Twilio is best known for its communications API, which allows developers to add messaging, voice or video to their apps with just a small slice of code. The company’s tools are used by customers like Lyft, Airbnb, Salesforce, Box and Duke University.

The former startup went public in 2016 at $15 a share. Yesterday Twilio’s stock closed at $113.90, giving the company a market cap of about $15.6 billion (after a horrendous week on Wall Street). It’s easy to look at its value (among other measures) and declare Twilio a successful public company. But just like every former startup out there, its ascent wasn’t always so certain.

Founded in 2008, Twilio was once a tentative early-stage company feeling its way forward in the market with an unproven product and more future potential than actual results. Recently, the company’s CEO Jeff Lawson shared a Twilio board deck from March 2010.

Naturally, we read through it — how could we not? — but we also decided to analyze it for you, pulling out what we learned and using the snapshot of Twilio’s history to illustrate how far the company has come in the last decade.

The presentation’s original time stamp lands after Twilio’s Series A and just before its Series B, allowing us to see a company molting from a hatchling to something more sturdy that could stand on its own two feet. The company raised $12 million six months after the deck was presented.

To get everyone on the same page, we’ll start with a little history, and then get into the deck itself. Let’s go!

An inside look at Bessemer Venture Partners’ investment process for Twilio

Where Twilio came from

Back in 2010, Twilio sold a product for developers, a communications API that with a simple API call reduced the complexity of adding messaging and other communications services to an application. It was revolutionary, and as the deck illustrated, developers were thrilled with it.

But it was not so clear at that point if the fledgling startup could take that idea and turn it into a successful business. We wouldn’t know that for years. The founders were struggling with the things that early companies typically struggle with: How could they make the financials work? Could they fill critical open headcount? Could they scale their processes and services to meet demand? And, a common concern for companies of Twilio’s ilk: How would they publicize themselves to the developer community?

These were all open questions when the founders gave their State of the Company address to the board of directors in March 2010. We’re going to use the contents of this deck to take a peek at where they were, and how far they’ve come.

We’ll start with the deck itself, a run-through of the company’s growth metrics, and then dig into its challenges at the time.

The numbers

Like many early-stage decks, the Twilio entry isn’t incredibly detailed. We don’t have a GAAP-friendly income statement, a detailed look at its cash reserves or anything like that. What we do have, however, is a revenue chart and a number of funnel metrics.

That’s more than we need to have fun. Let’s flip the slide order some and work through Twilio’s sales funnel, ending with revenue after we examine the resulting growth in accounts and usage that the then-startup was managing.

As you can see on the “New Visitors” slide, Twilio was on pace for its second-best month to date in March of 2010. The company’s best-ever month was recorded in February. That’s the sort of trend that you hope to see at an early-stage startup, charts that are recording successive record highs.

Also note the small absolute scale of the results — Twilio’s web traffic was tiny back then, with fewer than 1,000 new visitors each day. The lesson? If your company is small today, that doesn’t mean it will be small forever. Sometimes, it takes time for the market to arrive.

A smaller point is that it’s worth noting how lumpy the graph is with peaks and valleys probably causing more heartburn among senior staff than future results would warrant. The takeaway there is that small numbers swing. You can’t stop them.

