Jake Chapman

More posts from Jake Chapman

The World Economic Forum, the Detroit Auto Show and CES all occurred recently, and each has driven a great deal of discussion around self-driving cars. The expectation is that within a decade we will begin to see autonomous vehicles on the streets and a correlated reduction in accidents, traffic congestion and demand for parking.

While the ongoing conversation is good for those who wish to see self-driving cars enter use, a careful analysis of the facts, coupled with an understanding of how similar transitions have played out through history, indicates that the majority of the discussion occurring right now vastly underestimates the speed with which self-driving cars will become the norm and ignores the tectonic shifts the transition will bring to all corners of American life.

Self-driving cars will not only impact transportation, they will change how people feel about their homes, how cities are built, how families stay in touch, where we work and other facets of American life far removed from transportation.

The scope of a transportation revolution

The self-driving car revolution will be big and it will be here soon. Exactly how big and how soon are very complicated questions, but by analyzing disparate data sets, we can arrive at a fairly clear idea of what the next decade will bring.

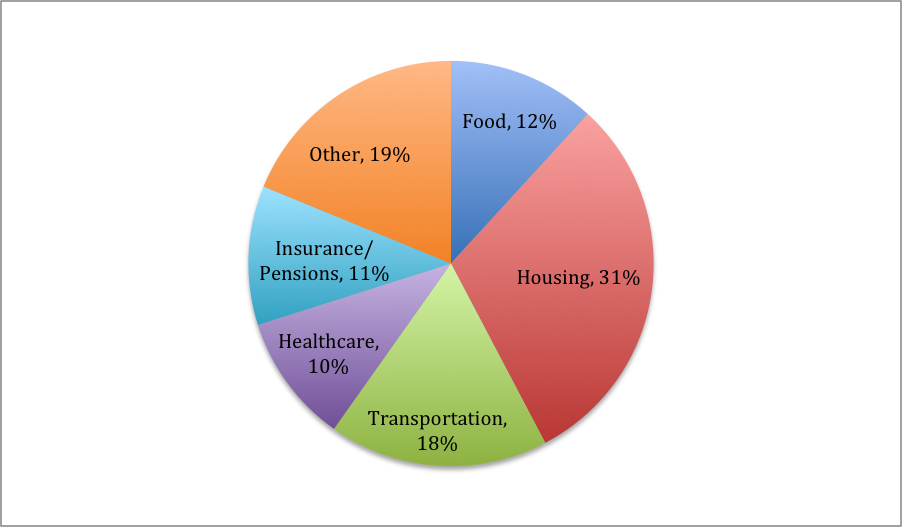

According to the Bureau of Labor Statistics, consumer expenditures roughly break out as shown in Figure 1.

It shouldn’t comes as a shock to anyone that transportation represents the second largest expense category for Americans, behind only housing. What may surprise some people is the transition to self-driving vehicles will impact not just the transportation sector but each and every major consumer expenditure. According to an auto industry analyst at Morgan Stanley, autonomous vehicles can contribute $1.3 trillion annually to the U.S. economy in a base case scenario.

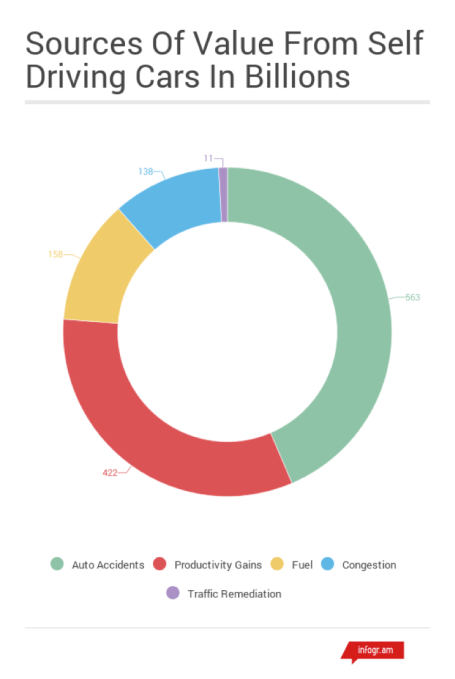

Figure 2 shows the breakdown of how autonomous vehicles add value to the economy.

