Tomasz Tunguz

One of the most critical metrics for software companies — but also one of the most difficult to measure — is the lifetime value of their customers (LTV). The lifetime value dictates how a company should spend its marketing and sales dollars.

Unfortunately, many early stage startups struggle to measure LTV, because they haven’t been around very long and, consequently, haven’t seen a large number of customers through their lifespans with the product.

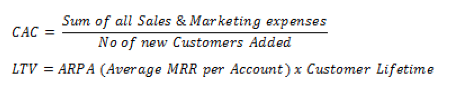

Most software companies calculate their LTV and a critical related metric, customer acquisition cost (CAC), using the following formulas:

But rather than measure it in this way, an early startup must estimate its customer lifetime value. So, what’s the best way to do this?

One of the most innovative techniques I’ve seen was created by a Redpoint portfolio company founder, Vik Singh, CEO of Infer. Vik’s innovation is using a rolling sales and marketing period to estimate both LTV and CAC. I’ve asked Vik to explain his approach below.

Shortcomings Of Traditional LTV And CAC Calculations

If you’re running a startup like me, there are three key problems with the standard formulas for determining LTV and CAC:

- Attributing sales and marketing spend to actual closed, won deals is very difficult in general, and even more pronounced for emerging SaaS companies that typically do not possess the marketing infrastructure for doing so.

- You need years with a reasonably sized base of paying customers to truly understand your LTV, and you have to assume that your product or service isn’t changing much (for your LTV to hold up over time). These factors pretty much don’t exist for early SaaS companies, and can easily break for even later-stage companies that are highly innovative.

- These are backwards-looking metrics. They tell you what your LTV or CAC was for a prior time period, but not what it’s shaping up to be, which is key for actionability.

While it’s often helpful for investors to use the traditional calculations (for example, one year of growth spend divided by the following year’s number of new customers) when generating comps for industry benchmarking across portfolio and publicly traded companies, these kind of generalizable formulas aren’t accurate or forward-looking enough to inform internal decision making and run a business.

As a company executive, you have access to more detailed numbers, a la your CRM and accounting systems — so it’s possible to build more advanced forecasting models to derive these metrics.

However, I would contend that you need rules of thumb that can be computed effortlessly. You can’t improve something if you can’t measure it, right? If you consistently monitor these key SaaS metrics, you can be more nimble about increasing LTV or decreasing CAC.

Calculating Expected CAC And LTV

So, here’s what I came up with that’s easy to compute, doesn’t depend on much closed sales data, is forwarding looking and better addresses the attribution gap. Let’s go…

The first thing you need is your cost per opportunity. Say you spent $10 million on sales and marketing (fully loaded — including salaries) in the month of June, and created 2,000 opportunities that month. Your cost per opportunity for June would be $5,000. This assumes a short opportunity lag time, which is common in the SaaS world, but you also could use the prior and following months to do the calculation if your sales cycle is longer.

Next, you want to determine your “expected” (as in probabilistic terms) CAC, using your opportunity win rate and average deal size, which shouldn’t fluctuate much. If, historically, your win rate has been 20 percent, and your average annual contract value (ACV) is $30,000, then your ECAC would work out as follows:

Expected # of New Customers = 0.2 (opportunity win rate) x 2K (opportunities) = 400

Expected CAC = $10 million (fully loaded growth spend) / 400 (expected new customers) = $25K

If you divide ECAC by your average ACV, you will derive the payback period (in months) — the time it will take for you to recoup your growth spend on acquiring that customer. In this case:

Expected Payback Period = $25K (ECAC) / $30K (first-year ACV) x 12 months = 10 months

The customer pays for itself two months before it’s up for renewal (assuming an annual contract), which is not bad. Related to payback, you can compute the return on investment (ROI) over a subscription period. For example:

Expected first-year ROI = ($30K (first-year ACV) – $25K (ECAC)) / $25K (ECAC) = 20 percent

And, if you know (or think) your ACV will appreciate 15 percent (so 115 percent of the first year ACV, or 1.15 in decimal form) if the customer renews for another year, then your expected ROI for two years of subscription works out as follows:

Expected second-year ACV = $30,000 * 1.15 (renewal increase) = $34,500

Expected two-year ROI = ($30,000 (first-year ACV) + $34,500 (second-year ACV) – $25K (ECAC)) / $25K (ECAC) = 158 percent

To compute LTV, you need to estimate how many years your typical customer will stay with you. This can take several years to find out using actual sales data, so if you don’t know, then be conservative based on other companies in your space (ask your investors!).

Let’s assume a three-year average lifetime — then, based on the assumptions above and on annual contracts (versus month-to-month service), you can forecast LTV as follows:

Expected LTV = ( $30K (average ACV) + $30K (average ACV) * 1.15 (renewal increase) * (1.15 (renewal increase) ^ (3-year lifetime – 1) – 1) / (1.15 (renewal increase) – 1) = $104,175

It will take more than two years to know your actual renewal increases if your renewals happen annually … and you probably won’t press hard on renewal increases after just one year with your earliest customers.

You can try analyzing industry comps to determine a good target, or just be conservative and remove the appreciation assumption, which also reduces the complexity of the formula (it would become $30K * 3 [estimated customer lifetime] = $90,000).

Finally, let’s put it together — divide ELTV by ECAC. Using the first ELTV value of $104,175, and dividing that by the ECAC of $25K, we get 4.167. From a company health perspective and what Andreessen Horowitz expects to see for a good SaaS business (3X or more), this is very good.

Continually Predict Your Business

Ask most SaaS executives what their CAC is and they’re likely to cite a number from a previous quarter or year. But because ECAC is based on the number of opportunities generated very recently (whether closed or not yet closed), it provides guidance on your current sales pipeline.

Another great thing about this technique is that you can adjust any rate and see how it changes the figures (i.e., decrease average deal size, increase the opportunity win rate and decrease lifetime value to see what the impact of, say, lowering your pricing scheme might look like).

Of course, the attribution of opportunities to growth spend isn’t perfect, but it’s much better than the outdated CAC used by most SaaS companies with which I’ve worked. This approach calls it out, so you’re forced to make an assumption, which is far better than the one-size-fits-all formulas we’re given by the investor community.

With the methodology above, an SaaS entrepreneur can compute their key SaaS metrics at any time. More frequent, useful guidance about a business will create a competitive edge by letting you read, predict, monitor and take advantage of market dynamics faster than other startups that might be crowding your space.

Comment