Neeraj Agrawal

What does it take to build a billion-dollar SaaS enterprise-software company? We gave a 30,000-foot answer to this complex — and fascinating — question in a recent TechCrunch post, The SaaS Adventure.

To recap: We’ve observed seven key phases in most SaaS companies’ go-to-market success. Most of the phases center around a mantra we call “triple, triple, double, double, double” (T2D3 for short), referring to a company’s annualized revenue growth.

We dubbed this journey the “SaaS Adventure,” which is broadly how we view the job of a VC: to serve as a more experienced travel guide to SaaS companies in their climb to the billion-dollar summit and, hopefully, beyond.

We got a very strong response to the SaaS Adventure post and the T2D3 concept. We were also, at the same time, impressed with fellow VC Aileen Lee’s original unicorn-company analysis, which she just updated with some new lessons last month. All this spurred us to conduct a more in-depth analysis of SaaS companies.

Our new analysis, which is featured in part here, provides high-level takeaways, as well as a more nuanced picture of the climb to SaaS success — all of which we hope will help new entrepreneurs fashion their own successful climbs.

Think of this as an expedition map; what mountaineers like to call “beta”: valuable advice to newcomers attempting a particular climb. We plan on refreshing this data set periodically with accompanying analysis.

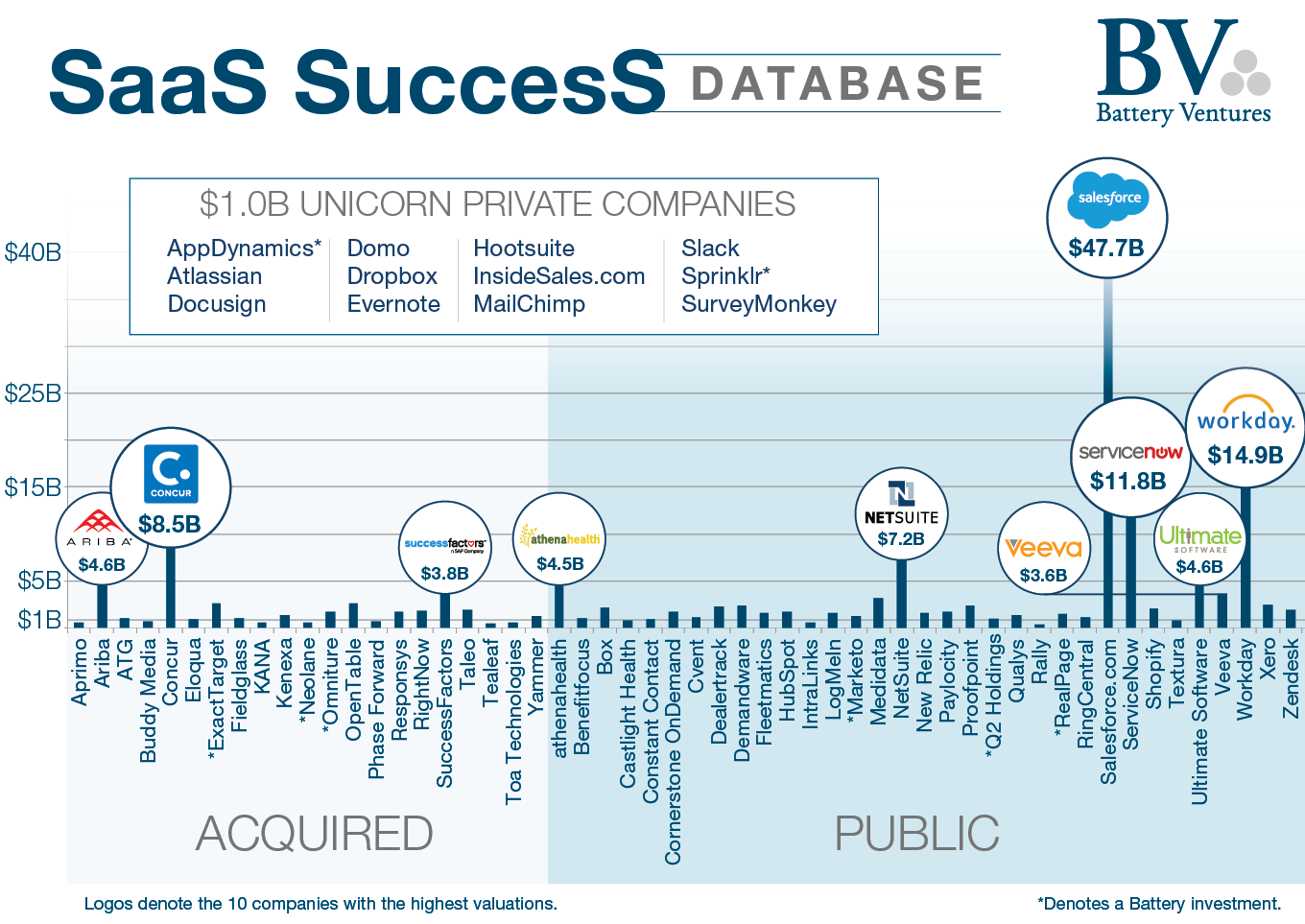

So here we introduce the SaaS Success Database: a round-up of 66 leading SaaS companies, public and private, that have defined the industry. The database encompasses companies with a realized exit of more than $500 million (either in the public markets or via an M&A transaction, as of June 30) and private companies valued at $1 billion or higher.

The SaaS Success Database traces SaaS companies’ evolution back to their early days, when they were known as Application Service Providers (ASPs). It includes eight companies in which Battery was lucky enough to invest.