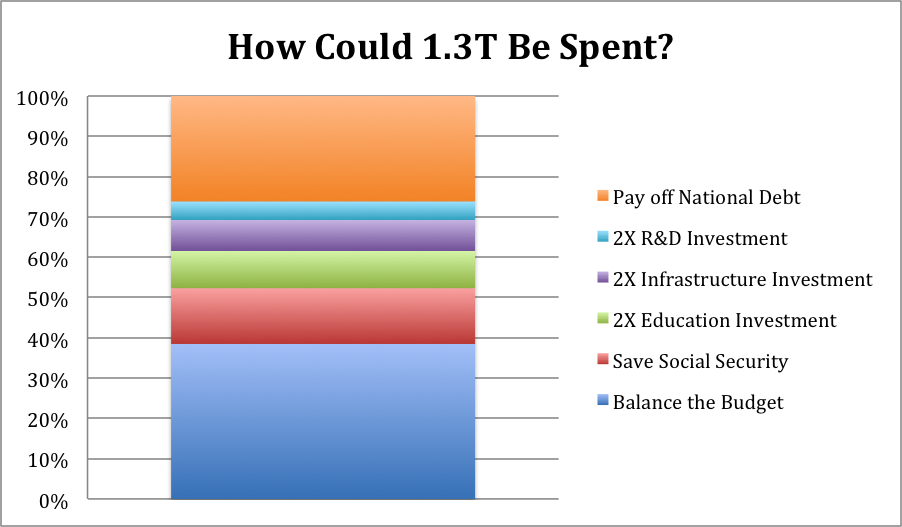

Indeed, $1.3 trillion is a lot of money. To put that number into perspective, here are a few of the things we could do with that much money (see Figure 3). We could balance the federal budget ($500 billion), make social security solvent ($180 billion), double all major federal research programs, including NASA, NSF, DARPA and NIH ($60 billion), double federal education investment ($120 billion) and, finally, double federal infrastructure investment ($100 billion). Amazingly, even if we committed to all of these investments we would still have more than $300 billion left over every year for debt reduction.

The speed of a transportation revolution

Many top auto industry analysts have predicted the transition to autonomous vehicles will take at least a decade to achieve scale. Xavier Mosquet at Boston Consulting Group has predicted ridesharing driverless vehicles won’t begin to appear in major cities for another six to nine years, and that further dissemination will take longer.

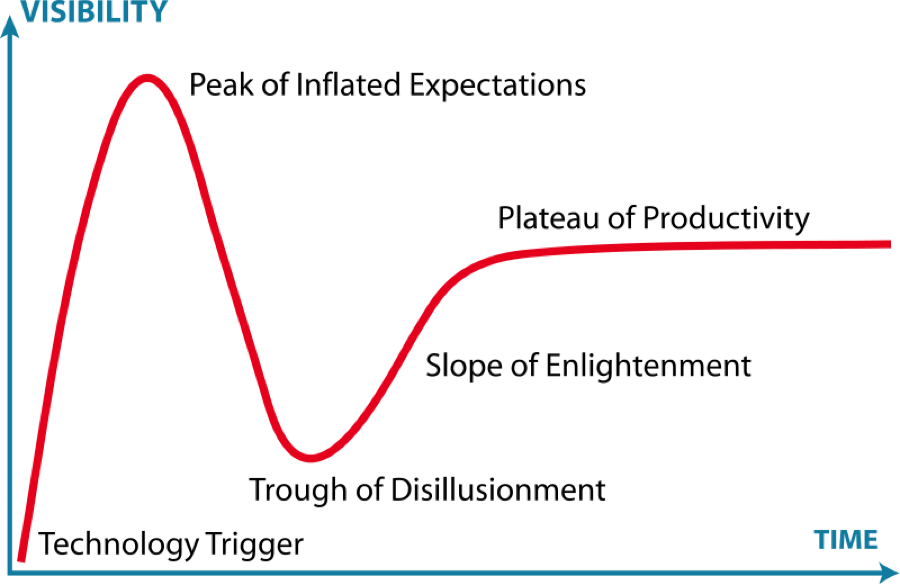

While there is much optimism around the future potential of self-driving cars, pessimism abounds around the timing of the transition. Pundits believe we are nearing the infamous “Peak of Inflated Expectations” in the Gartner Hype Cycle (see Figure 4), and a long letdown is ahead.

