Adam Marcus

More posts from Adam Marcus

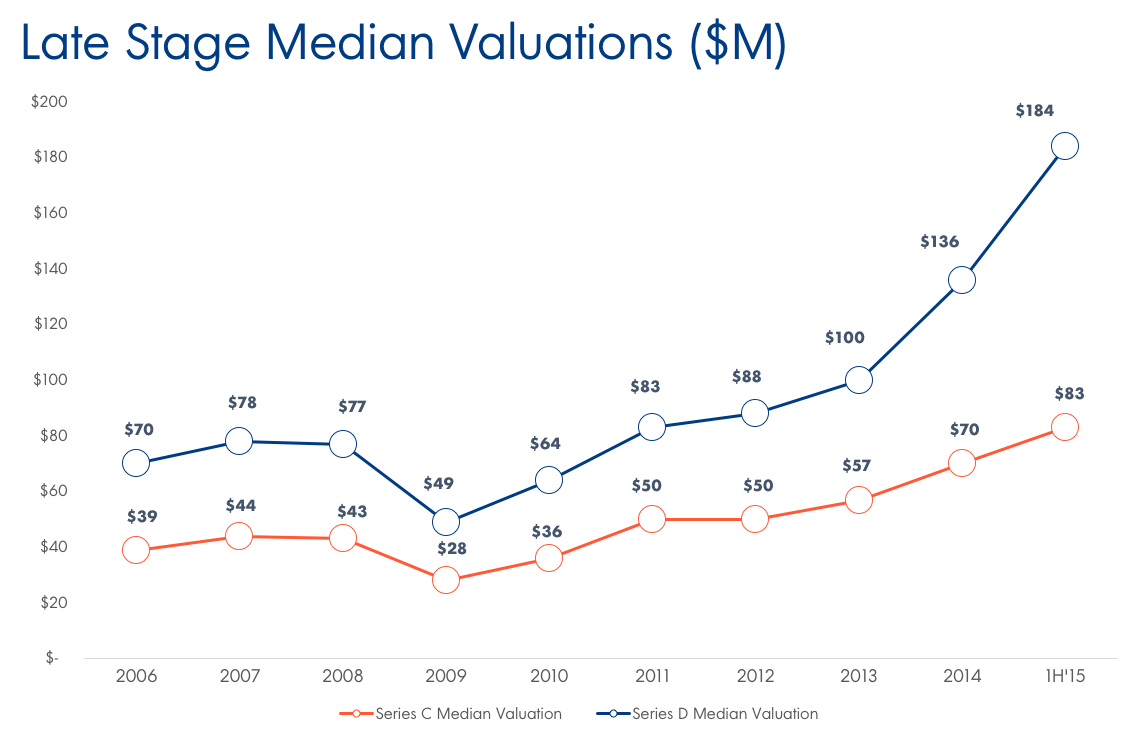

There has been a huge disconnect between private and public company valuations over the last few years.

This isn’t the first time I’ve said it. It probably won’t be the last.

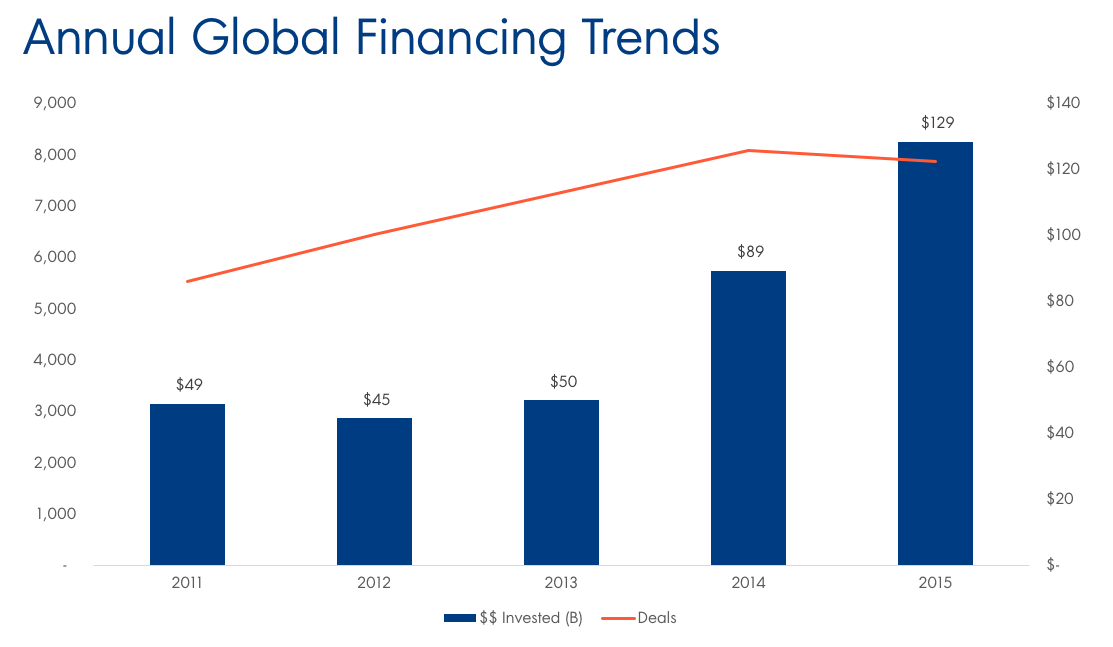

During this period of froth, companies were able to raise capital at increasingly ludicrous valuations, and entrepreneurs turned fundraising into a sport — with all the associated bragging rights. Deals closed peaked in 2014, but all-time funding hit its highest point last year, meaning 2015 saw some of the largest funding rounds to date.

The net result of this exuberance was a pissing match over valuations and capital raised, so much so that recruiters famously used these attributes as key selling points when trying to hire.

