Ryoma Ito

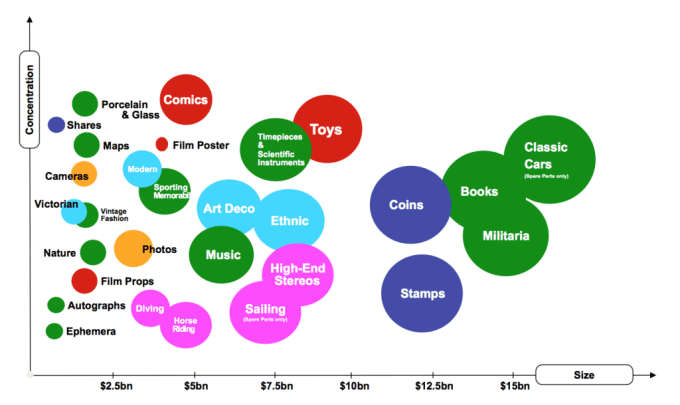

The estimated size of the global collectibles market is $370 billion.

People have an innate propensity to collect, which drives purchases of collectible goods like art, games, sports memorabilia, toys and more. But given that the world is rapidly adopting digital each day, how likely is it that this market can continue to grow as is?

Won’t this primarily physical market have little choice but to evolve with the times?

With an increase in digital adoption, a step-function innovation is emerging; digital collectibles. The new medium is gaining in popularity and its influence is spreading relatively quickly.

The potential impact on the cryptocurrency landscape, while seemingly unrelated, is quite profound. Businesses already present in the collectibles market have new offerings, demographics and economic impacts to take into account. Even household brands are acknowledging their significance and building strategies around them.

Digital collectibles have taken a foothold and are well on their way to increase their presence in our daily lives.

What is a digital collectible?

Sounds interesting, but seems like an oxymoron doesn’t it?

How can a digital file that can be freely copied and distributed be a collectible item that retains value? Can’t you just right-click and save to download the file to your device and own it for free? These are certainly valid questions, but the answers are not that obvious. To address these, we can look at an example physical collectible and understand which factors influence its value.

For example, professional athlete physical trading cards are readily accessible to the public; anybody can pretty much get their hands on one. Now imagine a situation where a professional athlete like Steph Curry autographs one of his cards — that autographed card is now differentiated from the vast number of other cards in circulation and can be considered a limited-edition collectible.

As long as there is a way to verify that the signature is authentic, this rare autographed card alone will have intrinsic value. Given this, we can say that being able to verify authenticity — and scarcity — is required for an item to be considered a collectible of value.

The difficulty with digital files is that it has historically been difficult to differentiate between copies and originals since every file is more or less the same. So then, how can you verify the authenticity, and scarcity, of a digital file, so that it can be considered a valuable collectible? With the development of a new type of decentralized database (aka blockchain), these issues can be resolved. A blockchain can provide the means for a creator to digitally autograph their file, in a permanent, and tamper-proof way, and for anyone to verify the authenticity of it.

It also publicly tracks purchases and transfers, so there’s always a verifiable ownership history. In the same way that a physical autograph creates a limited-edition collectible of distinct value, a digitally autographed file recorded on a blockchain creates a limited-edition digital collectible of distinct value. With a means to verify the authenticity and scarcity of a collectible, issues with copying/duplication becomes less relevant.

For instance, in the physical world, even if many forgeries of the Mona Lisa exist, only the authenticated original retains the true value. The same concept applies for a digital collectible. The copying/duplication of the actual work does not necessarily have a negative impact on the value of the original. If anything, the additional visibility that the copying/duplication brings will go toward increasing its value. People can go on to right-click and save the file, but it won’t mean they truly own the item.

To highlight this point, consider the Forever Rose digital collectible by Kevin Abosch, which was published to a blockchain and sold for $1 million.

Now that the image is pasted here, does it mean that if we save it to our device, we are all in possession of a $1 million artwork? If only that were the case. Even if millions of people saved this Forever Rose, it wouldn’t change the fact that only the verifiable authentic original retains the value, and only the verifiable owner can capture that value. Welcome to the world of digital collectibles!

Why would you buy a digital collectible?

The reasons for purchasing a digital collectible aren’t that different than those for purchasing physical collectibles. People tend to buy collectibles as an investment, to satisfy an emotional attachment and/or to acquire social status. These reasons are not exclusive to physical items and can easily apply to digital collectibles as well.

Additionally, the types of collectibles aren’t too different between the physical and digital mediums. For instance, at MakersPlace, there is a budding art ecosystem where digital collectible art is actively being created and sold. Art and digital collectibles are a match made in heaven. For many digital content creators, the thought of making money online was a far-fetched dream since their work could be copied and duplicated very easily. By leveraging digital collectibles, these creators now have a legitimate avenue to better protect and monetize their work. There’s already demand for this market, evidenced by frequent occurrences of artwork rising quickly in value.

For example, the limited edition work “Vincent” by artist Joern Bielewski (shown above) has editions that have increased in price by 10x within a year. Collectors are also spending notable amounts on this new form of digital collectible art. Artist Franco Verrascina recently sold his “Aisle of Plenty” digital collectible for ~$2,223. Collectors showcase their purchases in unique ways, such as on mobile devices and in 3D virtual worlds like Cryptovoxels and Decentraland. There are even digital frames like the Meural, which showcases digital art collectibles much in the same way physical art would be presented in a home.

Games are another popular type of physical collectible growing in popularity.

Ever imagine how the popular Magic the Gathering card game could evolve? Gods Unchained, a popular competitive trading card game, comes pretty close to fulfilling that vision. It utilizes digital collectibles, which players can buy, sell and trade to assemble a powerful deck and compete against others. The beauty of digital collectibles is that they are not restricted for use in a single game or service. Even if you acquired a digital collectible in one game, it is entirely possible to transition and utilize it in any other game that supports the same blockchain-based digital collectible standard.