While there are certainly technology, infrastructure, political and social challenges to face, the sheer weight of investment in the space is overwhelming. Traditional automakers GM and Ford have partnered with technology companies like Lyft and Google with an eye toward an autonomous future. Technology companies like Google and, reportedly, Apple have invested substantial resources in developing their own self-driving cars. New automaker Tesla has already released a semi-autonomous highway mode, and the government has gotten involved with President Obama earmarking $4 billion to prepare the way for autonomous cars.

The brightest minds in American industry, backed by unprecedented quantities of capital, are pushing autonomous vehicles forward with a shockingly unified vision. In the face of this commitment, accelerated adoption seems likely. However, the future is inherently unknowable, and if we want to predict the future, the best method is to examine our past. Specifically, we should look to see how quickly the transition from the horse and buggy to automobiles occurred.

From Mr. Ed to the Edsel

Horses served as a primary means of powered transportation for millennia leading up to the twentieth century. What we need to know is how long it took for them to give way to the automobile once the automobile ceased being a niche oddity.

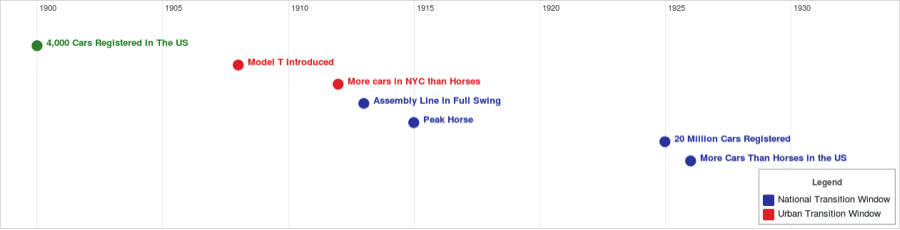

In 1900, only 4,000 cars were sold in the U.S., representing approximately one car for every 20,000 residents. At this time, it’s fairly safe to say the car was still a niche product. Henry Ford released the iconic Model T in 1908, but there was still less than one car for every 400 residents.

It wasn’t until 1914, one year after Henry Ford’s moving assembly line had been in full swing, that the car became part of the average American experience. In 1914, the U.S. boasted 1.7 million cars, or about one car for every 60 residents. Fast-forward to 1925, and there were more than 20 million automobiles registered — enough for the vast majority of urban households to own a car of their own. Looking at these numbers we can confidently say the transition from horse and buggy to automobile was completed between 1908 and 1925, a span of 17 years.

Complicating what superficially looks to be a 17-year transition period is the urban traffic survey data we have. New York City, for example, recorded that automobiles outnumbered horses on the streets by 1912; a year before the assembly line had even kicked automobile production into high gear and a blazingly fast four years from the introduction of the Model T.

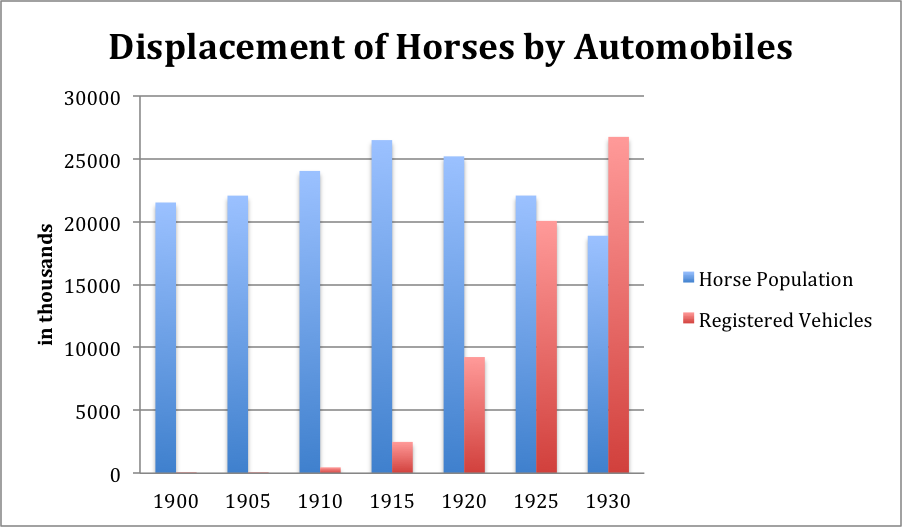

Clearly there is a discrepancy between the urban transition and the rural transition. To narrow the transition window further, it is instructive to look at horse populations in the U.S. Figure 5 shows horse population versus registered vehicles in the U.S. from 1900 through 1930.

