Slowing growth, huge losses and no shareholder control could make Snap Inc.’s IPO a perilous gamble for investors. What it does have going for it is an addicted user base, fast-growing revenues and a visionary CEO.

Snap has declared itself a camera company, envisioning itself as more than just an app. Yet its fledgling business is still entirely dependent on that app. It’s a teen sensation, but that’s mostly in America. Outside of the U.S. and Europe, it saw no user growth this past quarter.

There’s certainly a strong, sizeable business for Snap even it if can’t grow into a billion-daily-user juggernaut. Like Facebook, it may be going public a bit early — and it may take time for revenue to ripen into profit.

But its financials strike an uncanny resemblance to Twitter, which has yet to win investor confidence following slowed growth and mounting losses. Just as it was finishing a strong revenue year, Snapchat’s user growth slumped, raising questions about its possible scale.

But Snap is a hits-driven business, like a game company. If Evan Spiegel can orchestrate another product invention as beloved as Snapchat Stories or disappearing messages, there’s no telling how successful the company could become. He’s an unpredictable X-factor with enormous potential.

That’s the real story of the Snap IPO — you’ll have to bet on your gut, not your head.

Here’s a run-down of the big positive and negative points for the company as it prepares to go public:

Pros

Impressive engagement per user. The highlights of the S-1 were stats showing just how addicted users are to Snapchat. The average daily user opens Snapchat 18 times a day and uses it for 25 to 30 minutes, while 60 percent of them record Snaps and/or use its chat feature daily.

Strong revenue growth. Snap quickly ramped up its ad business, going from $59 million in 2015 to $204.5 million in 2016. It’s managed to convince advertisers to use its unique ad products and apply them to its massive time spent per user.

Compelling ad products. Snapchat has found a way to bypass ad fatigue and numbness with vivid, full-screen ad units. Its Snap Ads offer full-screen video with options to link out to websites, while its Sponsored Geofilters and Lenses literally overlay a brand on your friends’ faces so there’s no way to consume their content without experiencing the ad. People even spend a long time playing with Sponsored Lenses before sending Snaps with them, in some cases as much as 23 or 30 seconds. Snap’s ads rank first in advertiser satisfaction, beating YouTube, Google, Facebook and Instagram.

Evan Spiegel’s vision. Spiegel has led Snap through multiple hugely popular product creations, including disappearing messages, Stories slideshows and mobile-first Discover content from publishers. Meanwhile, his acquisitions of Looksery to power its iconic animated selfie Lenses and Bitstrips to power its Bitmoji customizable avatar stickers show he can spot and integrate high-potential technologies. While everyone else has been copying, he’s been inventing and recruiting what people want to use next.

Cons

Relentless competition from copycats. Snapchat’s Stories format is being cloned by everyone. Instagram Stories has already reached 150 million daily users, and now Facebook is trying Facebook Stories, Messenger Day and WhatsApp Status. The apps these copied features live in all have massive traction abroad, plus there’s South Korean competitor Snow. Together these could soak up users in demographics like young adults over 25 and teens in the developing world before Snapchat can get them addicted.

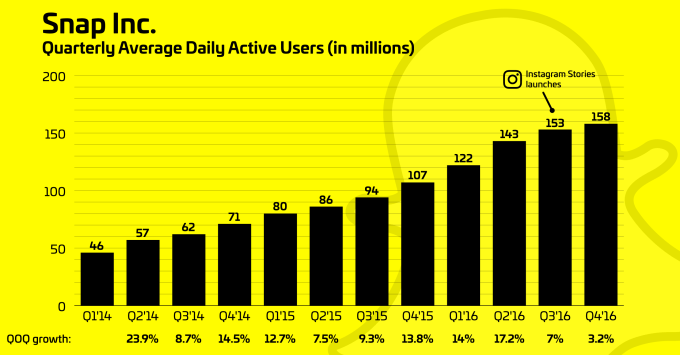

Slowing growth. Snapchat’s user growth fell from 17 percent in Q2 2016 to 3.2 percent in Q4, a steep slow-down that threatens its potential to reach massive scale. The drop-off occurred at the exact time when Instagram Stories launched. The first two risk factors listed by Snap are “users increasingly engage with competing products instead of ours” and “competitors may mimic our products.” If user growth slows to a trickle, it will have to rely on engagement to grow ad impressions, which can be thrown off by a bad app update or trend change.

