Banks are so greedy that LendUp can undercut them, help people avoid debt, and still make a profit on its payday loans and credit card. Not only is software eating finance, but morality is too. LendUp’s slogan is “Ladders Not Chutes”. Building a business that doesn’t try to exploit everyone has not only brought it years of double-digit monthly growth. LendUp has now attracted an $150 million Series B.

That includes $100 million in debt from Victory Park to finance LendUp loans, plus $50 million for equity from patient investors like Google Ventures, Kapor Capital, and QED. Each only invests its own money, rather than cash from a long list of LPs. That’s why LendUp CEO Sasha Orloff tells me they’re giving the startup time to build a long-standing brand in finance “the right way”, rather than squeezing as much profit as possible from its customers in the short-term.

“Everything has to be transparent. There is no fine print. No hidden fees. And everything has to get someone to a better place” Orloff insists.

There’s something deeply genuine in his plucky smile. Lots of entrepreneurs make strained claims about how they’re making the world a better place with social apps, enterprise software, or on-demand services. But LendUp’s leading man found an obvious way to actually do it. Straighten out a massive, crooked business that preys on the poor. Use software to make it more efficient. Split the savings with the customers. And grow because people like LendUp enough to tell their friends and family.

From Facepalm To Pivot

“Would you quit your job if we got into Y Combinator?” Sasha asked his step-brother Jacob Rosenberg. The book Banker To The Poor had inspired Sasha to work distributing loans in the developing world before spending years in different departments of CitiGroup, a giant bank. He’d complain about Citi’s backwards methods, and Jacob, who’d worked at Yahoo since he was 16, would always chime in that they were software problems. On an impulse, Sasha recorded a video application for YC with a blunt pitch: “Let’s build better software for banks.”

A few days later, “Oh shit”, Sasha exclaimed. They’d gotten in. “We had to come up with this whole story for our nervous Jewish parents to break them in on the idea that we were going to join YC and quit our jobs” Sasha tells me. “They freaked out be we did it anyway”.

Originally, the brothers were trying to build software for the big banks rather than create their own way to distribute loans. But banks weren’t buying. “You’re just a startup. Software has never been a competitive advantage” is all they heard. One did show interest in acquiring them, but the brothers facepalmed when the lender told them its software couldn’t even tell which people were already customers.

It was time to raise a Series A, and the founders had offers from Andreessen Horowitz and Kleiner Perkins, who knew banks would wise up eventually. Yet Google Ventures led a $14 million round with a different idea. Build a whole bank from scratch, full-stack, create a brand people loved, and use software to run circles around the lumbering finance giants.

Those institutions relied on code written in COBOL in the late 80s. “We were going to be able to launch products faster, learn and adapt” Sasha says. He pivoted the company and bought the LendUp URL.

Ladders Not Chutes

The startup’s first product is the LendUp Ladder. The brothers asked themselves “What’s the most horrible product on the market?” The answer will be familiar to anyone living in a low-income area. The payday loan. It’s a same-day infusion of a few hundred bucks for people who need money to pay bills or want cash but don’t have good enough credit to get a traditional loan.

“It’s a debt trap. The average loan size is $400, but you pay less than the fees on the interest due so the amount you owe gets bigger and bigger. They’re called ‘rollovers’” Sasha says, exasperated. “They’re framed as convenient but they’re very dangerous to consumers.”

The LendUp Ladder is different.

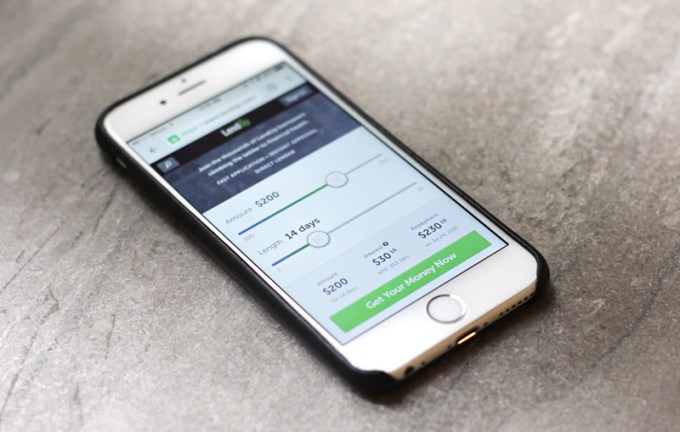

- It’s got a flat fee LendUp prints right on its home page, no matter how long it takes to pay back. What you see is what you get

- It lets customers get money in minutes straight from their phone

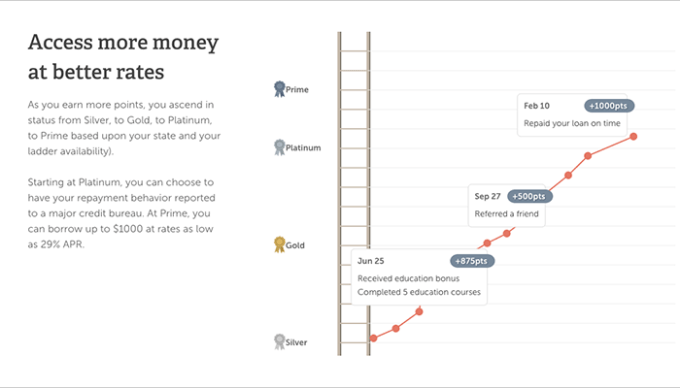

- It embeds education into the experience to teach users about credit scores, budgeting, interest, and protecting their identities

- People who pay on time earn points that let them borrow more at lower rates

- And it helps customers build their FICO credit score so they can eventually qualify for cheaper traditional loans

To make sure it gets its money back from people without credit histories, LendUp also looks at public records, specialty bureaus, and bank statements. Its machine learning technology lets that happen quickly and automatically rather than waiting for a bank employee to do the research manually.