Figure 6 illustrates two key dates in the transition. The first occurs in 1915, which is roughly when the U.S. achieved “Peak Horse.” This date is significant because, given the 30+ year life span of horses, it is, if anything, a trailing indicator of the transition away from horses to automobiles. The peak horse data coincides with the data showing the urban transition to automobiles actually occurred in the period between 1908 and 1915.

The second key date is 1926, where we see for the first time the absolute number of automobiles eclipse the number of horses. The data corroborates our earlier assertion that some time between 1920 and 1925 is when automobiles eclipsed horses in both rural and urban areas.

Triangulating these data points indicates two distinct transition periods: The urban transition, which occurred roughly between 1908 and 1912, and the full national transition, which began with the implementation of the assembly line in 1913 and was well underway by the early 1920s. For those playing along at home, this translates into a four-year urban transition and a 7-10 year national transition.

The parallels between the transition from horse-to-car and the transition from car-to-autonomous car are many; however, the hurdles faced by the current transition are actually much lower. To transition away from horses, the U.S. developed a nationwide network of paved roads, gas stations, gas distribution infrastructure and auto mechanics.

Each of these networks was a major infrastructure project in its own right, and yet each was developed in time to support a rapid transition to the automobile. In comparison, 95 percent of the infrastructure needed to support self-driving cars is already in place, making a very rapid transition plausible, if not likely.

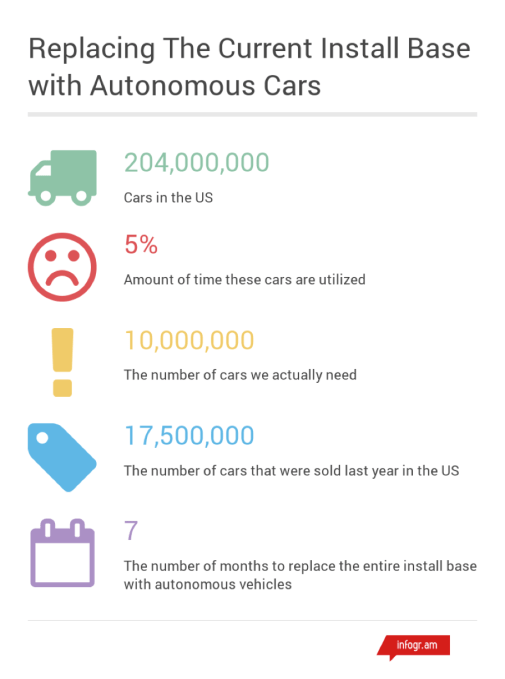

Some may argue that whether or not the infrastructure for self-driving cars already exists, the time it would take to replace the install base alone lengthens the transition. The U.S. Department of Transportation says there are 204 million vehicles available for daily use. In 2015, there were approximately 17.5 million cars sold in the U.S. If we assume all the numbers held steady, it would require a grueling 11.5 years to replace the entire install base.

Our analysis can’t stop here, however, because self-driving cars fundamentally change our relationship with the automobile. Currently, cars have an astoundingly low utilization rate of 5 percent. This means in a perfect world we would only need 1/20th the number of vehicles (10 million cars) to satisfy our needs (see Figure 7).

Given our manufacturing capability, the U.S. could build an autonomous fleet in as few as 7 months. Is this analysis simplistic? Yes. There are scores of positive and negative feedback cycles that would impact the amount of time it would take for a complete transition, and we will never get to 100 percent utilization. The important takeaway, though, is that we have the infrastructure and the manufacturing capability to “flip the switch” on autonomous cars much more quickly than most people realize.

The impact of transitioning to self-driving cars is potentially huge in terms of real dollars to the economy, and the transition could happen very quickly. But what would the transition mean in more concrete terms?

Changes to daily life

The disruptive changes autonomous vehicles will bring to this country are too numerous and nuanced to be discussed in a book, let alone this article. Instead, we will examine a few of the major non-obvious changes we can expect as a direct result of autonomous vehicles.

