Editor’s note: Want this in your inbox every Saturday morning? Click here to subscribe to Startups Weekly and all the other great TechCrunch newsletters.

Remember when the top investors and companies in tech were reacting to SoftBank’s every move? These days, we are picking through the latest results from the Japanese conglomerate and its Vision Fund to see how things went wrong, and where it is still succeeding with its startup portfolio.

First up, this fund appears to be out of additional money to spend, as Arman Tabatabai and Danny Crichton found buried in the footnotes of its new regulatory filing. Meanwhile, as they tallied on TechCrunch, the losses have piled up lately:

The Vision Fund officially lost $17.4 billion in value according to SoftBank’s financials for the year ending this past March 31. The year before, SoftBank had registered a positive gain in the Vision Fund’s value of $12.8 billion, which means that the damage of this year’s performance has completely wiped out all gains the fund had made in the previous year. But the real shock is the performance of the fund’s underlying portfolio companies. The Vision Fund currently has 88 active portfolio companies that have not exited. Of those, 19 investments saw a gain in combined value of $3.4 billion according to SoftBank, while 50 companies saw a decline in value aggregating to $20.7 billion in losses. 19 portfolio companies were left unchanged in value.

Is this worse than what the rest of the market at large is going through? Here’s Alex Wilhelm’s view on Extra Crunch:

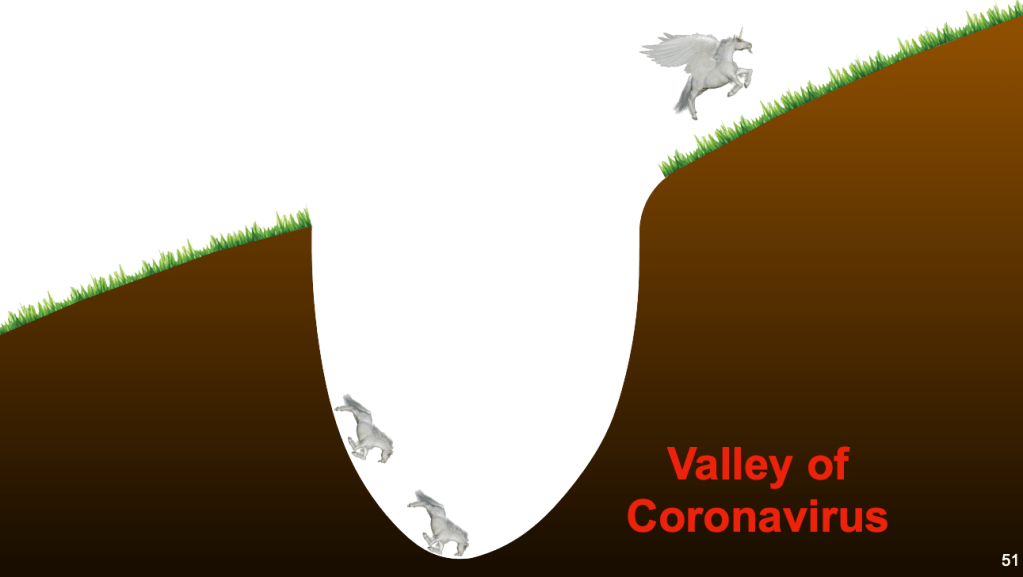

To some degree this feels counter-narrative. Tech shares have rebounded in recent weeks, rebuilding sentiment in the sector — perhaps the COVID-19 downturn won’t be that bad, the thinking seems to go. The SoftBank Vision Fund’s results paint a more negative picture of the economy: It’s bad in many areas, lots of companies are impacted and the value of many unicorns is too high, even if the scale of write-downs that private investors like venture capitalists will have to endure is not yet clear. The private market can, therefore, expect a host of down-rounds if unicorns need to raise capital in the short-term. And many will. The Vision Fund report card, then, is an indication that enterprise software is doing as well as we might have thought, that there are some winners in the health-tech space and that, aside from those exceptions, the rule appears to be a downturn in startup land.

Emphasis mine. Arman and Danny also broke out Arm’s financials for EC and what that top SoftBank company shows about the future of semiconductors. And, for both education and amusement, they provided a commentary about SoftBank’s in-depth and sometimes bizarre presentation about the results.