Dependence on Google Cloud. Snapchat’s infrastructure relies entirely on Google Cloud to store and transmit photos and videos. That makes it extremely sensitive to Google Cloud price changes, and could complicate expansion to markets like China where Google doesn’t operate. Snapchat has agreed to pay Google Cloud $400 million a year for five years of service, possibly locking in a price for that time period.

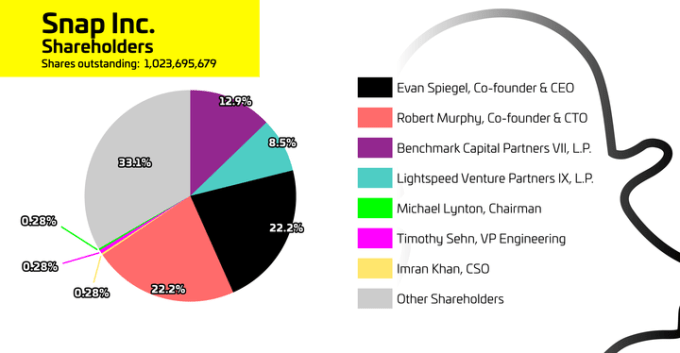

No shareholder voting power. Co-founders Evan Spiegel and Bobby Murphy control the majority of the voting shares, and the shares sold in the IPO won’t have voting power. That means shareholders won’t have any ability to influence the company’s direction, and this autocratic control could make investors hesitant.

Undifferentiated revenue streams. Snap makes all its money from advertising, with hardware like Spectacles not contributing materially to revenue. Those ads only come from Snap Ads inserted amongst Stories and Discover content, and Sponsored Creative Tools like Lenses and Geofilters. If there’s a decrease in Snapchat usage, which drives the impressions of the ads, putting all its eggs in one revenue basket could leave it exposed. It could take a while before Snap can build a meaningful hardware business due to the research necessary, considering it says, “we may develop future products that are regulated as medical devices by the FDA.”

Sizeable losses. It’s normal for startups to see losses instead of profits, even going into an IPO, though Snap’s are quite large. It lost $170 million in Q4 2016, up from $98 million a year earlier, and it lost $514.6 million total in 2016. Snap’s cost of revenue is higher than its revenue. At this rate, its spending to become a hardware and augmented reality company may overshadow its social media business unless it can produce a hit product from this research. That said, Snap is a young company to be going public, and its business has only been pulling in revenue for two years, so it has plenty of time to mature.

Will Snap be saved or self-destruct?

I envision two divergent scenarios for Snap.

The bear case sees it picked apart and muted by competition, with growth slowing to a crawl. Stuck with close to its current scale, it aggressively pushes to squeeze more revenue from each user. Teen trends change and engagement falters. Unable to discover additional game-changing hardware or software products, R&D costs keep it saddled with high losses. Investors resent having no say, and the share price languishes.

The bull case sees its growth rate bounce back or stabilize thanks to innovative new app features and deft international expansion to foreign teens. It becomes more capital-efficient, slimming losses, while also seeing progress from its research. It launches a popular hardware product for augmented reality that develops into a strong second revenue stream, while steadily earning more per Snapchat user with immersive, interactive ad formats that big brands are eager to pioneer. With strong network effect locking in users, it share price soars.

To invest in such a young startup’s public debut is to put faith in the unknown. Do you believe in Evan Spiegel?

Comment