Housing

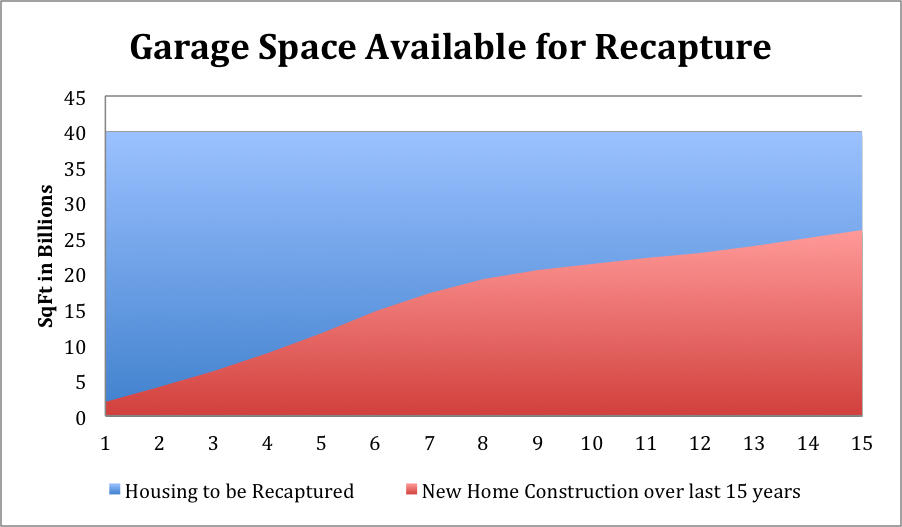

Garage space: Americans have been in love with the car for generations. One very obvious consequence is that the average American single-family home sports a two-car garage. While some homes have no garage, others have three-car garages, bringing the average to just over 1.9 garage spaces per home.

These two-car garages are space hogs, claiming somewhere around 500 square feet of prime living space. As the self-driving car transition matures, individual car ownership will wane, as will the necessity to park one’s automobile in a garage.

According to U.S. Census data, as of 2011, there were approximately 81 million detached single-family homes in the U.S. If these homes average two garage spaces, we would expect there to be somewhere in the neighborhood of 40 billion square feet of garage space available. To put that number in perspective, the U.S. only added approximately 1.5 billion square feet of single-family home space in all of 2014. If self-driving cars allow us to gradually reclaim garage space as living space, we can reclaim more than 25 years worth of new home construction (see Figure 8).

The tendrils of this garage space recapture will reach far and wide. Self storage as a business will face a quickly eroding market, new housing starts should see pressure, home decor/repair retailers should be buoyed by DIYers looking to improve newfound space, so-called “boomerang kids” returning from college should be able to move back in with their parents and Airbnb should see inventory increase as homeowners look to monetize newly refurbished living space.

Apartment rentals: Speaking of garage space, the impact on multi-family housing will be at least as significant as it is on detached single-family homes. According to a recent study, the cost of building parking garages into multi-family housing is borne by the tenants, and can drive rents up by 15 percent or more.

A four-story multi-family apartment complex will often dedicate the entire lower story to parking instead of additional housing units. This means 25 percent of the capital expense and maintenance of the building is dead weight borne by the other three floors of construction. Reducing the need for parking should translate directly to an increase in affordable housing.

Media business

The media business is fundamentally about grabbing your attention. Until the introduction of the modern smartphone in 2007, the amount of people’s time available to media had been static for decades, and competition was a zero-sum game. Mobile opened up new territories for settlement — territories that have now been claimed by Facebook, Twitter, Snapchat, Instagram and a handful of other major players.

We are once again approaching an era of zero-sum competition, but that era will be short-lived as the estimated 75 billion hours Americans spend commuting will be up for grabs. Today’s media giants will all make a play for this new supply of attention, but the jostling will make space for new upstarts or for an older player to reboot themselves.

Seventy-five billion hours is an extremely difficult number to conceptualize, but, in practical terms, it represents about twice the amount of time Americans spend on Facebook, an attention-based company worth almost $350 billion.