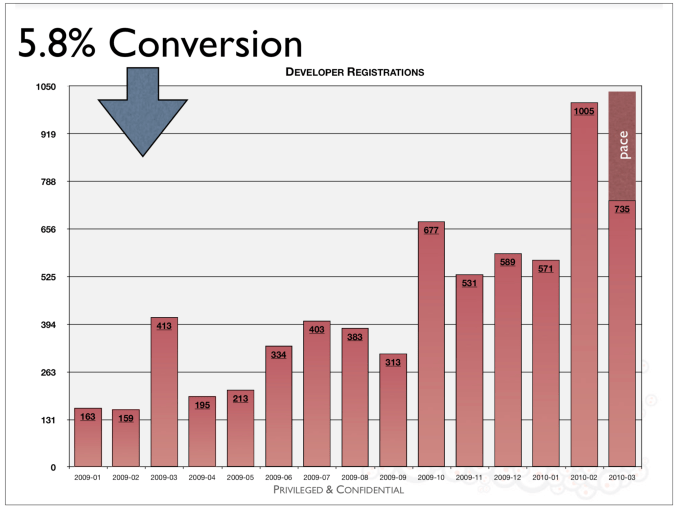

On this slide, we’re one step down the funnel. From new visitors to developer registrations. Recall that Twilio’s product depends on developers using it — by integrating Twilio’s APIs into their products, Twilio generates revenue from their pings to its servers for data and services.

As before, the chart shows an up-and-to-the-right scenario, in which the pace at which Twilio signed up developers was scaling. This chart is the start of what we might call pre-revenue forecasting. So from rising traffic, we can see a 5.8% conversion to signed-up developers. Twilio’s funnel is now cranking.

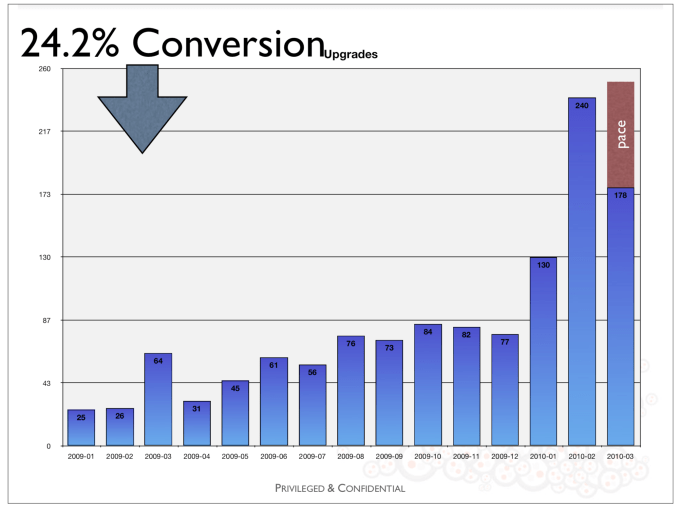

On this slide, we see a 24.2% conversion from developer signups to “Upgrades,” which we’re reading as paid products. So, 5.8% of new Twilio website visitors turn into new developer signups, of which about a quarter pay Twilio. For the then-small company, web traffic appeared to have a pretty high conversion rate into dollars.

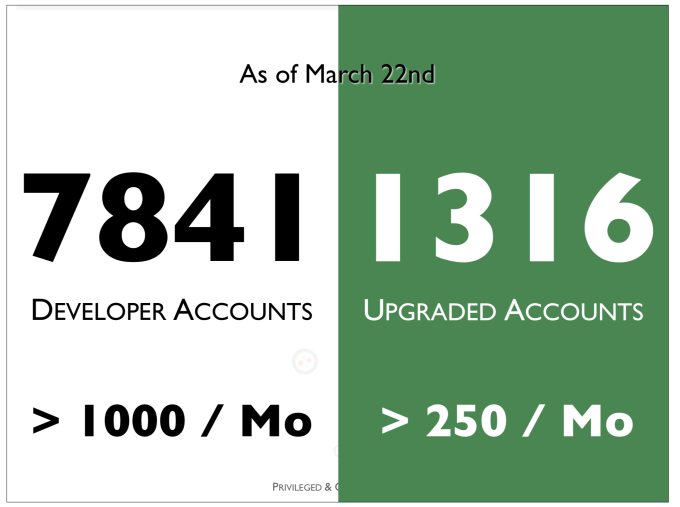

Turn the page again and you see a summary of the metrics we just saw set against their absolute totals. Sure, we saw that Twilio was signing up more than 1,000 new developers each month at the time of this deck, but the result becomes more impressive when we learn that it had fewer than 8,000 developers signed up total at that point in time.

