Sheji Ho

Following in the footsteps of China and the U.S., Southeast Asia is on the cusp of an e-commerce golden age. With online shopping accounting for only 1 percent of retail today, the region is slated to reach double-digit China-esque numbers within the next 4-5 years.

With a population of 600 million — twice that of the U.S. — Southeast Asia is poised to eventually become the third-largest e-commerce market in the world, second only to China and India (and ultimately surpassing the U.S.).

But enough of the macro overview. How did 2015 turn out? And what will 2016 bring to e-commerce?

Local, regional and global players stepped up their games. In particular, we saw Indonesia rise this year: MatahariMall launched with big fanfare as the nationalist answer to Rocket Internet’s Lazada; Lazada, in turn, doubled-down on Indonesia with the return of previous CEO Magnus Ekbom; for the first time, aCommerce Indonesia surpassed Thailand in order volume; and, recently, China’s Alibaba competitor JD snuck into Indonesia and surprised everyone with the launch of JD.id. This has served to add to an immense amount of pressure and competitiveness in the pure B2C space.

2015 also was the year of M&As, as other players allied together or were absorbed in order to arm themselves against the behemoths mentioned above. First, Ardent Capital-backed WhatsNew acquired lifestyle vertical site Moxy in Thailand in January.

More recently, we witnessed an encouraging e-commerce exit as beauty site Luxola was acquired by French luxury superstar LVMH. And in December, aCommerce gave a 20 percent stake to a 150-year-old Swiss retail distributor, giving it access to more than a hundred of its Western brands and physical infrastructure in the region.

Unfortunately, the year did not pass without its share of casualties due to the hyper-competition in B2C e-commerce in Southeast Asia. Fashion retailer Paraplou Group shut down in October after two years (and having raised $1.5 million) due to lack of focus and deep pockets.

In March, SingPost and Indonesia’s mobile phone retailer Trikomsel announced a mysterious e-commerce partnership — only to have reports pop-up of the telco’s dire financial situation three months later, in addition to the sudden removal of Wolfgang Baier as Group CEO of SingPost in December.

If 2014 was the year of unprecedented capital injections to build Southeast Asian e-commerce businesses, 2015 was the year we saw the early rise, fall and transmogrification of players in the fragmented landscape as they vied for a piece of the rapidly growing e-commerce pie.

In line with our annual tradition, we are giving you a sneak peek at what will be on the menu for next year. The conclusions were determined through extensive investor and executive interviews, as well as internal data and secondary sources from January 2015 to December 2015.

Because we work for a major Southeast Asian service provider, with the biggest e-commerce names in the region (such as Lazada, MatahariMall, L’Oreal and more), we are privileged to sit at the intersection of tech, logistics, retail, marketing and VC. We see where our partners are putting their money and where the investors are willing to follow.

As such, we are able to see with acuity where the growth will be. There’s no crystal ball or trusting a gut feeling here; we simply have the privilege of a bird’s-eye view that most players don’t have, and we’re providing projections here in the form of predictions.

1. Brand.com Is Poised To Be The New Black

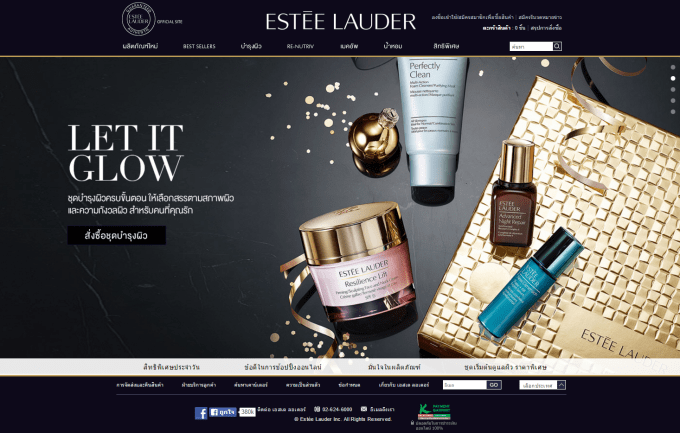

The evolution of e-commerce commonly follows the trajectory of P2P and C2C to B2C to eventually Brand.com. The U.S. went from Craigslist and eBay to Amazon to brand sites like Nike, J.Crew and Gap. China went from Taobao to Tmall and JD to the many standalone and marketplace brand sites, like Estee Lauder, Burberry and Coach.