LendUp Ladder works. The company did several hundred million dollars in loan volume last year, and grew new customers by 36% in December alone. Users are becoming evangelists.

A new study conducted with TransUnion, one of the big credit score companies, shows that people who use LendUp had a higher chance of upping their credit score than those using other online lenders or who didn’t borrow at all. “If you’re below a 680, a bank can’t loan to you. But 56% of the country is below 680” Sasha explains. “LendUp’s goal is to take people locked out of the banking system and give them a change to build their credit score.”

100X Bigger Market

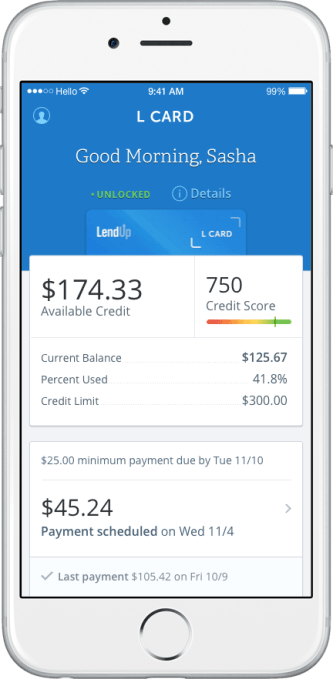

Now after several months in beta, LendUp is launching its own credit card. It’s a 100X bigger market than payday loans, but LendUp is bringing its same attitude that puts honesty first. No hidden fees. If you pay on time, it’s free, compared to the average payday loan that costs 500% to 700% APR. The startup hopes to graduate Ladder customers onto its cheaper L Card.

That’s when Sasha stops our interview and pulls out his phone. “Let me show you why having our own software is cool”. He toggles a switch on his LendUp Card app, and instantly halts the credit card. No charges allowed. Another tap, and it’s on again. There were no touchtone phone trees, holding times, or delays involved. “We can do things that don’t exist in the credit card market” Sasha beams.

That’s when Sasha stops our interview and pulls out his phone. “Let me show you why having our own software is cool”. He toggles a switch on his LendUp Card app, and instantly halts the credit card. No charges allowed. Another tap, and it’s on again. There were no touchtone phone trees, holding times, or delays involved. “We can do things that don’t exist in the credit card market” Sasha beams.

The L Card lets you opt to be notified about every purchase, so you could pause it if you see anything unauthorized. You can set budgets you can’t spend past, and set up whitelists for your utility bills, grocery stores, or gas stations. A wife could configure it so her husband can grab the family dinner but not splurge at Best Buy. Parents could prevent children from spending more than $50 at a time and monitor their purchases.

You even get a health bar. It turns out that after paying on time, the most important contributor to your FICO score is having a lot of available credit. Financial institutions want to know that if you have to go to the hospital or have unexpected bills, you’ll be able to pay them.

That means that even if you have a $10,000 credit limit on your L Card, you credit card will improve if you don’t spend much of it or pay it off before your statement comes. So the top of the LendUp Card app shows your credit health bar. Have over 70% left and it’s green, under 30% and it turns a frightful red, encouraging people to keep their balance paid.

Empower The Poor

With the $50 million in equity funding from Google Ventures, Data Collective, Capital One co-founder Nigel Morris’ QED Investors, Susa Ventures, Yuri Milner and Kapor Capital, LendUp plans to try more features like this.

“I want to hire a bunch of creative developers and product people and designers and let them build out stuff” Sasha tells me. “That’s the problem with banks, they’re not testing ideas and innovating.” LendUp has 140 employees but plans to potentially double that by the end of 2016.

Sasha says he sometimes worries that another startup will enter the market, burn all their capital, go bankrupt, and sour investors on more disciplined finance businesses like LendUp.

Sasha says he sometimes worries that another startup will enter the market, burn all their capital, go bankrupt, and sour investors on more disciplined finance businesses like LendUp.

There are other tech companies trying to beat the banks, but none that focus on serving credit to the poor. Marqeta just does debit cards and pre-paid cards. Avant does bigger $5000-plus personal loans for people already in good standing. SoFi offers cheap student loans to reliable Ivy Leaguers. Perhaps the closest thing to LendUp is Capital One, the largest subprime lender, but they don’t have software to underwrite loans with machine learning insights.

As Y Combinator’s Sam Altman says, “99% of startups die by suicide”. Sasha knows it. He tells me his biggest fear is actually keeping LendUp’s culture of duty to the less fortunate.

“It’s so easy to make money the wrong way in payday lending or subprime credit cards. It’s easy to take advantage of people and charge them more” he admits. “I get scared that someone on our team will start suggesting we do things that are against the mission of our company…that greed takes over. As you grow bigger it gets harder and harder to make sure every hire is mission-aligned.”

LendUp is already profitable on a per loan business, and would be overall if it wasn’t pouring so much capital into growth and engineering. One day, Sasha says perhaps it’ll license its technology to other banks like it planned to pre-pivot. But for now, he sees plenty of opportunity to positively impact the world creating a banking brand people trust.

Funnily enough, LendUp’s first office was above one of those exploitative payday loan places. Sasha says he’d walk by it each day whispering under his breath, “you’re going out of business.” Now he has the firepower to make that dream come true while unshackling people from debt along the way.

Comment