Twenty percent of the companies on our list were founded prior to 1997, but most were established after that and before the 2008 crash; 36.3 percent started up between 1998 and 2002 and 30.3 percent between 2003 and 2007.

Those founded on or after 2008 — AppDynamics*, Castlight Health, Domo, Hootsuite, New Relic, Slack, Sprinklr* and Yammer — fired ahead on all cylinders despite the tough economy, reinforcing that it’s not usually the market conditions, but instead the team and the product-market fit that can lead to success.

In future posts, we’ll tackle crucial issues surrounding each phase of the adventure, and talk to CEOs of some of the companies in this database who’ve made the climb themselves. (We’ve already spoken to two of these successful executives on video: Phil Fernandez of Marketo* and Jyoti Bansal of AppDynamics*.)

In terms of who is starting these successful companies, our analysis suggests they are mostly founded by teams: Two founders (comprising 34.9 percent of the total) was the most common configuration for companies in our database, with 33.3 percent of companies founded by three or more people (up to seven in our database). Surprisingly, these founding teams were often strangers: 60.0 percent had no prior history of working together. Only 31.8 percent of SaaS companies on the list had a solo founder.

In addition to demographics, we’ve examined these founding CEOs’ backgrounds and asked questions like: How many were first-time CEOs? (Just over 67 percent — although SaaS CEOs are typically grown-ups: 60 percent of founding CEOs started their companies in their 30s, 13.8 percent in their 40s and 6.2 percent when they were over 50.)

What kind of education and work experience did they bring to the job? Did these founding CEOs stick around for the IPO or other exits? If not, what characteristics differentiated the new CEO at each of those exit stages? These are all points we’ll dive into.

Next, we’ll examine the companies’ origins, addressing questions like geography, business model and selling strategy.