Today’s Southeast Asia is following a similar pattern, yet at a much faster pace due to “1 to n,” horizontal progress and the resulting leapfrogging behavior. In our region, we have P2P (OLX), C2C (Rakuten, Tokopedia, Shopee), B2C (Lazada, Zalora, MatahariMall) and Brand.com (L’Oreal, Estee Lauder) all happening at once within a very short time frame.

Even Unilever in Thailand has created an e-commerce division with revenue targets they expect to start hitting in 2016. We are seeing brands going online much earlier than one would normally expect.

It was no big surprise, then, when aCommerce recently landed a strategic investment from Asia’s biggest retail distributor, DKSH. Swiss-based DKSH owns distribution rights for some of the biggest brands in the region, such as P&G, Unilever and Johnson & Johnson.

This partnership validates the growing demand for brand e-commerce in the region, and will further expedite the process at which brands go online, whether on their own brand sites or on the many marketplaces in Southeast Asia.

2. Omni-Channel Awakens: “There Will Be No More E-Commerce, Only Commerce”

This is what aCommerce Group CEO Paul Srivorakul said when e-commerce logistics player SingPost announced it would create a futuristic mall that combined online and offline shopping, in pursuit of the omni-channel retail dream — a dream that is quickly becoming a reality in the U.S. and China.

Referring to a seamless shopping experience across stores and the online channel, omni-channel retail is considered the elusive Holy Grail in retailing due to the politics and logistical challenges of integrating often independent online channels with their brick-and-mortar counterparts. But so far, Southeast Asia has been late to the game, with its focus (reasonably so) on building up pure-play e-commerce first.

In 2016, we expect to see serious movement in the region from offline players moving online, and vice versa. 2016 will be the year in which offline brands will go online due to the plethora of online marketplaces available, as well as the presence of full-service e-commerce enablers.

For B2C players, the appeal of adding offline operations to the mix includes enabling faster last-mile fulfilment and delivery. In Southeast Asia, Vietnamese electronics retailer Nguyen Kim (acquired by Central Group) is able to pull off same-day, 4-hour deliveries because of the massive offline retail footprint it has.

E-commerce players with a traditional offline arm, such as MatahariMall, Cdiscount and Central, will be in an advantageous position to execute on this. However, 2016 will also have B2C pure players looking into this, as logistics and last-mile in Southeast Asia increasingly struggles with industry-wide capacity bottlenecks.

3. Niche-Commerce Models Will Evolve To Avoid The B2C Bloodbath

In our 2015 predictions, we discussed how B2C e-commerce is a long-term, cash-intensive, winner-takes-all game. Companies trying to battle it out in this space better have deep pockets (see Lazada, MatahariMall, and JD) — or face extinction (see Paraplou Group).

In his seminal essay “E-commerce is a Bear,” Andy Dunn, founder and chairman of Bonobos.com, elaborates on why B2C e-commerce is a winner-takes-all game, and what options remain for other players who don’t have the luxury of deep pockets or a sugar daddy.

Much of this comes down to a “David versus Goliath,” Peter Thiel-esque contrarian approach to e-commerce. The U.S. e-commerce scene has been dominated long enough by Amazon to witness some of these models coming to fruition over the last several years: 1) Proprietary Pricing (think flash sale, Gilt Groupe), 2) Proprietary Selection (ModCloth, NastyGal), 3) Proprietary Experience (Rent the Runway, Birchbox), and 4) Proprietary Merchandise (Warby Parker, Bonobos).

This will be the year where more creative e-commerce models emerge. Companies like Pomelo and Sale Stock Indonesia have already adopted the proprietary merchandise approach toward achieving a competitive advantage. They do this by designing their own fashion and gradually moving upstream to include manufacturing.

Moxy has staked their flag as the “Everything Store,” but focused on women. We also may see the return of subscription-commerce business models with retailers like Central, impacted by a dip in foreign shoppers, seriously considering a Gilt-style flash sales model to get rid of excess inventory.