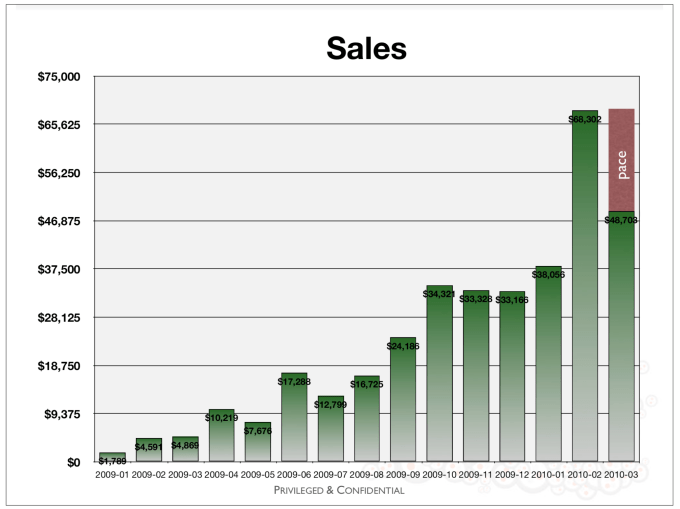

On the slide marked “Sales,” we can see the result of the company’s funnel: rising top line, with a huge record in February and the company on pace to best the result in March.

With about $70,000 in revenue expected in March, the company was on pace to generate far less than $1 million in ARR at this time, which was after its Series A. The company’s Series B came later, but inside the same year. So, we can surmise that Twilio’s venture capital interest and success was less predicated on revenue results (modest) than developer interest and momentum.

That’s downright fascinating. Now, back to the company’s product and market.

Can this thing scale?

Many startup founders have good ideas, but getting that idea out of their heads, productizing it, taking it to market and scaling it are not always simple matters, and many fail to execute for any number of good reasons. Twilio clearly found a way to solve these issues, but they were still fresh and raw in 2010.

The company by its nature with developers for customers had a particularly thorny problem. The startup would make its money (or not) based on the number of calls to that API. That meant as it grew in popularity, it needed to make sure they could handle the volume in order to ratchet up the revenue.

In 2010, they were in the earliest days of trying to make that happen, and the numbers in the deck reflected that. It could scale to a mere 5,000 simultaneous calls at that point, a babe in the API woods. While they didn’t share an exactly comparable number, to give you a sense of the scale today, the company reports that on average customers send nearly 100 million messages a day, including 13,000 per second at peak. So clearly it was able to deal with the questions about scaling.

Early challenges

Another issue facing any small and growing startup is hiring the right employees. In those days, the company was just 16 employees and had 10 openings, including a VP of business development, several engineers and an evangelist. By contrast, today the company has nearly 3,000 employees and has dozens of open positions to fill.

These early openings, however, would be crucial roles for a company just beginning to take off. They had one evangelist already, but the second one would help get the word out to the developer community at events like hackathons with contests for the best solutions. In those days, they were going to events like ones sponsored by Boxee, (a now-defunct development platform for TVs) and Google Chrome, which, like Twilio, was a newcomer.

They mentioned attending other events, like Google I/O, the Google developer conference which was also then just two years old, and GlueCon, the now-venerable developer conference which was just a year old in 2010.

In March 2010, more than 7,800 developers had signed up for the service. Today the company has more than 7 million developers on its platform.

The deck also covered how board members could help in terms of finding the right person to fill the crucial business development role, launching a formal PR effort and building a partner network — all steps that would help make the target developer community aware of the company and help add users.

Growing up

Of course we all know what happened to Twilio over the next decade. A host of venture rounds helped fuel the company, including a huge 2015 Series E, an investment that came a year before the company’s IPO.

Twilio raised just $3.7 million in its Series A. It was probably worth $15 million or less at the time. Today, despite a simply insane day in the public markets, the company is worth $15.4 billion, or about 105,000% more, using our estimated Series A price.

Can you see that growth in the company’s deck? Probably not. But you can easily see interest, growth and high-conversion figures contributing to a growing revenue stream.

From small acorns, big trees.

Comment