Ryan Caldbeck

Deja Vu moment: when another giant of consumer products is hoping to buy its way to success rather than innovate.

This week, the news was Unilever buying five year old Dollar Shave Club for $1B. Last week, hundred year old Danone buying Whitewave foods. We’re likely to see many more more this year, if not just this quarter, such as Oreo maker Mondelez completing their bid for Hershey or Cadbury.

Personal care; food; beverages — in category after category, the pattern is the same. We are seeing the systematic outsourcing of R&D to the market. The model has been evident in the pharmaceutical industry, where behemoths rarely invent products themselves and would rather acquire a company and then handle distribution, regulation and consolidation — as The Economist recently pointed out.

Cost Cutting: A Bandaid on a Broken System

For a clear illustration of cost-cutting to deliver returns, consider the Brazilian private-equity firm 3G Capital Partners LLP’s buyout of Heinz in 2013, followed by Heinz’s $49-billion acquisition of Kraft.

Since that deal last year, Kraft Heinz has cut more than 5,000 jobs and closed plants as part of a $1.5-billion cost-cutting campaign. There’s now speculation that 3G is eyeing a takeover of General Mills. And, Anheuser-Busch InBev NV’s proposed acquisition of SABMiller Plc continues to move forward. They are trying to drive shareholder value by cutting costs, not by growing.

Sure, these mergers consolidate, taking out costs that can then increase shareholder value in the near-term. But once the redundancies are removed, what are shareholders left with? The same problem that spurred the deal: shrinking market share due to no innovation. The key difference in shareholder value creation is that there is (by definition) a limit to the costs you can cut, but there is no limit to innovation.

The failure of large consumer and retail players to innovate is clear in the Walmart vs. Amazon battle.

Amazon is racing ahead with innovations that deeply cater to today’s consumer, such as Dash to allow customers to reorder laundry detergent or coffee with literally a touch of a button.

Meanwhile, Walmart struggles to hold its historical position as a low-cost leader by cutting cut costs, be it by cutting corners on quality or consolidating processes. For example, Walmart just reduced buttercream icing waste by its bakers to save on costs.

Mega Deals: Those Who Can’t Do, Acquire

The main alternative to cost-cutting, and an increasingly popular strategy, is to make up for lost ground on the innovation front acquiring young brands with dynamic new products. This strategy essentially outsources R&D and innovation to small brands that can afford to take risks; test new products in the market; and design interesting ideas for distribution, packaging and the overall brand experience.

Faced with short-termism, where businesses are pressured to deliver quick shareholder returns, big brands simply can’t afford this risk and have it go wrong.

Some large consumer companies now are looking for a better path by investing in companies at an earlier stage.

That’s why in late June, Kellogg Company joined the trend of large strategics with venture funds, establishing its own venture arm, eighteen94, to invest in consumer startups and gain access to innovative products.

Others are also making acquisitions to round out their product offerings – but frequently at a high price. Here are just a few recent examples: Coca-Cola invested in Fair Oaks Farms, maker of sustainable milk products, Campbell acquire Plum Organics, Post Holdings Inc. acquire protein beverages and foods maker Premier Nutrition Corp., and Steve Madden acquire Dolce Vita Holdings Inc.

Big Brands: Just Buying Time

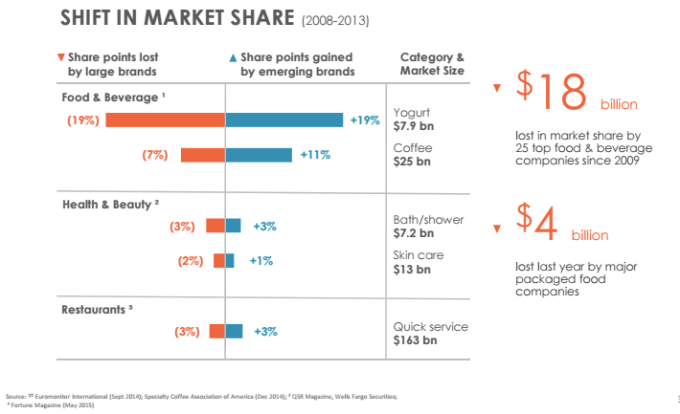

Struggling to innovate, large corporations in consumer and retail have suffered a steady decline in market share. Big brands lost share to small brands in 42 of the top 54 most relevant food categories in the past five years, according to the research report “Food: The Curse of the Large Brand” from investment banking firm Jefferies. Meanwhile, Boston Consulting Group estimates that between 2009 and 2013, large consumer goods companies lost 2.3% in market share.

Giant CPG brands are having market share taken away by innovative startups that are attuned to changing consumer preferences and are offering products that the market wants.

That’s because one category after another is being transformed by new brands as consumers demand more personalized offering – human-grade pet foods, organic products, convenient and healthy snacks. In yogurt, for example, large brands lost 19% in market share from 2008 to 2013, and emerging brands like Chobani gained 19%.

Similarly, large brand coffees lost 7% of the market, while emerging coffees like Blue Bottle and Artis expanded 11%. In the bath and shower category, big brands’ market share has contracted 3% as upstarts like The Seaweed Bath Co. and Rock Your Hair, have gained 3% more of the market. Another example came across in a recent report from Meridian Capital: Scrub Daddy, a new kind of kitchen sponge, went from startup to $35 million in revenue in just over a year as a result of exposure on Shark Tank.

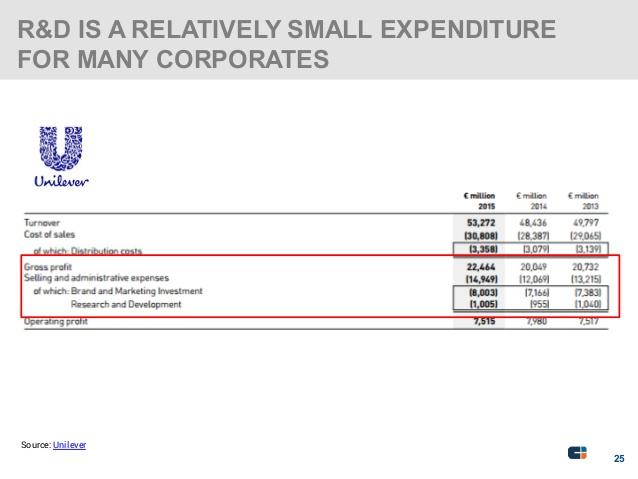

The numbers at some of the biggest consumer companies tell the story. Amid tailwinds of innovation amongst small brands in consumer, Pepsico spent $2.4 billion on marketing, and just $754 million on research and development in 2015. Remember the news on Dollar Shave Club? In 2015, Unilever spent $8 billion on marketing versus $1 billion on R&D. Think about spending 8x as much on marketing your stale old products as you do on building something new. Creating new, delightful products was simply not the priority.

That’s why, faced with shrinking market share, pressure to deliver returns in the short-term, and trouble innovating, some of the largest consumer and retail companies have fallen into the dangerous habit of steady cost cutting and making acquisitions in lieu of innovating.

But the disruption in CPG has only just begun. Cost cutting and mega-deals may buy time, but to truly succeed consumer and retail giants have to realize that innovation is the path forward.

What’s next? How to integrate these new brands in a way that preserves their value. Value preservation will be the defining asset for many of the large public companies – those that do this we will will continue atop the market overall. More thoughts on that in a future post.

Comment