Snap may have had a successful IPO, but that was pretty much wiped out after it reported its first-quarter earnings — where it completely whiffed on what Wall Street was expecting.

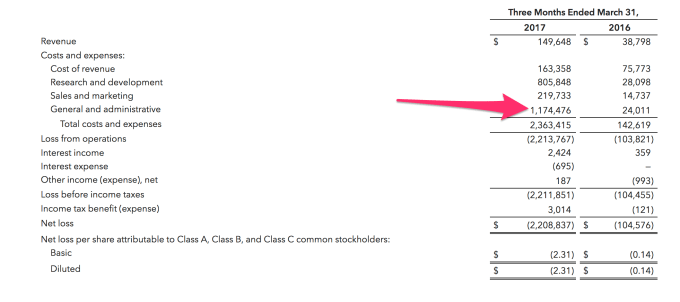

The company said it brought in $149.6 million in revenue in the first quarter this year. It also said it lost $2.31 per share, though most of that was due to expenses related to stock-based compensation. Meanwhile, analysts expected the company to report an adjusted loss of 16 cents per share on revenue of around $158 million. In short, it doesn’t look good — and it looks like its user growth came in soft, as well.

The stock is down more than 20 percent in extended trading after it reported its first-quarter earnings. Snap has collapsed below $18 per share, now well short of the price it hit when it went public and very close to the $17 per share it priced at the IPO.

A drop this steep isn’t all that surprising for a miss across the board. Since finally revealing the guts of its business when it went public, there were serious questions about its ability to grow and control costs, like the price of running its business on cloud services. Facebook, too, has aggressively copied some of Snap’s most popular features, like Stories. It’s planted those features into Instagram, which already has hundreds of millions of users, which may have stymied Snap’s user growth. Whether or not that was the actual case, the optics likely matter nearly as much.

In total, Snap’s losses ballooned to $2.2 billion, up from $104 million in the first quarter last year. Most of that cost, however, includes a $2 billion stock-based compensation expense due to the recognition of expense related to RSUs related to the IPO, the company said in its earnings report. So while it whiffed on that earnings number, things may not seem as grave as they look at face value. Taking all that into account, Snap’s losses roughly doubled in the first quarter this year compared to the same quarter in 2017.

To be sure, the first earnings report for any company going public can be a rough one. For Snap in particular, Wall Street only has a little more than two years of data on the company’s newly formed advertising business. That business is ballooning — growing 6x between 2015 and 2016 — but its costs are also mounting just as quickly. Wall Street is going to intensely scrutinize each new data point, whether that’s user growth, changes in costs or the amount of money it generates.

Snap, for the most part, was seen as the first major successful IPO of 2017. That opened the floodgates for a swath of companies to wrap up their IPOs and raise as much money as they could. Normally these kinds of companies want around a 20 percent pop when they go public to ensure everyone gets paid and they are still able to raise a lot of capital. But Snap’s in particular was an important one because it would be a litmus test for Wall Street’s appetite for risk for fresh IPOs in 2017.

Uncertainty is never a good thing, especially in the face of massive advertising juggernauts like Facebook and Google. While those own practically the entire online advertising market, Snap has to go around and pitch investors that it is (or soon will be) a distinct option 3 alongside those two. It has to figure out how to be part of primary advertising budgets for brands with a diverse set of products and use cases, along with a highly engaged user base, that can’t be copied.

Comment