4. Cross-Border E-Commerce Will Be Driven By Silk Road 2.0, Not AEC

Despite all the media hype and lofty expectations (even our own predictions last year), the ASEAN Economic Community (AEC) will not have a significant impact on e-commerce in 2016.

Governments are too fragmented on policy; coupled with the immediate growth opportunity within the domestic markets, it doesn’t make sense to focus on cross-border within ASEAN, as evidenced by companies such as Lazada and MatahariMall doubling-down on Indonesia’s e-commerce opportunity.

Cross-border e-commerce in 2016 will be driven mainly by what we call “Silk Road 2.0.” These are Greater China-based companies that will bring their products into Southeast Asia, laying the foundation for our generation’s version of the Silk Road and attempting to expand China’s soft power and hegemony through commerce and digital.

China’s JD is a classic example. The No. 2 online retailer in China just recently set up shop in Indonesia and will be expected to leverage their 40+ million SKU product assortment and China-Southeast Asia supply chain to compete with the likes of MatahariMall and Lazada. Alibaba investing almost half a billion into SingPost clears the way for Alibaba, Tmall and Taobao packages to smoothly enter Southeast Asia.

5. Payments: COD Will Continue Its Reign While Third-Party Payments Struggle

The next double-digit billion dollar opportunity in Southeast Asia e-commerce is the third-party online payment space. U.S. has PayPal and China has AliPay; what does Southeast Asia have?

Contrary to what many people believe, building a successful payment product isn’t about technology, it’s about distribution. Payment technology is a commodity; everyone’s building the same thing, including banks (SCB UP2ME), telcos (TrueMoney, PAYSBUY), media (Line Pay, AirPay by Garena), retailers (helloPay by Lazada) and payment-focused startups (2C2P, Omise).

The hard part is distribution. How do you reach critical mass in order to cruise off network effects? Until this happens, COD will remain the dominant payment method in Southeast Asia. Based on aCommerce’s latest aggregated numbers, COD made up 74 percent of transactions in Southeast Asia, up from 53 percent the year prior. This validates the importance of COD to e-commerce in our region, and already exceeds the COD penetration rate at the height of its popularity in China back in 2008.

Eventually, COD will naturally reach its shelf life and be replaced by a “modern” third-party online payment product. Even then, the most likely scenario will be one leading payment product per country in Southeast Asia due to the region being fragmented.

Until then, good luck “killing off” cash on delivery, Mr. Jon Sugihara.

6. The Fizzle Of Fast Fashion E-Tailers

We’ll see mass, fast-fashion players like Zalora struggle and either fizzle out or be rolled into cousin Lazada. People familiar with the history of e-commerce in China will see similarities between Zalora and VANCL. VANCL, a mono-brand fast-fashion retailer founded by Chen Nian (who sold his previous business, Joyo, to Amazon), rose to prominence in 2009, raised up to $570 million and even planned for an IPO, but then gradually faded away. Selling your own fashion products is less about retail economics and much more about brand building.

In addition, VANCL suffered from competition from Taobao merchants who sold similar products for higher quality at lower prices. Replace Taobao with Instagram and Facebook and you’ll understand the pain that Zalora and other mono-brand, mass-fashion retailers are going through in Southeast Asia.

Following the natural progression of e-commerce, fashion will start becoming a more popular category for online shoppers, especially with the rise of richer female consumers in Southeast Asia. Fashion brands currently have the choice of selling on the many marketplaces in Southeast Asia and/or selling via their own brand sites. We’ll expect them to set up shop on their own brand sites or specialized, fashion-friendly marketplaces.

However, premium fashion brands may be hesitant to set up shop on mass marketplaces like Lazada and Rakuten because of the risk of being perceived as a mass brand. After many years of courting fashion and luxury brands, Amazon is still struggling. Don’t forget, most of Amazon’s premium fashion sales today are generated via Shopbop, a fashion-only destination that the company acquired in 2006.