The symbolism of Jack Ma’s SoftBank board resignation

Masayoshi Son made his name via a seminal bet on a very young Alibaba back in the 1990s, and since then he and SoftBank have had much of their net value and stature tied up in the success of Jack Ma’s efforts. Ma, in turn, has bolstered SoftBank by holding a board seat on the conglomerate since 2008. After 14 years and broadly changing interests on both sides, it’s not surprising that he resigned. But as Danny wrote for TechCrunch in a helpful sidebar to the other Softbank coverage:

[I]t’s not just about an investor and his entrepreneur breaking some ties after two decades in business together. It’s about the fraying of the very globalization that powered the first wave of tech companies — that a Japanese conglomerate with major interests in the U.S. and Europe could invest in a Hong Kong/China startup and reap huge rewards. That tech world and the divide of the internet and the world’s markets continues unabated.

What will save college-town startup hubs?

Few people alive remember, but Palo Alto used to be considered a long way from San Francisco… this was back when Stanford University actually was a farm, though. The interplay of the university’s technical research and education with local technologists was core to how Silicon Valley formed and how the region grew, and in recent decades many other metros of all sizes have implemented their own successful versions of this playbook.

But maybe pandemic effects will cause startup activity to contract to the biggest startup hubs? In this week’s staff survey (a new format we’re trying out), Danny believes that’s the case. The revenues for universities will be hit too hard by the loss of foreign student tuition, decreased attendance domestically due to closed campuses and student financial problems, etc. Natasha Mascarenhas looks back at her own experiences and finds the in-person experience so irreplaceable that she thinks the core attendance will recover. Alex agrees with that.

As I move out of the Bay Area to a college town this weekend, I think I disagree with all of the above. Yes, I also expect higher education to get slammed — but what is going to remain? STEM programs already have government and private funding lined up that can stretch many years into the future, and these schools have wealthy, supportive alumni and can generate revenue from commercialization (aka startup creation). Which means that, as much as anything will exist anywhere physically in higher ed, the research labs and science and engineering programs of the country (and the world) will continue to operate. The tech companies that are still booming publicly or privately will need to hire more graduates with these degrees. So, even with remote learning, the core institutions and their environs will have the means to continue, and be regular destinations for tech talent.

Danny, it is the big cities that I think will get slammed the hardest, especially those with troubled local and state revenue sources like here in California. People of all income levels were already fleeing the largest metros due to high prices, now the pandemic is reinforcing that they can work remotely with little to no drop in productivity. Instead, commercial real estate, typically a key urban tax base, is in free-fall. Let’s say you work in tech but want to spend less and have more space and amenities. Yes there are many suburbs and exurbs you can move to — but the college town ones are some of the nicest. Nobody is fleeing Boulder now. But I bet a lot of people wish they could move there.

Combine all of this with the global networking tools that the tech industry has been hard at putting together, and I think finding a cofounder and building a company will soon be as easy as finding an online date. Why not find yourself a nice garage in a sleepy college town like Bill Hewlett and David Packard did not so long ago and settle in for some hardcore entrepreneurship? Find your cofounders and key employees from near and far as you please, and enjoy the benefits of your alma mater’s local network. Just make sure you have a great wifi connection and an ergonomic workstation.

Delivery robot demand starts to grow, create human jobs

Automation turns out to still require a lot of blood, sweat and tears to operate correctly. Resident automotive expert Kirsten Korosec takes a look at how the delivery robot sub-sector of autonomous vehicles has been hiring remote humans to help delivery robots navigate the trickiest parts of a route safely as demand grows during the pandemic. Her main example in this in-depth look on TechCrunch is a partnership between Postmates and a startup called Phantom Auto, which focuses on AV teleoperations.

Using Phantom Auto’s software, a Postmates fleet supervisor can monitor a robot from thousands of miles away. The supervisor will jump in to help the bot navigate the first and last 15 feet to a restaurant or the recipient or if it needs help crossing a busy street.

These robot guides can assist using a couple of methods. The human teleoperator can provide input to the system, something as simple as a thumbs up or thumbs down to help the bot make the right choice. The employee can also use a hand-held remote controller to steer, accelerate or slow down the bot in real-time.

The teleoperations component of mobility is spreading more broadly. She separately covered a scooter company in Atlanta that is hiring remote operators in Mexico City to deliver the vehicles to customers.

If you’re focused on these topics, you might be interested in the other things Kirsten is up to as well (if you’re not reading her already). In addition to her regular coverage, she’s been doing surveys of mobility investors along with Megan Rose Dickey for Extra Crunch. We published the first last week on the larger impact of the pandemic on the sector. Kirsten also has a weekly free newsletter called The Station about the topic and her coverage, which you can read and subscribe to here.