Most of us have recognized by now that we were in a bubble (yes, a bubble), and we’re currently undergoing a full-fledged correction. The pendulum of power and control is swinging back to the investor community. And it’s in this proverbial pendulum where the problem lies.

I’ve been involved with the tech community as both an operator and an investor for almost 20 years. I’ve had a front row seat over the course of numerous cycles and the change in ball control. What I believe gets lost in all of the hubris and egomania is the fact that entrepreneurs and VCs need each other to be successful — something First Round keenly pointed out in its recent letter to limited partners.

Said another way, low prices and unmotivated teams are not good for VCs. Similarly, high prices and crappy VC returns are not good for entrepreneurs — implicit in bad returns is the fact that VCs won’t be able to raise funds and subsequently invest in new companies.

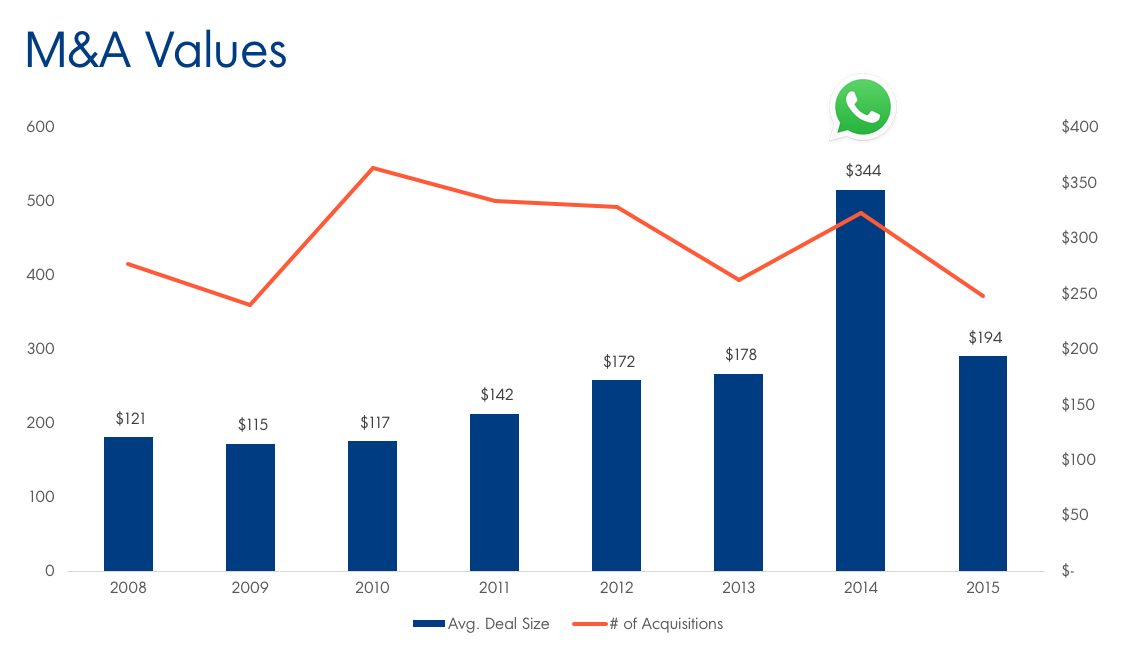

And the numbers don’t lie. The average size of M&A deals has remained relatively flat over the past seven years (WhatsApp is the cause of the 2014 spike).

Over the last few months, I’ve seen many of my VC peers salivating over the dramatic change in pricing and the increased leverage they have on deals. At OpenView, we have certainly experienced the change first hand. We no longer see companies coming in with multiple term sheets, valuation expectations in the 20-40X ARR range and timelines measured in days rather than weeks.

Instead, we’re seeing folks coming in without term sheets and suggesting that the market should dictate their valuation with no immediate timeline.

Frankly, I think this is a good thing for everybody.

When we reflect upon the 2014-2015 timeframe I don’t think anyone will view this as a healthy period for our ecosystem. Most of the funds raised and deployed during that time will yield crappy results, as many of them were deployed at Formula One speed — 18 months versus 3-4 years — at sky-high valuations.

The unfortunate byproduct of this latest boom cycle is that it has left many VCs with a bad taste in their mouths. And now they are looking to extract their due leverage. That’s where I get concerned. We’re hearing more and more VCs talking about issuing term sheets as an option on a deal with the assumption that they can re-trade the deal or just walk away. Brad Feld wrote a great post on this.

Clearly, FOMO has left the building.

So this is what I’m requesting of my fellow VCs. I think we can all admit that prices were out of whack and they needed to come down. They have already come down and will probably continue to slide for the next few quarters. Entrepreneurs recognize that. BODs recognize that. What we need to focus on now is quashing the bad juju created by misbehaving during a deal process.

This behavior simply doesn’t help anyone.

If you are excited about a company, do the work before issuing a term sheet. You have the time. There is no ticking game clock. At OpenView we do all our business diligence before issuing a term sheet. Always have. Anything we do post-term sheet is confirmatory. Ironically, this process, along with our price discipline, is precisely why we only did three deals last year.

Issuing a term sheet to figure out if you like a deal is destructive. There are many entrepreneurs from previous cycles who have developed a natural distrust of VCs given this bad behavior. These same entrepreneurs looked to extract their leverage when the pendulum swung back in their favor in 2014 and 2015.

Now is our chance to stop perpetuating this cycle. Do your work. Offer a price that works for you and your firm. Remember you are playing for the upside, not managing for the downside. Let’s not draw blood from the stone. And maybe next time we won’t see more than 150 companies whose top priority was price and capital instead of a more symbiotic equilibrium.

VCs and entrepreneurs need each other to be successful. Don’t forget that.

Comment