7. New Channels Will Emerge To Challenge Google And Facebook’s Dark Side

When you’re digging for gold in the remaining e-commerce gold rush on the planet, you better be equipped with the best picks and shovels available. Unfortunately for e-commerce players in our market, the range of weapons available is quite limited due to historical and socio-economic factors unique to Southeast Asia. The appearance of a “no-tail” landscape in terms of publishers severely hampers the effectiveness of traditional tools, such as affiliate marketing and programmatic display.

In Southeast Asia, players are already exhausting the “usual suspect” channels, such as Google Search, Facebook and Criteo, with the result being CPCs rising to all-time highs and companies tapping into offline marketing to seek better returns. This is Andrew Chen’s “Law of Shitty Clickthroughs” in full effect.

Companies and savvy entrepreneurs will start addressing this gap by designing and building new demand-generation platforms to offer an alternative to the Googles and Facebooks out there. Expect to see more e-commerce firms adding channels such as price comparison, coupon sites and cash-back sites, as well as innovative affiliate marketing solutions to balance their media mix. 2016 will give us the excavators and bulldozers to complement today’s picks and shovels.

8.The Battle For The Last Mile Continues As 3PLs Fail To Adapt

In 2016, we will see companies like Lazada (LEX), MatahariMall and aCommerce investing in building out their own delivery fleet in order to help relieve the industry-wide capacity issues and serve the anticipated record-breaking transaction volume. The pressure will only become bigger in 2016 as transaction volume is expected to hit record highs in Southeast Asia.

Challenges with last-mile delivery in Southeast Asia, if not addressed properly, will become the biggest bottleneck to e-commerce growth in the region. The industry is currently witnessing industry-wide capacity bottlenecks beyond what the JNEs, Kerry Logistics and DHLs of this world are able to handle.

Part of this is the poor infrastructure to begin with. China, the world’s largest e-commerce market, never really had this issue because of the socialist and central government mindset of prioritizing infrastructure investments. By the time e-commerce took off, the infrastructure was already there, which resulted in last-mile delivery becoming a commodity service.

Also, many existing delivery companies were never built for B2C deliveries to begin with. Their core competencies are in B2B deliveries, which typically don’t face B2C headaches, like returns management, reverse logistics, pre-calling, multiple delivery attempts and cash on delivery.

9. Channel Management Will Be The New “Programmatic” Ad Agencies Still Stuck In 2011

Year in, year out, brand advertisers, agencies and adtech sales execs rave about programmatic display advertising and DSPs being the future of digital marketing. However, few actually have been outside their ivory tower in Singapore long enough to realize that “no-tail” has essentially killed off any promise of “programmatic” advertising in Southeast Asia outside of Singapore and Malaysia.

The real “programmatic” opportunity in Southeast Asia will be in e-commerce, not in display advertising. With the advent and fragmentation of online marketplaces, the challenge for brands will be to choose on which channels to be present and what products to push in each of these channels.

2016 will see the emergence and adoption of next-generation channel management platforms, which are essentially “e-commerce DSPs.” These products will help brands enable omni-channel retailing across all major marketplaces, while also offering traditional programmatic benefits such as a dynamic optimization engine and plug-and-play integration with multiple first- and third-party data sources for better targeting, personalization and optimization.

10. The Talent War Will Inflate Salaries Faster Than Uber’s Valuation

One of the biggest issues faced by all e-commerce players in Southeast Asia is the lack of talent. In 2015, it was common to see employees being poached left and right with new salaries of 1.5-3x. Obviously, this isn’t sustainable, but it is the current foundation of the talent war in Southeast Asia.

Opportunistic professionals, often young, jump to roles where their skills, experience and leadership don’t match the package and title. “The most important thing to optimize for on your first job is growth. Growth is king, queen, and emperor combined. Optimize for growth above compensation, above location, above lifestyle, and above anything else,” says Auren Hoffman, former LiveRamp CEO who founded and sold five companies.

E-commerce companies need to understand that despite all of us being in the midst of a Gold Rush, this is a long-term game. To attract and retain the best talent, more and more e-commerce companies will be buckling down on culture and building an appealing work environment. aCommerce in 2016 will be relocating its headquarters to the E-commerce Valley of Bangkok — Emquartier (also home to Lazada’s regional headquarters).

11. Amazon Will Enter Southeast Asia

Not. Sorry, Jeff.

Comment