Investors surveyed on enterprise software, cannabis

Pandemic or no, enterprise investors will not stop being bullish, thank you very much. Resident enterprise reporter Ron Miller caught up with top investors in the space in the space for the first of a series on the cloud that he has coming. Here’s a money quote from the Extra Crunch article, courtesy of Max Gazor at CRV.

It’s abundantly clear that cloud software markets are bigger than most people anticipated. We continue to invest heavily there as we have been doing for the last decade. Specifically, the most exciting trend right now in enterprise is low-code software development. I’m on the board of Airtable, where I led the Series A and co-led the Series B investments, so I see first-hand how this will play out. We are heading toward a future where hundreds of millions of people will be empowered to compose software that fits their own needs. Imagine the productivity and transformation that will unlock in the world! It may be one of the largest market opportunities we have seen since cloud computing.

And now for something completely different. Cannabis has emerged as a serious half-legal sector that few of us have qualms about, in this part of the world at least. It has tended to breed its own strain of investor — many of whom Matt Burns caught up with for our second survey this week. The pandemic seems to have turned things around for the category, at least according to some. Here’s Matt Hawkins of Entourage Effect Capital:

Cannabis went from illegal to essential in about two weeks flat — cannabis is now listed right alongside hospitals, doctors, grocery stores, gas stations and fire departments as an essential service. As we edge close to federal legalization, there is still a large demand for research on cannabis’ medicinal benefits and a lot more opportunities to create cannabis-derived medicines. There is a lot to be excited about in the long term.

Across the week

Extra Crunch

What to do when your VC writes your startup off

Why VCs say they’re open for business, even if they’re pausing new deals

GitLab’s head of Remote on hiring, onboarding and why Slack is a no-work zone (part 1)

GitLab’s head of Remote on what people tend to get wrong about remote work (part 2)

Popping the hood on Vroom’s IPO filing

TechCrunch

Work From Home is dead, long live Work From Anywhere

Following Luckin Coffee scandal, Nasdaq ready to tighten rules on IPO listings

How I Podcast: Articles of Interest’s Avery Trufelman

Europe to Facebook: Pay taxes and respect our values — or we’ll regulate

How to decode a data breach notice

Around TechCrunch

TechCrunch Disrupt 2020 is going virtual

Startup Battlefield is going virtual with TechCrunch Disrupt 2020

Sequoia Capital’s Roelof Botha is coming to Disrupt this fall

Extra Crunch Live: Join Verizon CEO Hans Vestberg for a live Q&A May 26 at 2pm ET/11am PT

Extra Crunch Live: Join Box CEO Aaron Levie May 28th at noon PT/3 pm ET/7 pm GMT

#EquityPod: Clubhouse proves that time is a flat circle

From Alex:

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

First, a big thanks to everyone who took part in the Equity survey, we really appreciated your notes and thoughts. The crew is chewing over what you said, and we’ll roll up the best feedback into show tweaks in the future.

Today, though, we’ve got Danny and Natasha and Chris and Alex back again for our regular news dive. This week we had to leave the Vroom IPO filing, Danny’s group project on The Future of Work and a handwashing startup (?) from Natasha to get to the very biggest stories:

- Brex’s $150 million raise: Natasha covered the latest huge round from corporate charge-card behemoth Brex. The party’s over in Silicon Valley for a little while, so Brex is turning down your favorite startup’s credit limit while it stacks cash for the downturn.

- Spruce raises a $29 million Series B: Led by Scale Venture Partners, Spruce is taking on the world of real estate transactions with digital tooling and an API. As Danny notes, it’s a huge market and one that could find a boost from the pandemic.

- MasterClass raises $100 million: Somewhere between education and entertainment, MasterClass has found its niche. The startup’s $180 yearly subscription product appears to be performing well, given that the company just stacked nine-figures into its checking account. What’s it worth? The company would only tell Natasha that it was more than $800 million.

- Clubhouse does, well, you know. Clubhouse happened. So we talked about it.

- SoftBank dropped its earnings lately, which gave Danny time to break out his pocket calculator and figure out how much money it spent daily, and Alex time to parse the comedy that its slideshow entailed. Here’s our favorites from the mix. (Source materials are here.)

And at the end, we got Danny to explain what the flying frack is going on over at Luckin. It’s somewhere between tragedy and farce, we reckon. That’s it for today, more Tuesday after the holiday!

Comment