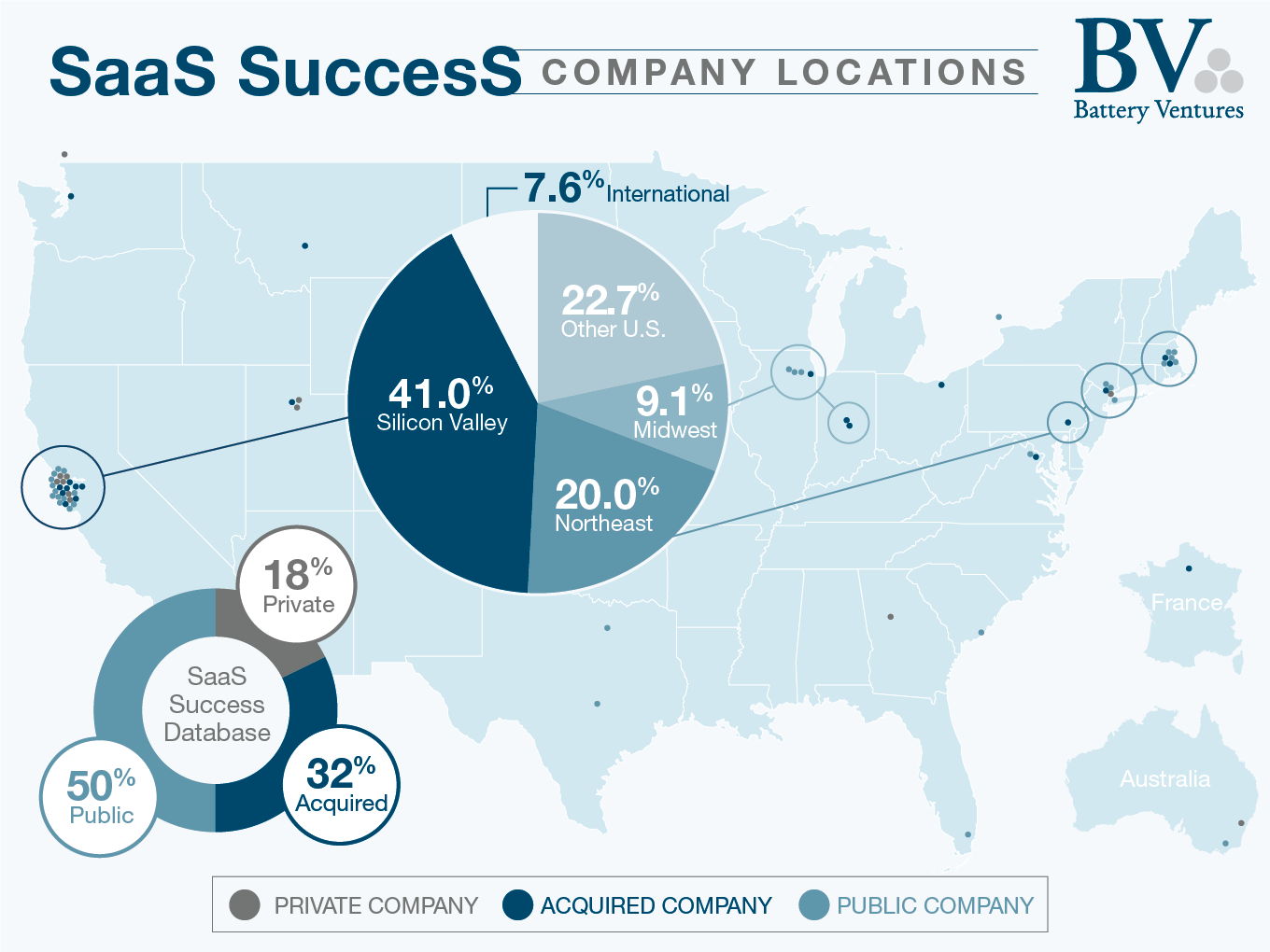

SaaS success turns out to be less Silicon Valley-centric than other areas of tech: nearly 41 percent of our companies were Valley-based, followed by close to 20 percent in the Northeast, 9.1 percent in the Midwest, and a pretty even sprinkling between Texas, the Mid-Atlantic region, the Rocky Mountains and the Northwest. (Only five companies hailed from Canada or other points outside the U.S.)

Our top SaaS players tend to sell broadly across many industries (82 percent), with the buying decision-maker for the product being either the CMO (27.2 percent) or CIO (27.3 percent).

The remaining 18 percent of the companies we studied target a specific vertical, like pharma (Medidata, Phase Forward, Veeva), healthcare (athenahealth), real estate (RealPage) or even super-specific verticals (Dealertrack for auto-dealership management, Fleetmatics for fleet management, OpenTable for restaurants, or Q2 Holdings* for regional and community banks).

In future posts we’ll address other questions from this phase, such as: Did these companies switch to SaaS delivery or start off that way, and how does such a shift typically impact a company’s future success?

Among public SaaS companies, is there a “sweet spot” for revenue per customer? Should your SaaS company aim to land a few whales or many smaller fish — and how does each approach impact subsequent growth?

At base camp leading to the ascent or exit, we wondered: Given a relatively long time to liquidity — 36.5 percent of our companies that have either gone public or been acquired took more than 10 years from founding to liquidity — does a longer (or shorter) climb correlate to other success metrics? What’s the typical financial profile of a successful SaaS company on the verge of a public exit? How does IPO day usually go for top SaaS companies? All are topics we’ll address soon.

And what are the growth prospects for the newly public companies on our list? Early analysis shows it’s very strong, with only 6.7 percent of companies displaying year-over-year revenue growth under 25 percent at the time of IPO; 42.2 percent, the biggest group, were companies roaring ahead with more than 100 percent revenue growth on IPO day.

The SaaS climb is arduous and full of the unexpected. No map can fully prepare you for the improvisations necessary along the way, or give you the guts for the climb itself. But we hope the SaaS Success Database provides valuable insights into building a successful SaaS enterprise-software company — including all the elements of that trek.

Comment