Berlin-based startup Number26 just raised a $40 million Series B round led by Horizons Ventures. With 200,000 clients, Number26 wants to become a major consumer-facing bank in Europe providing all the services you’d expect from your bank. And this funding round is an important milestone in order to reach this goal.

Battery Ventures, Robert Gentz, David Schneider and Rubin Ritteralso also participated in today’s round. Existing investors Peter Thiel’s Valar Ventures, Earlybird Ventures and Redalpine Ventures re-invested as well.

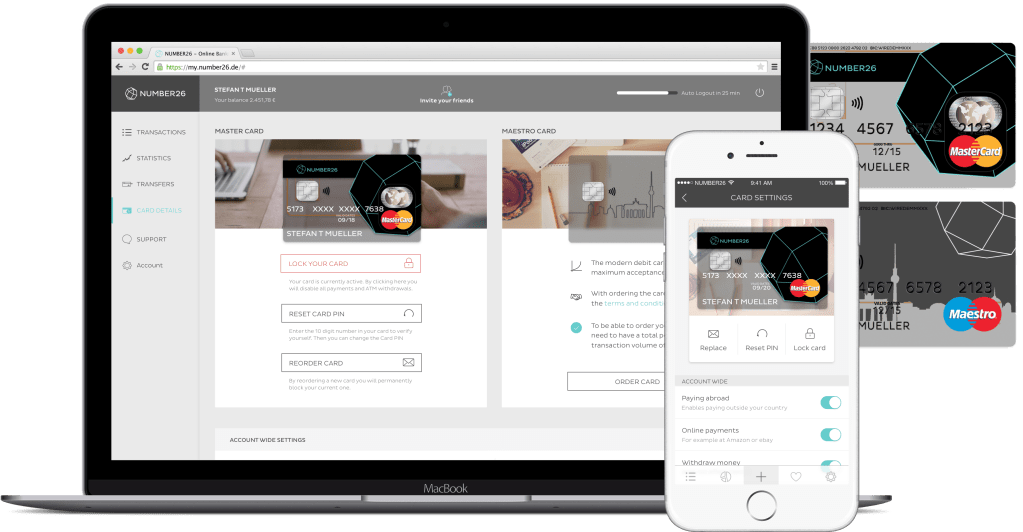

At heart, Number26 provides a free current account with a MasterCard. But compared to traditional brick-and-mortar banks, Number26 has a few nifty features. For instance, the mobile app is a well-designed native app. It’s night and day compared to other banking apps I’ve been using.

When it comes to the card, you can customize it to your needs. For instance, you can receive a push notification for every transaction above a certain amount. Or you can temporarily disable online purchases, ATM withdrawals or foreign transactions. You can re-enable everything later.

And the best feature is that you can pay or withdraw money everywhere around the world — Number26 won’t charge you with foreign transaction fees or crappy exchange rates. Number26 uses the MasterCard exchange rate and doesn’t add any fee on top of it.

The startup has partnered with Wirecard for the back end. Wirecard has a banking license and actually manages your money. Number26 sits on top of Wirecard and handles all the consumer-facing features. Technically, Number26 isn’t a bank per se — or not yet, at least.

Even though Number26 has outsourced the money-counting part, it doesn’t mean that the company doesn’t have growing pains. Number26 is in charge of “know your customer” processes, and the company has also recently noticed that some customers were abusing ATM withdrawals. That’s why Number26 recently closed down around 400 accounts. There will be more missteps along the way, but you should be able to blindly trust your bank. So Number26 has to be careful on this front.

Over time, the company has added new features. In Germany, you can withdraw cash at retail shops, set up overdraft and more. The company has expanded to six other European countries (France, Greece, Ireland, Italy, Slovakia and Spain) and partnered with TransferWise for international transfers in foreign currencies. And this partnership is key to the company’s future.

“We will be rolling out our product more aggressively into different countries across Europe during the second half of this year,” co-founder and CEO Valentin Stalf told me. “That’s also when we will be taking a decision on entering the U.K. market.”

Number26 participated in the Startup Battlefield competition at TechCrunch Disrupt in London in October 2014 and later launched in January 2015. At the time, the company was already thinking about becoming the central hub for fintech services. “We could integrate TransferWise for international transfers for example,” Stalf said at the time, before actually partnering with TransferWise. “The idea is to be the connector for finance startups.”

And it looks like the company plans to do just that. Number26 is looking at partners when it comes to investment, savings, credit and insurance products. It’s going to be hard to find partners that provide these products across all of Number26’s markets. But maybe Number26 could partner with multiple companies to cover multiple countries for one feature.

“We believe the bank of the future is driven much more by the customer relation and the mobile experience than by the size of the balance sheet,” Stalf said. “Therefore, we selectively partner with some of the best fintech companies around the world to offer a platform of products within a seamless, mobile-centric experience. Unfortunately I can’t release the exact partners on the investment or savings sides yet.”

And this brings us to the revenue question. Right now, the company is making money through three different ways. Whenever you use your card to pay for something, MasterCard gets a cut of the transaction as it manages the payment network. MasterCard then gives back a cut of this cut to the bank that issued the card. So Number26 makes pennies here and there from your card transactions.

Second, Number26 makes money from overdraft interest (obviously). And third, Number26 gets a cut of the TransferWise fees when somebody initiates a TransferWise transfer from the Number26 app.

In the future, Number26 wants a revenue sharing deal with other potential partners for investment, savings, credit and insurance features. This kind of revenue model only works at a large scale, and the good news is that Number26 doesn’t spend a lot of money on customer acquisition. Most new customers hear about Number26 from existing customers.

According to a source, Number26’s valuation for today’s round was quite high. Numbers from the pitch deck don’t add up just yet, so Horizons Ventures trusts that Number26 will be able to turn an attractive service into a profitable business.

As Number26 becomes a full-fledged bank, the startup also plans to introduce premium features, such as higher limits, insurances, extra services and more. Current free features will remain free, but the company will add more features on top of those.

I personally think Number26 has a shot at creating a compelling service. With the Great Fintech Revolution (or however you want to call it), financial services have been unbundled with startups handling just one specific financial service, such as international transfers, peer-to-peer loans, new investment products, etc. Number26 is rebundling all these services into a convenient one-stop shop. And that’s a nice value proposition as Number26 could be the startup that turns other fintech startups into mass market products.

Comment