue of $26.2 million in that three-month period. So, if we adjust the firm’s gross profit, the company winds up with a gross margin of just a hair over 20%.

So what? The company is spending heavily — $19.2 million in Q1 alone — on sales and marketing to generate relatively low-margin revenue. Or more precisely, Lemonade generated enough adjusted gross profit in Q1 2020 to cover 28% of its GAAP sales and marketing spend for the same period. Figure that one out.

Anyway, the company raised $300 million from SoftBank last year, so it has lots of cash. “$304.0 million in cash and short-term investments,” as of the end of Q1 2020, in fact. So, the company can sustain its Q1 2020 operating cash burn ($19.4 million) for a long time. Why go public then?

Because like we wrote this morning (Extra Crunch subscription required), Vroom showed that the IPO market is open for growth shares and SoftBank needs a win. Let’s see what investors think, but this IPO feels like it’s timed to get out while the getting is good. Who can get mad at that?

Comment