Here’s a list of top media companies, with a total value approaching $700 billion (given consolidation in the media industry, these 15 conglomerates own almost all the name brands in traditional media):

| Name | Market Cap in Billions |

| Disney | 152 |

| Comcast | 133 |

| Time Warner | 56 |

| 21st Century Fox | 52 |

| Time Warner Cable | 51 |

| DirecTV | 47 |

| NetFlix | 39 |

| WPP | 27 |

| Sony | 27 |

| Vivendi | 25 |

| CBS | 22 |

| British Sky Broadcasting | 18 |

| Viacom | 17 |

| Bertelsmann | ~15 |

| Televisa | 13 |

| Total | $694 Billion |

Urban greening

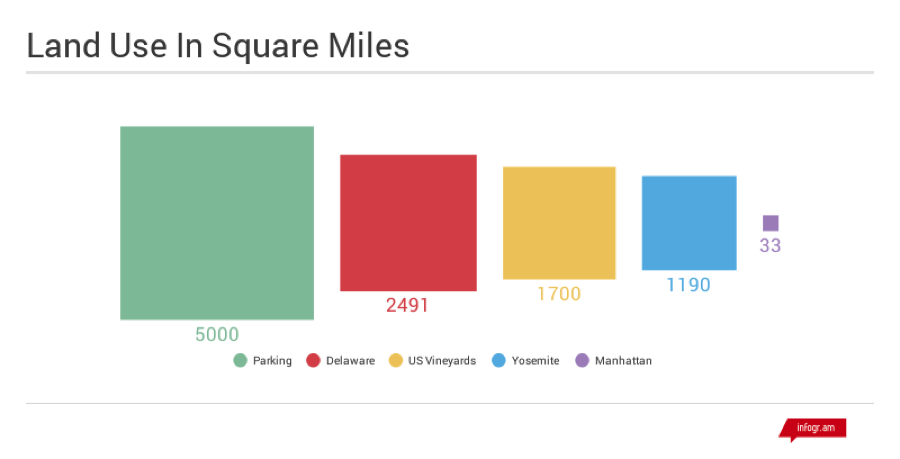

A U.C. Berkeley study recently noted there are between 700 million and 2 billion parking spaces in the U.S., covering substantially more than 5,000 square miles. This means three times as much land in the U.S. is devoted to parking than is devoted to growing wine grapes (see Figure 9). What civilized people would so horribly misallocate their resources?

As self-driving cars begin to obviate the need for high-value urban real estate to be devoted to parking, these spaces can be reclaimed. This newly liberated land can gradually be transitioned from the urban blight it currently represents to new housing, urban green space, unique local businesses and the things that make living in an urban environment interesting.

Dying industries

The transition to self-driving cars will be fast, and it will create tremendous value for the country, but that isn’t to say it will be positive for everyone. Many sectors of society will be clear losers in this transition.

There are some obvious businesses that will gradually face extinction. These include gas stations, auto parts retailers and service stations. It is hard to imagine a self-driving future that doesn’t ultimately break us away from individual car ownership; once you approach cars from the fleet perspective, gasoline and retail-level auto maintenance don’t make sense.

There are some less-obvious victims, too. Public storage facilities will feel the bite as their largest competitor will become the 40 BILLION square feet of free garage space opening up over the next couple decades.

In the transportation space, airlines will face pressure as the shorter regional flights that are so critical to the hub and spoke system will need to compete against self-driving cars. Once a self-driving car can make the door-to-door trip from San Francisco to Los Angeles in four hours or less, it will be cheaper, safer and more convenient than anything the airlines will be able to offer. Similarly, the insurance industry will need to adjust as the highly profitable auto insurance business line disappears.

As the number of accidents plummet, the auto insurance industry will see their margins compressed to near zero. Moreover, given the problems around attributing agency/fault in a world dominated by self-driving vehicles. it may make more sense for auto insurance to eventually be taken over by a state-run fund similar to the workers’ compensation system.

There aren’t many things we can say about the future with certainty. However, we can say that the potential for massive social and economic change contained in autonomous vehicle technology rivals the potential, now released, first contained in computers, the Internet and the mobile device.

For those who are looking for a new American Century or a new “New Deal,” look no further than Uber, GM, Ford, Google, Lyft and Apple. The autonomous vehicle dividend is almost mature, and if policy makers don’t epically screw this up, we may all get to cash in.

Comment