How cool would it be if you could purchase a digital collectible character in Gods Unchained and use it as a fighter in a Mortal Kombat-type game? While this might not be possible with traditional games, it certainly is possible with games that utilize blockchain-based digital collectibles. A new era of interoperable games is on the horizon!

Interested in sports memorabilia? Even these have made their way into the digital collectibles market. There are digital collectibles like the MLB Champions, which let owners buy, sell and trade official Major League Baseball player cards. It’s not that much different than buying and selling physical professional athlete trading cards. The National Basketball Association has also gotten onboard with digital collectibles and is working on releasing NBA Top Shot as a way for fans to buy, sell and use player highlights. Remember that epic moment when Kawhi Leonard made a game-winning buzzer-beater to beat the 76ers in Game 7?

KAWHI CALLED SERIES! pic.twitter.com/V4AIuMULNO

— Toronto Raptors (@Raptors) May 13, 2019

Imagine if that highlight reel were wrapped up as a limited-edition digital collectible, digitally signed by Kawhi Leonard that you could verifiably own? All those highlights from your favorite players and teams could be yours to exclusively collect. That is where the future of sports memorabilia is headed.

What’s the impact of digital collectibles?

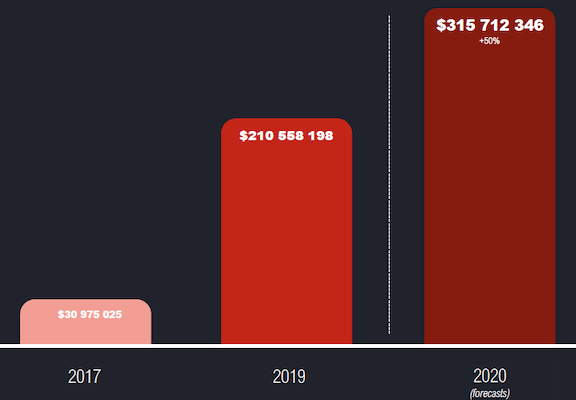

NonFungible.com recently reported that the digital collectible market has grown 579% to an estimated $210 million market-cap since digital collectibles made a grand entrance in 2017. At this scale, it’s clear that the digital collectibles market is still in its infancy, but there is evidence of their adoption and growth exhibiting their potential. For the time being, digital collectibles are unlikely to cannibalize the current collectibles market, as it may take time for the mass market to acknowledge collectible value from intangible assets and take even longer for them to consider replacing their physical collectibles with intangible ones. Those that are actively collecting physical items will likely continue to do so, but will supplement their collecting habits by exploring this new digital medium, in tandem.

With 50% growth forecasted this year, increased adoption of digital collectibles will continue to help supplement and bring new life to the overall collectible market. While new apps, services and games educating and promoting the use of digital collectibles will help fuel this growth in the coming year, an important factor will likely be the adoption from brands. Influential brands like the NBA, UFC and NFLPA that are looking to tap into the digital-centric demographic are leveraging digital collectibles to market and monetize, which will certainly drive the penetration of digital collectibles in the mass market. As adoption increases, companies catering to the collectibles market will also see more opportunities to tap into new demographics and diversify their businesses.

Rare-goods marketplaces like GOAT that enable the trade of verified authentic goods could further engage users by expanding their offering with the introduction of digital collectibles. For such businesses that incorporate digital collectibles, increasing profit would likely come easier as the process for authentication/verification would be automatic and immediate. Moreover, dealing with digital goods is typically far more economical and logistically less complex than physical goods. The more interest and sales of digital collectible takes hold, the harder it’ll become to justify the sales of physical collectibles.

As digital collectibles are built on top of blockchain technology, the impact it can have on the cryptocurrency landscape is quite notable. Cryptocurrency is currently the leading method to purchase digital collectibles. If there are more people purchasing digital collectibles, it naturally implies that there will be more people with cryptocurrency.

An increase in cryptocurrency holders means there’s more demand for that currency, which will likely lead to an increase in its price. There exists a strong correlation between digital collectible adoption and the price of the cryptocurrencies supporting it. This creates an interesting opportunity to evaluate digital collectibles, and cryptocurrencies, as viable indicators for investment. Investors could buy into the currencies supporting digital collectibles, if they believe the growth and adoption of digital collectibles will continue. Investors can also evaluate the digital collectibles themselves, as opportunities for investment. Whether it be gaming assets, art, virtual worlds, domains or sports memorabilia, there’s already a broad range of digital collectibles from which to choose. If you have an eye for catching momentum, generating sizable returns would be well within the realm of possibilities.

For instance, if you’d bought a plot of land in virtual world Cryptovoxels just six months ago, you could realize a 400% return at current prices. Buying from an emerging or popular artist can produce similar returns. Consider Katy Arrington, a rising star in the crypto art scene. The editions of her “Bride of Frankenstein” artwork have increased by 992% in just two months. If you consider the size of the returns and the short duration for the returns to materialize, digital collectibles could be compelling investments, especially compared to traditional investments. Just like with any opportunity, the earlier you can get in, the better your return potential can be.

The digital collectibles market is off to a healthy start, with supporters exhibiting their ability to thrive in the ecosystem.

Creators can generate more value for their work by utilizing digital collectibles as a new revenue stream. Collectors can diversity their holdings by accessing this new collectible medium. Brands and businesses can increase their reach by tapping into this digital-centric demographic. There will certainly be exciting and innovative ways in which digital collectibles can be utilized, as the adoption increases.

Are you ready to venture in and explore this exciting new collectible medium?

Comment